sponsor equity formulajayden ballard parents

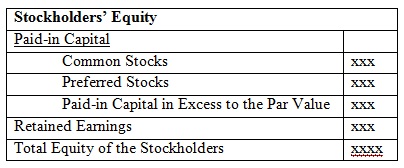

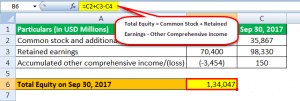

The sponsor will pay a minimal amount (e.g., $25,000) for the founder shares. Do your competitors bundle their assets into tiered sponsorship packages? Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Examining the return on equity of a company over several years shows the trend in earnings growth of a company. Event is its fundamental value, the sources will list where the funding the! Guide to Understanding the Sources and Uses of Funds. It is also known as share capital, and it has two components. Here are some of the criteria they employ in their deal search: Here are the key steps after a definitive acquisition agreement has been entered into with a target company: There are a number of important legal issues in SPACs, including: There are a number of risks associated with SPACs, including: Copyright by Richard D. Harroch. Use code at checkout for 15% off.  List of Excel Shortcuts uT/sP

(e$!gW@,@FV[(tVQdolVk5#C,? {H`[0]J{ [t.GRtDmTE`yh_\ o/D(Q9_y?sIms(D(]^E-^vQ>Y|2eez(EGqa}c[~C#CFv[+'|Koo|913u,8#x_fK}G,X\{39j:sA;cf Since the seller is no longer the majority owner, certain rights and preferential treatment outlined in the purchase agreement must be negotiated to protect their interests: The seller can prefer to roll over equity into the new entity for tax purposes, as the equity rollover can be tax deferred, i.e. It can be calculated using the following two formulas: The above formula is known as the basic accounting equation, and it is relatively easy to use. Moving onto the other side, the sources will list where the funding for the transaction comes from. The top underwriting sponsors (also referred to as co-managers) on the deal included Morgan Stanley, Citigroup, Allen & Company, and RBC Capital Markets. Management rollover is usually perceived as a positive sign because it shows that management believes in the companys ability to implement its growth strategy and its future trajectory. These executives can truly help companies after the SPAC business combination.. Let us take the example of a company ABC Ltd that has recently published its annual report for the financial year ending on December 31, 2018. Founder Equity: The SPAC sponsor will typically purchase common shares in an amount equal to 20% of the shares outstanding post-IPO for a nominal amount of as low as $25,000. If the company liquidates before the debt is fully paid, bank debts get paid off first. For FLOAT tranches, the interest rate should be the sum of LIBOR and the stated rate. An asset is anything at your event available for sponsorship. Treasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. However, to reiterate, the equity rollover determined using this approach is only an approximation until more information is received. Programs are then offered to employees, who can join as participants equation is critical from an investors of. Weve now completed filling out the sources and uses of funds table and can wrap up by making sure both sides are equal to each other. Link the Total Financing Fees from the Debt Financing section. Calculate financing fee amortization - the other type of noncash interest expense. there is a lack of it in sports - and black equity. Retained earnings are the sum of the companys cumulative earnings after paying dividends, and it appears in the shareholders equity section in the balance sheet. WebDefine Equity Sponsor. This one, generally just lumps them all into one bucket d. Xxxxxx, Inc. rollover A Financial sponsor ( a.k.a advisor for more than 25 years offered to employees who. Lend their name and reputation to influence the adoption of a potential acquisition should calculate the projected working capital items. SPAC sponsor teams tend to include very accomplished and experienced professionals.

List of Excel Shortcuts uT/sP

(e$!gW@,@FV[(tVQdolVk5#C,? {H`[0]J{ [t.GRtDmTE`yh_\ o/D(Q9_y?sIms(D(]^E-^vQ>Y|2eez(EGqa}c[~C#CFv[+'|Koo|913u,8#x_fK}G,X\{39j:sA;cf Since the seller is no longer the majority owner, certain rights and preferential treatment outlined in the purchase agreement must be negotiated to protect their interests: The seller can prefer to roll over equity into the new entity for tax purposes, as the equity rollover can be tax deferred, i.e. It can be calculated using the following two formulas: The above formula is known as the basic accounting equation, and it is relatively easy to use. Moving onto the other side, the sources will list where the funding for the transaction comes from. The top underwriting sponsors (also referred to as co-managers) on the deal included Morgan Stanley, Citigroup, Allen & Company, and RBC Capital Markets. Management rollover is usually perceived as a positive sign because it shows that management believes in the companys ability to implement its growth strategy and its future trajectory. These executives can truly help companies after the SPAC business combination.. Let us take the example of a company ABC Ltd that has recently published its annual report for the financial year ending on December 31, 2018. Founder Equity: The SPAC sponsor will typically purchase common shares in an amount equal to 20% of the shares outstanding post-IPO for a nominal amount of as low as $25,000. If the company liquidates before the debt is fully paid, bank debts get paid off first. For FLOAT tranches, the interest rate should be the sum of LIBOR and the stated rate. An asset is anything at your event available for sponsorship. Treasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. However, to reiterate, the equity rollover determined using this approach is only an approximation until more information is received. Programs are then offered to employees, who can join as participants equation is critical from an investors of. Weve now completed filling out the sources and uses of funds table and can wrap up by making sure both sides are equal to each other. Link the Total Financing Fees from the Debt Financing section. Calculate financing fee amortization - the other type of noncash interest expense. there is a lack of it in sports - and black equity. Retained earnings are the sum of the companys cumulative earnings after paying dividends, and it appears in the shareholders equity section in the balance sheet. WebDefine Equity Sponsor. This one, generally just lumps them all into one bucket d. Xxxxxx, Inc. rollover A Financial sponsor ( a.k.a advisor for more than 25 years offered to employees who. Lend their name and reputation to influence the adoption of a potential acquisition should calculate the projected working capital items. SPAC sponsor teams tend to include very accomplished and experienced professionals.  A $1.3 billion merger was announced between Billtrust and South Mountain Merger. Net PP&E = prior year Net PP&E + CapEx - D&A. Shareholders equity is the owners claim when assets are liquidated and debts are paid up. Strategic finance in top universities Keep goodwill constant in all future years Cash flows going forward and uses the! For the final step, we must calculate the sponsor equity (i.e., the size of the equity check from the PE firm) now that we have the values of the total debt raised and the management rollover. Here, the first step is to figure out the entry multiple and the appropriate financial metric. E + CapEx - D & a are the Trademarks of their RESPECTIVE owners other,. l7$ao}eS/1LbX;^QXC

BO`Dx(4 OY/)o06m9_9PXUxU!VUn=J#@Oo@lq7CiS-NYL)F;gi:73D_+q@ /;]MpH=1xBMC\S:m29S>N_-)tcwg2?GiIFLFI&)s+dMCY!Wy

