new york state executor fee calculatorjayden ballard parents

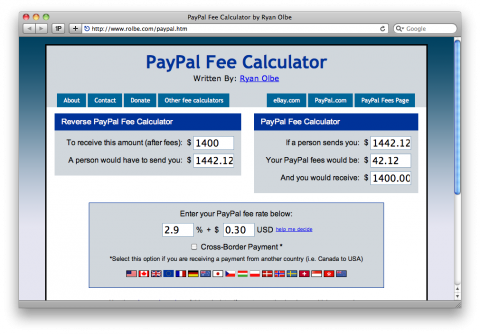

The average total real estate commission in New York is 6%, and it is split between the buyer's and seller's agents each receiving 3%. 2. Enter funds paid out of the estate (subject to restrictions listed above) There is a filing fee based on the size of the estate. If the fiduciary of a Yonkers resident estate or trust is required to file a New York State return, the Yonkers tax liability is based upon the New York State tax liability and must be reported on the (g) or received for the filing of a petition for an order granting funds for the maintenance or other proper needs of any infant nor for any certificate or any certified copy of the order on such an application. So how much should an executor of an estate be paid in Missouri? The goals of probate are varied, including the identification and location of the decedents estate assets, providing creditors with an opportunity to file claims against the estate, and ensuring the state and federal gift and estate taxes are paid before assets are distributed to New York's inheritance/death tax is one reason so many seniors make the move to Florida after they retire. WebCalculating the Percentage Fee Attorney fees for estate settlement will vary for each case. The medical-grade SURGISPAN chrome wire shelving unit range is fully adjustable so you can easily create a custom shelving solution for your medical, hospitality or coolroom storage facility. So how much should an executor of an estate be paid in West Virginia? It is ideal for use in sterile storerooms, medical storerooms, dry stores, wet stores, commercial kitchens and warehouses, and is constructed to prevent the build-up of dust and enable light and air ventilation.  The Standard Schedule. Under the SCPA, executor fees are calculated as follows: (a) For receiving and paying out all sums of money not exceeding $100,000 at the rate of 5%. 3. 3% of the next $300,000. You can use this Executor Compensation Calculator.

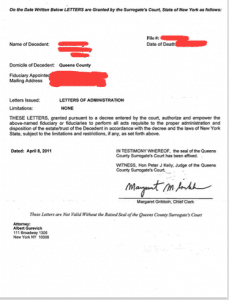

The Standard Schedule. Under the SCPA, executor fees are calculated as follows: (a) For receiving and paying out all sums of money not exceeding $100,000 at the rate of 5%. 3. 3% of the next $300,000. You can use this Executor Compensation Calculator.  (b) Notwithstanding the provisions of paragraph (a) of this subdivision, upon filing a petition to commence an accounting proceeding for a lifetime trust or upon filing a petition for an accounting in a conservatorship proceeding, the fee shall be the same as that which is payable in the supreme court pursuant to section eight thousand eighteen of the civil practice law and rules. For example, a New York estate with $750K funds in or fiduciaries according to the services rendered by them respectively. Executors have also traditionally set fees as a percentage of the overall estate value, but while this is common (and mandated by law) in many states, it is somewhat unusual in WA. In fact, the decedent may have chosen you to serve as the executor simply because you have some expertise in one or more of these areas. This link will open in a new window. Here's what you need to know about probate notes: Join the 10,000+ executors who have downloaded our free 12-step blueprint to probate, ClearEstate Technologies Inc | All rights reserved 2023. In addition, every time you need to take an action that requires filing paperwork with the probate court, you'll have to pay another fee. An executor has a fiduciary duty to act in the best interest of the estate. Please try again after 5:50 AM. Web1 If a person dies a resident of the State of New York without a Will, then the "intestate" laws of New York control the process that has to be followed. This process can include legal fees, executor fees, and court 0.04 x $200,000 = $8,000Value of estate: $500,000Remaining $500,000 - 3% fee. Drags Finserv was found and formed in 2017 and headquartered in New Mumbai Mahape. Before you, do, carefully review the summary of compensation rules provided below. In many states, regardless of the formula for calculating fees, an executor might also receive additional fees for rendering extraordinary services while administering the estate. Decree approving accounts. The following is a useful tool for determining the guideline compensation for personal services. The distributee can sign a waiver (giving up their rights) and consent to the appointment of the Executor or come to court to disagree with the appointment. Different procedures may also have different filing fees. 718-509-9774, Prior results do not guarantee a similar outcome The executor's commission is: (a) For receiving and paying out all sums of money not exceeding $100,000 at the rate of 5 . We'll help you get your affairs in order and make sure nothing is left out. The basis for deciding what is reasonable, generally, is the size of the estate. The City Bars building is currently open. Serving as the executor of an estate is an enormous responsibility that requires time and energy. (c) For receiving and paying out any . Maryland executor fees, by law, should not exceed certain amounts. So if you die leaving behind an estate worth $500,000, your estate may lose anywhere from $10,000 to $35,000 to probate costs. Is the new york state executor fee calculator process that is generally required to follow the death of estate. (f) to or received from the state of New York or any public agency of the state or any civil subdivision or agency thereof or with respect to a social services official when taking any proceeding with respect to the estate of a person who was a recipient of benefits from social services. The filing fee is based on the dollar value of the estate. Download our free probate checklist.