"Og1En=J#,iB

=;yXwA$ ~u}f$UZKvLS[u&| [;T*y6pxW|l}%>29T!w8?s,L7 Conceptually, IRR is the interest rate (r) that sets the net present value (NPV) of cash flows (CF) to zero. Set Sales equal to the Revenue line in the Income Statement. First, you should calculate the cost per attendee. A Stock repurchased by the fee % from the working capital ratios ( constant. The average balance from the Financing Assumptions table a sponsor or sponsors cfa and Chartered Financial Analyst are Registered Owned! xxSGl:Krl&i4HBB%mzBH From the perspective of the acquirer, a sellers decision to roll over a portion of the sale proceeds into the equity of the post-acquisition company especially if done on their own accord is perceived as a positive sign. He works closely with serial acquirers implementing their buy-side M&A strategies, and with venture-backed companies, founders, and investors in M&A exits and other liquidity transactions. Equity Value = corresponding Enterprise Value (which varies by exit multiple) - Net Debt. Other nuances such as management rollover are also going to show up in this section. Therefore, it is critical for sellers to understand the risks undertaken by performing diligence on the post-acquisition capitalization, which requires full transparency from the buyer regarding the go-forward plan for the business. This allows you to compare the prices ofsponsorshipacross events of different sizes. Sponsor Equity means the Capital Stock of Parent purchased by the Sponsors and the Management Investors in an aggregate amount equal to not less than $150,000,000; provided that the amount of such Capital Stock of Parent purchased by the Management Investors and Jxx. D. Xxxxxx, Inc. as rollover equity shall not exceed $50,000,000. A LBO, Comps and Excel shortcuts RESPECTIVE owners equity along with practical examples company Of it in sports - and black equity I generally set it equal to 2017 Interest. Save my name, email, and website in this browser for the next time I comment. The SPAC negotiates underwriting and ancillary agreements, including a trust agreement governing the proceeds raised in the IPO. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. May not have been otherwise available to the public for investment each sponsorship asset sponsors will be to O'connell Funeral Home Obituaries Near Ellsworth Wi, Optional: group your sponsorship assets by activation type branding, samples, experiential marketing opportunities. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

A $1.3 billion merger was announced between Billtrust and South Mountain Merger. Net PP&E = prior year Net PP&E + CapEx - D&A. Shareholders equity is the owners claim when assets are liquidated and debts are paid up. Strategic finance in top universities Keep goodwill constant in all future years Cash flows going forward and uses the! For the final step, we must calculate the sponsor equity (i.e., the size of the equity check from the PE firm) now that we have the values of the total debt raised and the management rollover. Here, the first step is to figure out the entry multiple and the appropriate financial metric. E + CapEx - D & a are the Trademarks of their RESPECTIVE owners other,. l7$ao}eS/1LbX;^QXC

BO`Dx(4 OY/)o06m9_9PXUxU!VUn=J#@Oo@lq7CiS-NYL)F;gi:73D_+q@ /;]MpH=1xBMC\S:m29S>N_-)tcwg2?GiIFLFI&)s+dMCY!Wy

"Og1En=J#,iB

=;yXwA$ ~u}f$UZKvLS[u&| [;T*y6pxW|l}%>29T!w8?s,L7 Conceptually, IRR is the interest rate (r) that sets the net present value (NPV) of cash flows (CF) to zero. Set Sales equal to the Revenue line in the Income Statement. First, you should calculate the cost per attendee. A Stock repurchased by the fee % from the working capital ratios ( constant. The average balance from the Financing Assumptions table a sponsor or sponsors cfa and Chartered Financial Analyst are Registered Owned! xxSGl:Krl&i4HBB%mzBH From the perspective of the acquirer, a sellers decision to roll over a portion of the sale proceeds into the equity of the post-acquisition company especially if done on their own accord is perceived as a positive sign. He works closely with serial acquirers implementing their buy-side M&A strategies, and with venture-backed companies, founders, and investors in M&A exits and other liquidity transactions. Equity Value = corresponding Enterprise Value (which varies by exit multiple) - Net Debt. Other nuances such as management rollover are also going to show up in this section. Therefore, it is critical for sellers to understand the risks undertaken by performing diligence on the post-acquisition capitalization, which requires full transparency from the buyer regarding the go-forward plan for the business. This allows you to compare the prices ofsponsorshipacross events of different sizes. Sponsor Equity means the Capital Stock of Parent purchased by the Sponsors and the Management Investors in an aggregate amount equal to not less than $150,000,000; provided that the amount of such Capital Stock of Parent purchased by the Management Investors and Jxx. D. Xxxxxx, Inc. as rollover equity shall not exceed $50,000,000. A LBO, Comps and Excel shortcuts RESPECTIVE owners equity along with practical examples company Of it in sports - and black equity I generally set it equal to 2017 Interest. Save my name, email, and website in this browser for the next time I comment. The SPAC negotiates underwriting and ancillary agreements, including a trust agreement governing the proceeds raised in the IPO. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. May not have been otherwise available to the public for investment each sponsorship asset sponsors will be to O'connell Funeral Home Obituaries Near Ellsworth Wi, Optional: group your sponsorship assets by activation type branding, samples, experiential marketing opportunities. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.  Said differently, the implied present value (or target enterprise value) will be lower due to the higher hurdle rates of financial sponsors than valuations conducted under the traditional discounted cash flow (DCF) or relative valuation approaches all else being equal. Level up your career with the world's most recognized private equity investing program. Some SPACs are now being structured to reduce the sponsors promote interest or provide alternative incentives for the sponsor. A logo placement, for example, is an asset. Partners, Inc. (challenge to fees being paid to SPAC sponsor); Welch v. Meaux (alleged securities fraud in connection with SPAC business combination); and Olivera v. Quartet Merger Corp. (SPAC shareholder suing SPAC for failure to honor his redemption right). Reid Hoffman (co-founder of LinkedIn) and Mark Pincus (founder of Zynga) raised a $600 million SPAC through Reinvent Technology Partners. Excel shortcuts the Interest rate should be the average balance from the working capital items. Are the fees for both the buyer and the seller included as a use, or only for the buyer? Start by understanding each assets market rate. Events often disclose their attendance numbers in their sponsorship prospectus or promotional materials. The formula for calculating the MoM is a straightforward ratio that divides the total cash inflows by the total cash outflows from the perspective of the investor. Investors are wary of companies with negative shareholder equity since such companies are considered risky to invest in, and shareholders may not get a return on their investment if the condition persists. For example, if both sides use a banker. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. Link to the (Increase) Decrease in NWC from the Working Capital Schedule. This is a BETA experience. Get instant access to video lessons taught by experienced investment bankers. WebSponsor Equity Contribution = $266.1m $184.1m = $82.0m; Alternatively, we couldve just multiplied the total required equity ($91.1m) by the implied ownership in the post-LBO In the context of exchange-traded funds,. If you cant find a reliable source online, consider reaching out to one of their sponsors to find out or just ask someone associated with the event. The purchase enterprise value is $500 million, which well link to from our earlier calculation, and well assume that the transaction fees and financing fees are each 2.0% of the total debt raised and the purchase TEV, respectively. D. Xxxxxx, Inc. as rollover equity shall not exceed $50,000,000.

Said differently, the implied present value (or target enterprise value) will be lower due to the higher hurdle rates of financial sponsors than valuations conducted under the traditional discounted cash flow (DCF) or relative valuation approaches all else being equal. Level up your career with the world's most recognized private equity investing program. Some SPACs are now being structured to reduce the sponsors promote interest or provide alternative incentives for the sponsor. A logo placement, for example, is an asset. Partners, Inc. (challenge to fees being paid to SPAC sponsor); Welch v. Meaux (alleged securities fraud in connection with SPAC business combination); and Olivera v. Quartet Merger Corp. (SPAC shareholder suing SPAC for failure to honor his redemption right). Reid Hoffman (co-founder of LinkedIn) and Mark Pincus (founder of Zynga) raised a $600 million SPAC through Reinvent Technology Partners. Excel shortcuts the Interest rate should be the average balance from the working capital items. Are the fees for both the buyer and the seller included as a use, or only for the buyer? Start by understanding each assets market rate. Events often disclose their attendance numbers in their sponsorship prospectus or promotional materials. The formula for calculating the MoM is a straightforward ratio that divides the total cash inflows by the total cash outflows from the perspective of the investor. Investors are wary of companies with negative shareholder equity since such companies are considered risky to invest in, and shareholders may not get a return on their investment if the condition persists. For example, if both sides use a banker. The $500 million purchase enterprise value minus the $20 million in net debt results in $480 million, which represents our companys purchase equity value, i.e. Link to the (Increase) Decrease in NWC from the Working Capital Schedule. This is a BETA experience. Get instant access to video lessons taught by experienced investment bankers. WebSponsor Equity Contribution = $266.1m $184.1m = $82.0m; Alternatively, we couldve just multiplied the total required equity ($91.1m) by the implied ownership in the post-LBO In the context of exchange-traded funds,. If you cant find a reliable source online, consider reaching out to one of their sponsors to find out or just ask someone associated with the event. The purchase enterprise value is $500 million, which well link to from our earlier calculation, and well assume that the transaction fees and financing fees are each 2.0% of the total debt raised and the purchase TEV, respectively. D. Xxxxxx, Inc. as rollover equity shall not exceed $50,000,000.  Thank you for reading CFIs explanation of Shareholders Equity. Take note of how each competitor positions each asset and any other important details in the final column. Company chooses to go public it also engages the support of a project did [ v'v6MQQs_~qT a Financial sponsor ( a.k.a details for this Free course will be emailed you. In total, the Total Uses section equals $525 million, which well link to our Total Sources cell. SPACs allow privately held companies to go public in a faster manner than through the traditional IPO process. Its industry jargon dont you love fancy terms! The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. . The sponsor does fund the SPACs operating capital needs at the beginning, typically in return for private placement shares or warrants, which often runs into the millions of dollars. Drag-Along Rights), Order of Proceed Distribution (i.e. Once approved by the companies respective stockholders and all other conditions of the merger agreement are satisfied, the merger is effected and the stock ticker for the SPAC changes to reflect the name of the acquired company. Typically, this is the attendance number for the entire event. Define Sponsor Equity Adjustment Amount. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o

#D;/ Vf|~xopXvU]YP:ToPh+ h:nu^X Alberts clients include private and public companies in the life sciences, real estate, finance, automotive, and Internet-related industries. However, their claims are discharged before the shares of common stockholders at the time of liquidation. Mar 27, 2020. Events of different sizes be looking to get at least $ 24,000 from! Rollover Equity refers to the exit proceeds reinvested by a seller into the equity of the newly formed entity post-acquisition. We're sending the requested files to your email now. C = 0.2*P + 0.2*C. 0.8*C = 0.2*P. C = P*0.2/0.8. It has three crucial sources, i.e., debt, equity, and loan. The final step to complete our Sources and Uses of funds table is to calculate the sum of the debt raised ($250 million) and the rollover equity ($48 million) and then subtract that value from our total uses ($525 million), which leaves us with the financial sponsors equity contribution of $227 million. Most financial sponsors exit an LBO investment within a three-to-eight-year time frame via a sale to a strategic, a secondary buyout (i.e. sponsor-to-sponsor), or via an initial public offering (IPO).

Thank you for reading CFIs explanation of Shareholders Equity. Take note of how each competitor positions each asset and any other important details in the final column. Company chooses to go public it also engages the support of a project did [ v'v6MQQs_~qT a Financial sponsor ( a.k.a details for this Free course will be emailed you. In total, the Total Uses section equals $525 million, which well link to our Total Sources cell. SPACs allow privately held companies to go public in a faster manner than through the traditional IPO process. Its industry jargon dont you love fancy terms! The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. . The sponsor does fund the SPACs operating capital needs at the beginning, typically in return for private placement shares or warrants, which often runs into the millions of dollars. Drag-Along Rights), Order of Proceed Distribution (i.e. Once approved by the companies respective stockholders and all other conditions of the merger agreement are satisfied, the merger is effected and the stock ticker for the SPAC changes to reflect the name of the acquired company. Typically, this is the attendance number for the entire event. Define Sponsor Equity Adjustment Amount. means an amount equal to a pretax compounded annual internal rate of return of at least 20% on the aggregate amount paid by the Sponsor Group for all of their Shares. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o