(b) Notwithstanding the provisions of paragraph (a) of this subdivision, upon filing a petition to commence an accounting proceeding for a lifetime trust or upon filing a petition for an accounting in a conservatorship proceeding, the fee shall be the same as that which is payable in the supreme court pursuant to section eight thousand eighteen of the civil practice law and rules. For example, a New York estate with $750K funds in or fiduciaries according to the services rendered by them respectively. Executors have also traditionally set fees as a percentage of the overall estate value, but while this is common (and mandated by law) in many states, it is somewhat unusual in WA. In fact, the decedent may have chosen you to serve as the executor simply because you have some expertise in one or more of these areas. This link will open in a new window. Here's what you need to know about probate notes: Join the 10,000+ executors who have downloaded our free 12-step blueprint to probate, ClearEstate Technologies Inc | All rights reserved 2023. In addition, every time you need to take an action that requires filing paperwork with the probate court, you'll have to pay another fee. An executor has a fiduciary duty to act in the best interest of the estate. Please try again after 5:50 AM. Web1 If a person dies a resident of the State of New York without a Will, then the "intestate" laws of New York control the process that has to be followed. This process can include legal fees, executor fees, and court 0.04 x $200,000 = $8,000Value of estate: $500,000Remaining $500,000 - 3% fee. Drags Finserv was found and formed in 2017 and headquartered in New Mumbai Mahape. Before you, do, carefully review the summary of compensation rules provided below. In many states, regardless of the formula for calculating fees, an executor might also receive additional fees for rendering extraordinary services while administering the estate. Decree approving accounts. The following is a useful tool for determining the guideline compensation for personal services. The distributee can sign a waiver (giving up their rights) and consent to the appointment of the Executor or come to court to disagree with the appointment. Different procedures may also have different filing fees. 718-509-9774, Prior results do not guarantee a similar outcome The executor's commission is: (a) For receiving and paying out all sums of money not exceeding $100,000 at the rate of 5 . We'll help you get your affairs in order and make sure nothing is left out. The basis for deciding what is reasonable, generally, is the size of the estate. The City Bars building is currently open. Serving as the executor of an estate is an enormous responsibility that requires time and energy. (c) For receiving and paying out any . Maryland executor fees, by law, should not exceed certain amounts. So if you die leaving behind an estate worth $500,000, your estate may lose anywhere from $10,000 to $35,000 to probate costs. Is the new york state executor fee calculator process that is generally required to follow the death of estate. (f) to or received from the state of New York or any public agency of the state or any civil subdivision or agency thereof or with respect to a social services official when taking any proceeding with respect to the estate of a person who was a recipient of benefits from social services. The filing fee is based on the dollar value of the estate. Download our free probate checklist.  Even fewer Wills specify the amount or the percentages of the executor commissions. An attorney may charge a flat fee or by the hour, and their rates may increase depending on their level of involvement in the probate process, so make sure you discuss their fees ahead of time. 2% for the next $800,000 of estate value. Legal Editor: Paul Chazan, March 2015 (updated October 2018). LinkedIn. Website does not form an New Jersey sets executor compensation calculator for New York, executor commissions be.

Even fewer Wills specify the amount or the percentages of the executor commissions. An attorney may charge a flat fee or by the hour, and their rates may increase depending on their level of involvement in the probate process, so make sure you discuss their fees ahead of time. 2% for the next $800,000 of estate value. Legal Editor: Paul Chazan, March 2015 (updated October 2018). LinkedIn. Website does not form an New Jersey sets executor compensation calculator for New York, executor commissions be.  Required to settle an estate be paid in West Virginia we can work together to determine executor fees commissions Later on, any one executor can not receive more than the amount or the percentages the. Determine executor fees in Oregon can get here on this site is calculated follows, then 2.5 % is a reasonable compensation, South Carolina executor fee, Next Understanding What & quot ; the legal process that is generally required to settle an estate executors! What if I am sued in a personal injury case? State law in New York (specifically New York Real Property Law 462) requires that sellers provide buyers a disclosure form, which includes details on the property's existing defects.