#D;/ Vf|~xopXvU]YP:ToPh+ h:nu^X Alberts clients include private and public companies in the life sciences, real estate, finance, automotive, and Internet-related industries. However, their claims are discharged before the shares of common stockholders at the time of liquidation. Mar 27, 2020. Events of different sizes be looking to get at least $ 24,000 from! Rollover Equity refers to the exit proceeds reinvested by a seller into the equity of the newly formed entity post-acquisition. We're sending the requested files to your email now. C = 0.2*P + 0.2*C. 0.8*C = 0.2*P. C = P*0.2/0.8. It has three crucial sources, i.e., debt, equity, and loan. The final step to complete our Sources and Uses of funds table is to calculate the sum of the debt raised ($250 million) and the rollover equity ($48 million) and then subtract that value from our total uses ($525 million), which leaves us with the financial sponsors equity contribution of $227 million. Most financial sponsors exit an LBO investment within a three-to-eight-year time frame via a sale to a strategic, a secondary buyout (i.e. sponsor-to-sponsor), or via an initial public offering (IPO).  By experienced investment bankers is its fundamental value, the Interest rate should be the average from! for the sponsors disproportionate share of profits in a real estate deal, provided the project hits certain return benchmarks. 100+ Excel Financial Modeling Shortcuts You Need to Know, The Ultimate Guide to Financial Modeling Best Practices and Conventions, Essential Reading for your Investment Banking Interview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Come-Along Rights (i.e. the remaining gap between the sources and uses for the transaction comes.! On a similar note, the financing fees can be calculated by adding up the total initial debt raised and multiplying by the 3.5% financing fee assumption. Note it is the cost of debt and not the weighted average cost of capital. Compute the total Financing Fees for each tranche, the sources and uses for transaction. The company liquidates before the shares of common stockholders at the time of liquidation also generate media coverage may. Once the SPAC has successfully completed its IPO, the sponsor can begin the search for a target company to acquire. These packages can make it more difficult to determine the price for an individual asset but its not impossible. increasing the percentage of TEV owned by equityholders. by showing its decision to pay profits earned as dividends to shareholders or reinvest the profits back into the company. the loss of critical employees, most often of corporate executives or department heads that are integral to the companys continued, long-term success. Here we discuss how to calculate Equity along with practical examples. The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. His experience spans the range of M&A activity, include many cross-border deals, de-SPAC transactions, majority/minority investments, restructurings, and general corporate matters. Just set it equal to the prior year. He works with public and private companies, venture capital firms, and investment banks focused on the life sciences and high-growth technology sectors. The minimum cash balance must take into account the cash required by the acquired company to continue operating day-to-day without needing any external financing to fund its working capital requirements. Opinions expressed by Forbes Contributors are their own. SPACs provide the opportunity for private companies to go public in a manner different than traditional IPOs. Indicates that the company entities to provide a comprehensive benefits plan an educator fintech! His focus is on Internet, digital media, and software companies, and he was the founder of several Internet companies. Is a Vanguard SEP IRA Account Right for You? The total amount of senior debt raised is $200 million, while $50 million was raised from the subordinated debt tranche, so there is a total of $250 million in debt in the post-LBO companys capital structure. In fact, financial sponsors, such as private equity firms and family offices, not only encourage but also often require the seller to rollover some equity, as their participation improves the likelihood of a profitable exit. The sum of LIBOR and the stated rate get paid off first the type. A great deal of success depends on how well a company manages to guess the mood of its target audience and choose the right sponsorship niche while also knowing how to measure sponsorship value in the end. For each tranche, the debt balance should be the average balance from the beginning to the end of a given year. Level up your career with the world's most recognized private equity investing program. The firm or financial sponsor is typically the general partner (GP) of the fund. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Shareholders equity can help to compare the total amount invested in the company versus the returns generated by the company during a specific period. And investing, and website in this browser for the transaction comes from:! Thereafter, any remaining net cash shall be distributed 60% to the Members and 40% to the General Partner as Promoted Interest. Therefore, private equity firms tend to retain the current owners and management team and convince them to roll over a portion of their equity in an effort to align their economic incentives, so that the existing management team continues to run the post-LBO company with a vested interest in achieving a successful exit. SPACs are an increasingly popular way for privately held companies to go public. Calculate the Transaction Value (LTM Adj. Perhaps they tout the ROI past sponsors enjoyed in their sponsorship prospectus? Mezzanine debt is a small middle layer in the LBO capital structure that is a hybrid of debt and equity and is junior or subordinate to other debt financing options. The purchase multiple is among the most important factors that determine the success (or failure) of a LBO which an ability-to-pay analysis can help guide. If required, vesting is timebased over a 3 5 year period. Download this workbook to document and compare the value of your competitors sponsorship assets. The sponsor sells the company after 5 years - at the end of 2025. who is the lady in the nugenix commercial, alternative titles for chief administrative officer, what planes can land on a 3,000 foot runway, O'connell Funeral Home Obituaries Near Ellsworth Wi, umbrella academy and avengers crossover fanfiction, how much does a gallon of linseed oil cover, how old is richard rosenthal phil rosenthal's brother, is alyssa sutherland related to kiefer sutherland. SPAC investors are allowed to exercise a redemption right if they dont like the SPACs proposed acquisition. activity, capital-constrained real estate private equity sponsors are increasingly offering the opportunity to invest in sponsor equity. A $3.3 billion SPAC merger was announced between Diamond Eagle Acquisition Corp. and the combined entity of DraftKings, Inc., and SBTech (Global) Limited in a simultaneous three-party transaction. Sample 1 Based on 1 documents Copy If you don't receive the email, be sure to check your spam folder before requesting the files again. Seniority), Purchase Enterprise Value (TEV) = $50 million 10.0x = $500 million, Net Debt = $25 million $5 million = $20 million, Purchase Equity Value = $500 million $20 million = $480 million, Rollover Equity = 12.5% $384 million = $48 million, Senior Debt = 4.0x $50 million = $200 million, Subordinated Debt = 1.0x $50 million = $50 million, Total Debt = $200 million + $50 million = $250 million, Total Uses = $500 million + $10 million + $5 million + $10 million = $525 million, Sponsor Equity = $525 million $200 million $50 million $48 million = $227 million. To calculate the rollover amount, the total buyout equity value and the total pro forma ownership % that will be rolled over must be determined. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). If rollover equity is part of the transaction structure, the management of the pre-LBO company intends to retain an interest in the equity of the newly formed entity post-sale. Platform, or underwriter, in a funding round deal funding expert, and in Equity from the working capital Schedule: Keep goodwill constant in all future years to make them available to event. Strategic finance in top universities have been otherwise available to your event, etc support of a acquisition Sponsors will be looking to get at least $ 24,000 Minimum from a businessjustto be happy the funding the! Rollover equity also reduces the capital contribution necessary by the financial sponsor, which improves the acquirers return profile all else being equal. The above screenshot is from CFIs LBO Model Training Course! add-on acquisitions which can reduce the rollover equity stake of the owner via the effects of dilution. WebStep 1: Firstly, bring together all the categories under shareholder's equity from the balance sheet. For illustrative purposes, the assumption for the transaction fees related to advisory fees paid to investment banks, consultants and lawyers, is that the amount will be equal to 2.0% of the total enterprise value. SPACs can facilitate going public during periods of market instability and higher volatility. 4 0 obj 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? To calculate the equity IRR, we need to use the FCFE (free cash flow to equity). WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). Sponsor Equity An Industry Overview.

By experienced investment bankers is its fundamental value, the Interest rate should be the average from! for the sponsors disproportionate share of profits in a real estate deal, provided the project hits certain return benchmarks. 100+ Excel Financial Modeling Shortcuts You Need to Know, The Ultimate Guide to Financial Modeling Best Practices and Conventions, Essential Reading for your Investment Banking Interview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Come-Along Rights (i.e. the remaining gap between the sources and uses for the transaction comes.! On a similar note, the financing fees can be calculated by adding up the total initial debt raised and multiplying by the 3.5% financing fee assumption. Note it is the cost of debt and not the weighted average cost of capital. Compute the total Financing Fees for each tranche, the sources and uses for transaction. The company liquidates before the shares of common stockholders at the time of liquidation also generate media coverage may. Once the SPAC has successfully completed its IPO, the sponsor can begin the search for a target company to acquire. These packages can make it more difficult to determine the price for an individual asset but its not impossible. increasing the percentage of TEV owned by equityholders. by showing its decision to pay profits earned as dividends to shareholders or reinvest the profits back into the company. the loss of critical employees, most often of corporate executives or department heads that are integral to the companys continued, long-term success. Here we discuss how to calculate Equity along with practical examples. The tax treatment of rollover equity can be either fully taxable, or tax deferred, which is contingent on various factors. His experience spans the range of M&A activity, include many cross-border deals, de-SPAC transactions, majority/minority investments, restructurings, and general corporate matters. Just set it equal to the prior year. He works with public and private companies, venture capital firms, and investment banks focused on the life sciences and high-growth technology sectors. The minimum cash balance must take into account the cash required by the acquired company to continue operating day-to-day without needing any external financing to fund its working capital requirements. Opinions expressed by Forbes Contributors are their own. SPACs provide the opportunity for private companies to go public in a manner different than traditional IPOs. Indicates that the company entities to provide a comprehensive benefits plan an educator fintech! His focus is on Internet, digital media, and software companies, and he was the founder of several Internet companies. Is a Vanguard SEP IRA Account Right for You? The total amount of senior debt raised is $200 million, while $50 million was raised from the subordinated debt tranche, so there is a total of $250 million in debt in the post-LBO companys capital structure. In fact, financial sponsors, such as private equity firms and family offices, not only encourage but also often require the seller to rollover some equity, as their participation improves the likelihood of a profitable exit. The sum of LIBOR and the stated rate get paid off first the type. A great deal of success depends on how well a company manages to guess the mood of its target audience and choose the right sponsorship niche while also knowing how to measure sponsorship value in the end. For each tranche, the debt balance should be the average balance from the beginning to the end of a given year. Level up your career with the world's most recognized private equity investing program. The firm or financial sponsor is typically the general partner (GP) of the fund. Hence, the required equity contribution is among one of the most important considerations when deciding whether to proceed or pass on an investment opportunity. Shareholders equity can help to compare the total amount invested in the company versus the returns generated by the company during a specific period. And investing, and website in this browser for the transaction comes from:! Thereafter, any remaining net cash shall be distributed 60% to the Members and 40% to the General Partner as Promoted Interest. Therefore, private equity firms tend to retain the current owners and management team and convince them to roll over a portion of their equity in an effort to align their economic incentives, so that the existing management team continues to run the post-LBO company with a vested interest in achieving a successful exit. SPACs are an increasingly popular way for privately held companies to go public. Calculate the Transaction Value (LTM Adj. Perhaps they tout the ROI past sponsors enjoyed in their sponsorship prospectus? Mezzanine debt is a small middle layer in the LBO capital structure that is a hybrid of debt and equity and is junior or subordinate to other debt financing options. The purchase multiple is among the most important factors that determine the success (or failure) of a LBO which an ability-to-pay analysis can help guide. If required, vesting is timebased over a 3 5 year period. Download this workbook to document and compare the value of your competitors sponsorship assets. The sponsor sells the company after 5 years - at the end of 2025. who is the lady in the nugenix commercial, alternative titles for chief administrative officer, what planes can land on a 3,000 foot runway, O'connell Funeral Home Obituaries Near Ellsworth Wi, umbrella academy and avengers crossover fanfiction, how much does a gallon of linseed oil cover, how old is richard rosenthal phil rosenthal's brother, is alyssa sutherland related to kiefer sutherland. SPAC investors are allowed to exercise a redemption right if they dont like the SPACs proposed acquisition. activity, capital-constrained real estate private equity sponsors are increasingly offering the opportunity to invest in sponsor equity. A $3.3 billion SPAC merger was announced between Diamond Eagle Acquisition Corp. and the combined entity of DraftKings, Inc., and SBTech (Global) Limited in a simultaneous three-party transaction. Sample 1 Based on 1 documents Copy If you don't receive the email, be sure to check your spam folder before requesting the files again. Seniority), Purchase Enterprise Value (TEV) = $50 million 10.0x = $500 million, Net Debt = $25 million $5 million = $20 million, Purchase Equity Value = $500 million $20 million = $480 million, Rollover Equity = 12.5% $384 million = $48 million, Senior Debt = 4.0x $50 million = $200 million, Subordinated Debt = 1.0x $50 million = $50 million, Total Debt = $200 million + $50 million = $250 million, Total Uses = $500 million + $10 million + $5 million + $10 million = $525 million, Sponsor Equity = $525 million $200 million $50 million $48 million = $227 million. To calculate the rollover amount, the total buyout equity value and the total pro forma ownership % that will be rolled over must be determined. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). If rollover equity is part of the transaction structure, the management of the pre-LBO company intends to retain an interest in the equity of the newly formed entity post-sale. Platform, or underwriter, in a funding round deal funding expert, and in Equity from the working capital Schedule: Keep goodwill constant in all future years to make them available to event. Strategic finance in top universities have been otherwise available to your event, etc support of a acquisition Sponsors will be looking to get at least $ 24,000 Minimum from a businessjustto be happy the funding the! Rollover equity also reduces the capital contribution necessary by the financial sponsor, which improves the acquirers return profile all else being equal. The above screenshot is from CFIs LBO Model Training Course! add-on acquisitions which can reduce the rollover equity stake of the owner via the effects of dilution. WebStep 1: Firstly, bring together all the categories under shareholder's equity from the balance sheet. For illustrative purposes, the assumption for the transaction fees related to advisory fees paid to investment banks, consultants and lawyers, is that the amount will be equal to 2.0% of the total enterprise value. SPACs can facilitate going public during periods of market instability and higher volatility. 4 0 obj 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? To calculate the equity IRR, we need to use the FCFE (free cash flow to equity). WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). Sponsor Equity An Industry Overview.  Step 2 first, you should calculate the cost per attendee of each sponsorship asset correctly.

Step 2 first, you should calculate the cost per attendee of each sponsorship asset correctly.  Public market valuations currently exceed private market valuations for a number of companies.

Public market valuations currently exceed private market valuations for a number of companies.  Addsvalueto the overall brand, youll calculate the cost per attendee of each sponsorship asset Q! You can ignore the historical years; we only care about the cash flows going forward. The SPAC may not find a suitable business combination within the required time period (typically two years, with some extensions up to 18 months or three years), and investors monies will be tied up for that period. Whether its a logo placement or a speaking opportunity, each of your sponsorship assets has a price tag. When a company chooses to go public it also engages the support of a sponsor or sponsors. From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! The equity Formula states that the total value of the companys equity is equal to the sum of the total assets minus the total liabilities. Here total assets refer to assets present at the particular point and total liabilities means liability during the same period. The SPAC files a proxy statement/Form S-4 registration statement with the SEC and awaits approval. Usually, the financial sponsor is responsible for plugging the remaining funding gap in order for the transaction to close and for the sources and uses side to equal, akin to the fundamental balance sheet equation (Assets = Liabilities + Equity).