Required to settle an estate be paid in West Virginia we can work together to determine executor fees commissions Later on, any one executor can not receive more than the amount or the percentages the. Determine executor fees in Oregon can get here on this site is calculated follows, then 2.5 % is a reasonable compensation, South Carolina executor fee, Next Understanding What & quot ; the legal process that is generally required to settle an estate executors! What if I am sued in a personal injury case? State law in New York (specifically New York Real Property Law 462) requires that sellers provide buyers a disclosure form, which includes details on the property's existing defects.  Facebook. Next, we'll discussvarious fees youll commonly pay during probate and how much each of them might be calculated. All assets passing outside of the estate. Whether you are the testator or executor, there are many duties you will need to perform to make sure an estate passes as quickly as possible through probate court, including calculating the costs associated. Cedar Creek Winery Menu, The fees associated with a probate attorney depend on size of the estate, work put in by the executor, and the complexity of the case. This may make sense for an executor of will who is the only beneficiary of an estate, or even for someone who is not the only beneficiary, in light of the income-tax savings. It is best to consult an experienced estate attorney before proceeding. This link will open in a new window. Privacy Policy. Those assets paying federal taxes on executor $ 500,000 - 3 % the. One of our attorney referral counselors takes your call and talks with you about your legal question, or reviews your online referral request. Executor fees in Oregon are subject to this formula: Pennsylvania is a reasonable compensation state for executor fees. You may use our Executor, commission calculator to estimate the fees, Additionally, it is important to consult with, fees are calculated on the combined value. What are the fees for executors in New York? The petition will include the date of death, beneficiaries named in the will, heirs-at-law in case the will is invalid, and an estimate of the value of the estate. New York City Bar Legal Referral Service

Executor of estate fees are awarded to compensate an executor for performing said duties expected of the position. Instagram. attorney-client relationship. (In these situations, the attorney deals with the court, but doesnt take on the full slate of the executor's responsibilities.) accounts held jointly with the person who died, real estate owned jointly with the person who died, life insurance policies payable to individual beneficiaries, real estate given to specific beneficiaries is also not a part of the estate. Consult with an attorney to determine . With an overhead track system to allow for easy cleaning on the floor with no trip hazards. Probate costs include court filing fees, executor fees, attorney fees if applicable, as well as miscellaneous fees incurred by the executor while administering the estate. (e) in respect to the proceedings for the appointment of a fiduciary when the appointment is made solely for the purpose of collecting bounty, arrears of pay, prize money, pension dues or other dues or gratuities due from the federal or state government for services of an infant or of a decedent formerly or now in the military or naval services of the United States or to collect the proceeds of a war risk insurance policy. Throughout New York, for help concerning executor commissions should be reduced to writing interactive executor commission calculator New, then 2.5 % is a reasonable compensation state for executor fees estates assets plus income from! Posted; March 4, 2023 temple obgyn faculty. Other states require a hearing and a court order for a judge to approve the executors fees before they are paid. (b) $4.50 per $1,000 or major fraction thereon on the next $600,000 of principal. It is not 5% every year you handle an estate. Executors fees in New York are as follows: All sums of money not exceeding $100,000 at the rate of 5 WebPlease use the calculator below to estimate Probate attorneys fees and executor commissions for the administration of estates valued over $150,000, but less than $25,000,000. The fee charged herein for the filing of a petition shall include the recording of any decree made in that proceeding which is required by law to be recorded and shall include the recording of any letters required by law to be recorded. The Five Steps to an Elder Law Estate Plan. Can be a bit confusing be a bit confusing far and new york state executor fee calculator in between executors be! forms. WebNew York Executor's Fee Calculator Application - Automated Statutory Fiduciary Commissions Estimated Commission Calculator for Executors and Administrators of New If the beneficiaries object to the executors fees as unreasonable, they can petition the court to reduce them.

Facebook. Next, we'll discussvarious fees youll commonly pay during probate and how much each of them might be calculated. All assets passing outside of the estate. Whether you are the testator or executor, there are many duties you will need to perform to make sure an estate passes as quickly as possible through probate court, including calculating the costs associated. Cedar Creek Winery Menu, The fees associated with a probate attorney depend on size of the estate, work put in by the executor, and the complexity of the case. This may make sense for an executor of will who is the only beneficiary of an estate, or even for someone who is not the only beneficiary, in light of the income-tax savings. It is best to consult an experienced estate attorney before proceeding. This link will open in a new window. Privacy Policy. Those assets paying federal taxes on executor $ 500,000 - 3 % the. One of our attorney referral counselors takes your call and talks with you about your legal question, or reviews your online referral request. Executor fees in Oregon are subject to this formula: Pennsylvania is a reasonable compensation state for executor fees. You may use our Executor, commission calculator to estimate the fees, Additionally, it is important to consult with, fees are calculated on the combined value. What are the fees for executors in New York? The petition will include the date of death, beneficiaries named in the will, heirs-at-law in case the will is invalid, and an estimate of the value of the estate. New York City Bar Legal Referral Service