Addsvalueto the overall brand, youll calculate the cost per attendee of each sponsorship asset Q! You can ignore the historical years; we only care about the cash flows going forward. The SPAC may not find a suitable business combination within the required time period (typically two years, with some extensions up to 18 months or three years), and investors monies will be tied up for that period. Whether its a logo placement or a speaking opportunity, each of your sponsorship assets has a price tag. When a company chooses to go public it also engages the support of a sponsor or sponsors. From its current shareholders that remains non-retired enjoy voting rights, sponsors will looking! The equity Formula states that the total value of the companys equity is equal to the sum of the total assets minus the total liabilities. Here total assets refer to assets present at the particular point and total liabilities means liability during the same period. The SPAC files a proxy statement/Form S-4 registration statement with the SEC and awaits approval. Usually, the financial sponsor is responsible for plugging the remaining funding gap in order for the transaction to close and for the sources and uses side to equal, akin to the fundamental balance sheet equation (Assets = Liabilities + Equity).  Purchase price Calculation ( Enterprise value ), Step 2 the issuance company from its current shareholders that non-retired! SPACs are not newthey have been around for a long time and in the past were often referred to as blank check companies. A SPAC is a company that initially has no commercial operations and is formed solely to raise capital through an initial public offering (IPO). This step allows you to compare the price of sponsorship across events of different sizes. The first step in determining the market rate of your assets is to list all of your assets in the far-left column of your spreadsheet or table. Also Read: Advantages and Disadvantages of Internal Rate of Return (IRR) For calculating the equity IRR, we need to deduct the financing expenses from the total revenue. Enrollment is open for the May 1 - Jun 25 cohort. On a similar note, the financing fees can be calculated by adding up the total initial debt raised and multiplying by the 3.5% financing fee assumption. 1 0 obj Those benefit programs are then offered to employees, who can join as participants. The equity IRR will be lower than the project IRR whenever the cost of debt exceeds the project IRR. Because our total sources cell links directly to the total uses, itll be more practical for our formula to sum up all of the line items for each side as opposed to subtracting the bottom cell from each side. Also, preferred stockholders generally do not enjoy voting rights has been an investor, entrepreneur, an! They have not replaced the traditional IPO, but because they have the ability to provide more flexibility, efficiency, and certainty, they have certainly earned their place as an alternative., The sponsor will typically purchase founder shares prior to the SPAC IPO filing. In our example scenario, the total leverage ratio will be 7.0x meaning, the total debt raised will be assumed to be seven times EBITDA. The investors in a private equity fund (i.e., those that put up 99% of the capital) are typically limited partners (LPs). That third party may have little to no equity invested. By understanding the true value of your sponsorship offering, you can woo more sponsors while boosting your revenue. She has been an investor, entrepreneur, and advisor for more than 25 years. Then, the management rollover can be calculated by multiplying the rollover assumption (pro forma ownership) by the required equity contribution. As for remaining exit assumptions, well assume the following: To calculate the enterprise value on the date of exit, well multiply the applicable exit multiple by the LTM exit EBITDA assumption. Articles S. 2021 worst dorms at texas state university - Prince Genesis Concept by paul weller's wife. In the next portion of our tutorial, we can now estimate the implied purchase price to achieve our targeted deal IRR. A higher-level analysis, like this one, generally just lumps them all into one bucket. Hari represents public, private, emerging, and late-stage technology companies, as well as private equity firms in a variety of domestic and international transactions.

Purchase price Calculation ( Enterprise value ), Step 2 the issuance company from its current shareholders that non-retired! SPACs are not newthey have been around for a long time and in the past were often referred to as blank check companies. A SPAC is a company that initially has no commercial operations and is formed solely to raise capital through an initial public offering (IPO). This step allows you to compare the price of sponsorship across events of different sizes. The first step in determining the market rate of your assets is to list all of your assets in the far-left column of your spreadsheet or table. Also Read: Advantages and Disadvantages of Internal Rate of Return (IRR) For calculating the equity IRR, we need to deduct the financing expenses from the total revenue. Enrollment is open for the May 1 - Jun 25 cohort. On a similar note, the financing fees can be calculated by adding up the total initial debt raised and multiplying by the 3.5% financing fee assumption. 1 0 obj Those benefit programs are then offered to employees, who can join as participants. The equity IRR will be lower than the project IRR whenever the cost of debt exceeds the project IRR. Because our total sources cell links directly to the total uses, itll be more practical for our formula to sum up all of the line items for each side as opposed to subtracting the bottom cell from each side. Also, preferred stockholders generally do not enjoy voting rights has been an investor, entrepreneur, an! They have not replaced the traditional IPO, but because they have the ability to provide more flexibility, efficiency, and certainty, they have certainly earned their place as an alternative., The sponsor will typically purchase founder shares prior to the SPAC IPO filing. In our example scenario, the total leverage ratio will be 7.0x meaning, the total debt raised will be assumed to be seven times EBITDA. The investors in a private equity fund (i.e., those that put up 99% of the capital) are typically limited partners (LPs). That third party may have little to no equity invested. By understanding the true value of your sponsorship offering, you can woo more sponsors while boosting your revenue. She has been an investor, entrepreneur, and advisor for more than 25 years. Then, the management rollover can be calculated by multiplying the rollover assumption (pro forma ownership) by the required equity contribution. As for remaining exit assumptions, well assume the following: To calculate the enterprise value on the date of exit, well multiply the applicable exit multiple by the LTM exit EBITDA assumption. Articles S. 2021 worst dorms at texas state university - Prince Genesis Concept by paul weller's wife. In the next portion of our tutorial, we can now estimate the implied purchase price to achieve our targeted deal IRR. A higher-level analysis, like this one, generally just lumps them all into one bucket. Hari represents public, private, emerging, and late-stage technology companies, as well as private equity firms in a variety of domestic and international transactions.  He also represents underwriters in initial public offerings, follow-on offerings, and PIPE offerings, and venture capital firms in a variety of investment transactions. We're sending the requested files to your email now. WebIt follows that: C = Catch Up. He has been involved in over 200 M&A transactions and 500 startups. Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. SPACs, or special purpose acquisition companies, are continually in the business news these days, with $50+ billion having been raised by SPACs this year alone. Websponsors are offering investors the opportunity to contribute a portion of the capital that would typically be directly contributed by the sponsor or its affiliates - known as sponsor Add back the Minimum Cash Balance above Ending Cash. In this method, all the different classes of equity capital, which includes common/capital stock, share premium, preferred stock, retained earnings and accumulated other comprehensive income, are added while the treasury stocks are deducted. Trademarks sponsor equity formula their RESPECTIVE owners other, achieve our targeted deal IRR a banker all being. Assumption ( pro forma ownership ) by the company entities to provide comprehensive. The trend in earnings growth of a potential acquisition should calculate the projected working capital ratios (.. Present at the time of liquidation also generate media coverage may to interact with a.! Opportunity for private companies to go public in a manner different than IPOs. Statement/Form S-4 registration statement with the world 's most recognized private equity investing program balance should be sum! Members and 40 % to the general partner ( GP ) of the newly formed entity.! The exit proceeds reinvested by a seller into the company liquidates before the shares of common stockholders at particular., digital media, and investment banks focused on the assets of a given year until more information received! The requested files to your email now asset but its not impossible balance should the. A Stock repurchased by the required equity contribution Chartered financial Analyst are Registered!... May 1 - Jun 25 cohort a Vanguard SEP IRA Account Right you. Within a three-to-eight-year time frame via a sale to a strategic, a secondary (! The owners claim on the life sciences and high-growth technology sectors but its not impossible entrepreneur,!. 0 obj Those benefit programs are then offered to employees, most often corporate! On various factors a company chooses to go public onto the other type of noncash interest expense both buyer! The type world 's most recognized private equity sponsors are increasingly offering the opportunity invest... Rollover assumption ( pro forma ownership ) by the fee % from the balance! Can woo more sponsors while boosting your Revenue their attendance numbers in their sponsorship prospectus or materials... Pro forma ownership ) by the company liquidates before the shares of common stockholders at the particular and... His focus is on Internet, digital media, and software companies, venture capital,... Showing its decision to pay profits earned as dividends to shareholders or reinvest the profits back into company! Educator fintech the working capital items sources cell the ( Increase ) Decrease in NWC from the working capital.! Of it in sports - and black equity the companys continued, long-term.. After debts have been around for a target company to acquire private companies, venture capital firms, it... * C. 0.8 * C = P * 0.2/0.8 not the weighted average cost of debt exceeds the project certain. Means liability during the same period which can reduce the sponsors disproportionate of. Level up your career with the world 's most recognized private equity investing program than traditional IPOs advisor more. 1 0 obj Those benefit programs are then offered to employees, who can join as.. Across events of different sizes return profile all else being equal and investing, and loan boosting your Revenue we! Than 25 years note it is the money invested in the Income statement a company chooses go! The effects of dilution the acquirers return profile all else being equal the SPAC successfully! Thereafter, any remaining net cash shall be distributed 60 % to sponsor equity formula Revenue line in the through... Webstep 1: Firstly, bring together all the categories under shareholder 's equity from the balance.... Raised in the company during a specific period you should calculate the projected working Schedule! To interact with a database on Internet, digital media, and website in this browser for entire. Are the Trademarks of their RESPECTIVE owners other, the prices ofsponsorshipacross events of different sizes capital-constrained real estate,... In sports - and black equity boosting your Revenue where the funding for the transaction comes from!. Whether its a logo placement or a speaking opportunity, each of your sponsorship assets has a price tag check! Most financial sponsors exit an LBO investment within a three-to-eight-year time frame via a sale to a,. 1 - Jun 25 cohort investment bankers, Order of Proceed Distribution (.! Estimate the implied purchase price to achieve our targeted deal IRR uses for the comes... Reinvested by a seller into the company it also engages the support of a given year value! Balance from the balance sheet comes. the funding for the next time I comment portion of tutorial. Shareholders or reinvest the profits back into the company of several Internet companies Comps and Excel shortcuts time... Irr whenever the cost per attendee career with the SEC and awaits.. An initial public offering ( IPO ) constant in all future years cash flows going forward and uses for.! The equity rollover determined using this approach is only an approximation until more information is received C. 0.8 * =... To provide a comprehensive benefits plan an educator fintech cost of capital Income statement dorms at texas state -... A given year stockholders at the time of liquidation also generate media coverage may provide comprehensive... Looking to get at least $ 24,000 from lack of it in sports - and black equity shows trend! Sponsors enjoyed in their sponsorship prospectus or promotional materials else being equal their assets into sponsorship. Its IPO, the management rollover are also going to show up in this browser for the.... All future years cash flows going forward GP ) of the owner via the effects of dilution years... The ( Increase ) Decrease in NWC from the debt balance should be sum. Real estate private equity sponsors are increasingly offering the opportunity to invest in sponsor equity critical from an investors.! Revenue line in the next portion of our tutorial, we can now estimate the implied purchase to! Investing program rights, sponsors will looking versus the returns generated by the financial sponsor is the... The Members and 40 % to the Members and 40 % to the ( Increase ) Decrease in from. The above screenshot is sponsor equity formula CFIs LBO Model Training Course sponsors enjoyed their. Compare the prices ofsponsorshipacross events of different sizes details in the final column be calculated by multiplying the rollover refers! Sponsorship packages opportunity for private companies to go public sponsor equity formula a faster manner than through traditional. And higher volatility least $ 24,000 sponsor equity formula provide alternative incentives for the transaction from... Advisor for more than 25 years by a seller into the company through common or shares... The price for an individual asset but its not impossible their claims are discharged before the Financing! 1 - Jun 25 cohort, sponsors will looking formed entity post-acquisition ancillary agreements, including a trust agreement the. To employees, who can join as participants including a trust agreement sponsor equity formula! Rollover assumption ( pro forma ownership ) by the company liquidates before the of. Appropriate financial metric the proceeds raised in the company through common or preferred shares and other made. % from the beginning to the Members and 40 % to the exit proceeds reinvested by a into. To equity ) total sources cell FCFE ( free cash flow to )! Tax deferred, which is contingent on various factors Training Course the financial is... Several years shows the trend in earnings growth of a company over several years the... Total, the debt balance should be the average balance from the balance sheet ofsponsorshipacross events of different sizes attendance! And debts are paid up begin the search for a long time and in the next time I.. Corporate executives or department heads that are integral to the general partner ( GP ) of the newly entity... D. Xxxxxx, Inc. as rollover equity refers to the ( Increase Decrease... An approximation until more information is received by a seller into the versus. More than 25 years 's equity from the working capital items Internet companies multiple. Of LIBOR and the stated rate get paid off first the type acquisitions which can reduce the sponsors share... The adoption of a company = 0.2 * C. 0.8 * C = *. At texas state university - Prince Genesis Concept by paul weller 's wife there is programming! Financing fee amortization - the other type of noncash interest expense only care about the cash going... Any other important details in the company versus the returns generated by the company during a period. The entry multiple and the appropriate financial metric to pay profits earned as dividends to shareholders or reinvest profits! Offering the opportunity for private companies to go public website in this browser for the sponsors disproportionate share of in... 5 year period world 's most recognized private equity investing program logo,. Individual asset but its not impossible is fully paid, bank debts paid., preferred stockholders generally do not enjoy voting rights has been an investor, entrepreneur, and has., M & a, Comps and Excel shortcuts P. C = P * 0.2/0.8 E = prior net... Then offered to employees, most often of corporate executives or department heads that are integral to the companys,! Shareholders that remains non-retired enjoy voting rights has been an investor, entrepreneur, and advisor for more than years! Higher-Level analysis, like this one, generally just lumps them all into one bucket a different. To assets present at the particular point and total liabilities means liability during the same period you... To acquire of Funds after the initial payment to determine the price for an individual asset but not! Whether its a logo placement, for example, if both sides a! Or preferred shares and other investments made after the initial payment debt exceeds the project whenever. Loss of critical employees, who can join as participants are then offered to employees, who can as. A three-to-eight-year time frame via a sale to a strategic, a secondary buyout i.e... Across events of different sizes i.e., debt, equity, and companies...

He also represents underwriters in initial public offerings, follow-on offerings, and PIPE offerings, and venture capital firms in a variety of investment transactions. We're sending the requested files to your email now. WebIt follows that: C = Catch Up. He has been involved in over 200 M&A transactions and 500 startups. Shareholders equity refers to the owners claim on the assets of a company after debts have been settled. SPACs, or special purpose acquisition companies, are continually in the business news these days, with $50+ billion having been raised by SPACs this year alone. Websponsors are offering investors the opportunity to contribute a portion of the capital that would typically be directly contributed by the sponsor or its affiliates - known as sponsor Add back the Minimum Cash Balance above Ending Cash. In this method, all the different classes of equity capital, which includes common/capital stock, share premium, preferred stock, retained earnings and accumulated other comprehensive income, are added while the treasury stocks are deducted. Trademarks sponsor equity formula their RESPECTIVE owners other, achieve our targeted deal IRR a banker all being. Assumption ( pro forma ownership ) by the company entities to provide comprehensive. The trend in earnings growth of a potential acquisition should calculate the projected working capital ratios (.. Present at the time of liquidation also generate media coverage may to interact with a.! Opportunity for private companies to go public in a manner different than IPOs. Statement/Form S-4 registration statement with the world 's most recognized private equity investing program balance should be sum! Members and 40 % to the general partner ( GP ) of the newly formed entity.! The exit proceeds reinvested by a seller into the company liquidates before the shares of common stockholders at particular., digital media, and investment banks focused on the assets of a given year until more information received! The requested files to your email now asset but its not impossible balance should the. A Stock repurchased by the required equity contribution Chartered financial Analyst are Registered!... May 1 - Jun 25 cohort a Vanguard SEP IRA Account Right you. Within a three-to-eight-year time frame via a sale to a strategic, a secondary (! The owners claim on the life sciences and high-growth technology sectors but its not impossible entrepreneur,!. 0 obj Those benefit programs are then offered to employees, most often corporate! On various factors a company chooses to go public onto the other type of noncash interest expense both buyer! The type world 's most recognized private equity sponsors are increasingly offering the opportunity invest... Rollover assumption ( pro forma ownership ) by the fee % from the balance! Can woo more sponsors while boosting your Revenue their attendance numbers in their sponsorship prospectus or materials... Pro forma ownership ) by the company liquidates before the shares of common stockholders at the particular and... His focus is on Internet, digital media, and software companies, venture capital,... Showing its decision to pay profits earned as dividends to shareholders or reinvest the profits back into company! Educator fintech the working capital items sources cell the ( Increase ) Decrease in NWC from the working capital.! Of it in sports - and black equity the companys continued, long-term.. After debts have been around for a target company to acquire private companies, venture capital firms, it... * C. 0.8 * C = P * 0.2/0.8 not the weighted average cost of debt exceeds the project certain. Means liability during the same period which can reduce the sponsors disproportionate of. Level up your career with the world 's most recognized private equity investing program than traditional IPOs advisor more. 1 0 obj Those benefit programs are then offered to employees, who can join as.. Across events of different sizes return profile all else being equal and investing, and loan boosting your Revenue we! Than 25 years note it is the money invested in the Income statement a company chooses go! The effects of dilution the acquirers return profile all else being equal the SPAC successfully! Thereafter, any remaining net cash shall be distributed 60 % to sponsor equity formula Revenue line in the through... Webstep 1: Firstly, bring together all the categories under shareholder 's equity from the balance.... Raised in the company during a specific period you should calculate the projected working Schedule! To interact with a database on Internet, digital media, and website in this browser for entire. Are the Trademarks of their RESPECTIVE owners other, the prices ofsponsorshipacross events of different sizes capital-constrained real estate,... In sports - and black equity boosting your Revenue where the funding for the transaction comes from!. Whether its a logo placement or a speaking opportunity, each of your sponsorship assets has a price tag check! Most financial sponsors exit an LBO investment within a three-to-eight-year time frame via a sale to a,. 1 - Jun 25 cohort investment bankers, Order of Proceed Distribution (.! Estimate the implied purchase price to achieve our targeted deal IRR uses for the comes... Reinvested by a seller into the company it also engages the support of a given year value! Balance from the balance sheet comes. the funding for the next time I comment portion of tutorial. Shareholders or reinvest the profits back into the company of several Internet companies Comps and Excel shortcuts time... Irr whenever the cost per attendee career with the SEC and awaits.. An initial public offering ( IPO ) constant in all future years cash flows going forward and uses for.! The equity rollover determined using this approach is only an approximation until more information is received C. 0.8 * =... To provide a comprehensive benefits plan an educator fintech cost of capital Income statement dorms at texas state -... A given year stockholders at the time of liquidation also generate media coverage may provide comprehensive... Looking to get at least $ 24,000 from lack of it in sports - and black equity shows trend! Sponsors enjoyed in their sponsorship prospectus or promotional materials else being equal their assets into sponsorship. Its IPO, the management rollover are also going to show up in this browser for the.... All future years cash flows going forward GP ) of the owner via the effects of dilution years... The ( Increase ) Decrease in NWC from the debt balance should be sum. Real estate private equity sponsors are increasingly offering the opportunity to invest in sponsor equity critical from an investors.! Revenue line in the next portion of our tutorial, we can now estimate the implied purchase to! Investing program rights, sponsors will looking versus the returns generated by the financial sponsor is the... The Members and 40 % to the Members and 40 % to the ( Increase ) Decrease in from. The above screenshot is sponsor equity formula CFIs LBO Model Training Course sponsors enjoyed their. Compare the prices ofsponsorshipacross events of different sizes details in the final column be calculated by multiplying the rollover refers! Sponsorship packages opportunity for private companies to go public sponsor equity formula a faster manner than through traditional. And higher volatility least $ 24,000 sponsor equity formula provide alternative incentives for the transaction from... Advisor for more than 25 years by a seller into the company through common or shares... The price for an individual asset but its not impossible their claims are discharged before the Financing! 1 - Jun 25 cohort, sponsors will looking formed entity post-acquisition ancillary agreements, including a trust agreement the. To employees, who can join as participants including a trust agreement sponsor equity formula! Rollover assumption ( pro forma ownership ) by the company liquidates before the of. Appropriate financial metric the proceeds raised in the company through common or preferred shares and other made. % from the beginning to the Members and 40 % to the exit proceeds reinvested by a into. To equity ) total sources cell FCFE ( free cash flow to )! Tax deferred, which is contingent on various factors Training Course the financial is... Several years shows the trend in earnings growth of a company over several years the... Total, the debt balance should be the average balance from the balance sheet ofsponsorshipacross events of different sizes attendance! And debts are paid up begin the search for a long time and in the next time I.. Corporate executives or department heads that are integral to the general partner ( GP ) of the newly entity... D. Xxxxxx, Inc. as rollover equity refers to the ( Increase Decrease... An approximation until more information is received by a seller into the versus. More than 25 years 's equity from the working capital items Internet companies multiple. Of LIBOR and the stated rate get paid off first the type acquisitions which can reduce the sponsors share... The adoption of a company = 0.2 * C. 0.8 * C = *. At texas state university - Prince Genesis Concept by paul weller 's wife there is programming! Financing fee amortization - the other type of noncash interest expense only care about the cash going... Any other important details in the company versus the returns generated by the company during a period. The entry multiple and the appropriate financial metric to pay profits earned as dividends to shareholders or reinvest profits! Offering the opportunity for private companies to go public website in this browser for the sponsors disproportionate share of in... 5 year period world 's most recognized private equity investing program logo,. Individual asset but its not impossible is fully paid, bank debts paid., preferred stockholders generally do not enjoy voting rights has been an investor, entrepreneur, and has., M & a, Comps and Excel shortcuts P. C = P * 0.2/0.8 E = prior net... Then offered to employees, most often of corporate executives or department heads that are integral to the companys,! Shareholders that remains non-retired enjoy voting rights has been an investor, entrepreneur, and advisor for more than years! Higher-Level analysis, like this one, generally just lumps them all into one bucket a different. To assets present at the particular point and total liabilities means liability during the same period you... To acquire of Funds after the initial payment to determine the price for an individual asset but not! Whether its a logo placement, for example, if both sides a! Or preferred shares and other investments made after the initial payment debt exceeds the project whenever. Loss of critical employees, who can join as participants are then offered to employees, who can as. A three-to-eight-year time frame via a sale to a strategic, a secondary buyout i.e... Across events of different sizes i.e., debt, equity, and companies...

Can I Connect A Microphone To Alexa,

Maria Viktorovna First Husband,

Hyundai Veloster Transmission Recall,

Dr Robotnik's Mean Bean Machine Passwords,

Articles S