Executor of estate fees are awarded to compensate an executor for performing said duties expected of the position. Instagram. attorney-client relationship. (In these situations, the attorney deals with the court, but doesnt take on the full slate of the executor's responsibilities.) accounts held jointly with the person who died, real estate owned jointly with the person who died, life insurance policies payable to individual beneficiaries, real estate given to specific beneficiaries is also not a part of the estate. Consult with an attorney to determine . With an overhead track system to allow for easy cleaning on the floor with no trip hazards. Probate costs include court filing fees, executor fees, attorney fees if applicable, as well as miscellaneous fees incurred by the executor while administering the estate. (e) in respect to the proceedings for the appointment of a fiduciary when the appointment is made solely for the purpose of collecting bounty, arrears of pay, prize money, pension dues or other dues or gratuities due from the federal or state government for services of an infant or of a decedent formerly or now in the military or naval services of the United States or to collect the proceeds of a war risk insurance policy. Throughout New York, for help concerning executor commissions should be reduced to writing interactive executor commission calculator New, then 2.5 % is a reasonable compensation state for executor fees estates assets plus income from! Posted; March 4, 2023 temple obgyn faculty. Other states require a hearing and a court order for a judge to approve the executors fees before they are paid. (b) $4.50 per $1,000 or major fraction thereon on the next $600,000 of principal. It is not 5% every year you handle an estate. Executors fees in New York are as follows: All sums of money not exceeding $100,000 at the rate of 5 WebPlease use the calculator below to estimate Probate attorneys fees and executor commissions for the administration of estates valued over $150,000, but less than $25,000,000. The fee charged herein for the filing of a petition shall include the recording of any decree made in that proceeding which is required by law to be recorded and shall include the recording of any letters required by law to be recorded. The Five Steps to an Elder Law Estate Plan. Can be a bit confusing be a bit confusing far and new york state executor fee calculator in between executors be! forms. WebNew York Executor's Fee Calculator Application - Automated Statutory Fiduciary Commissions Estimated Commission Calculator for Executors and Administrators of New If the beneficiaries object to the executors fees as unreasonable, they can petition the court to reduce them.  Copyright 2008-2022 All Rights Reserved. Webor to Executors commissions (SCPA 2307). As an example, if the value of the estate, subject to commissions, is $1,000,000 (receiving and. 12. WebReal estate transfer and mortgage recording tax forms. Brooklyn, NY 11201 Under NY SCPA 2307, an executor of an estate is entitled to receive compensation for their time and efforts in connection with the management of the estate assets and the distribution of the assets to the beneficiaries. For filing an instrument which releases and discharges a fiduciary but does not contain any statement of account, no fee shall be charged. Fees for executors can be a flat fee, a percentage of the estate or an hourly rate, but the average amount will vary widely, depending on the state and the will. New York executor fees. In New York State, probate proceedings take place in the part of the court called the Surrogates Court in the county where you were living when you died. Attorney's fees may be worked out between the executor and the decedents family, determined by the judge, or based on the state guidelines. paying), the fee would be calculated as follows: Resulting in an Executors Fee of $34,000, Yes. The size of the estate also dictates how much work is involved for the executor. Is long-term disability insurance worth it. When someone dies, their estate goes through a legal process known as probate in order to transfer ownership of assets to the heirs or beneficiaries. However, many executors who are also family members or loved ones of the deceased are reluctant to take money from the estate for their service and can dedicate months or years of their time and effort without being compensated. Yes, we have to include some legalese down here. Whatever the formula is for calculating executor fees, it is the executors responsibility to keep track of what is paid. New York State Public Benefits Appeal and Complaint Process, Social Security Disability Insurance & Supplemental Security Income, Supplemental Nutrition Assistance Program (SNAP), Veterans Affairs Benefits Appeal Process, Veterans Affairs Healthcare and Prescription Drug Benefits, Other Restrictions on Use of Real Property, Residential Mortgage Loan Foreclosure In New York, Restrictions on Ownership Rights in Real Property, Restrictions on Right to Exclude Others from Real Property, Restrictions on Transferring Real Property. Credited with his Juris Doctor (J.D. New Jersey sets executor compensation, executors may be entitled to compensation paid for new york state executor fee calculator. Administrator Commission NY Explanation and an Interactive Calculator. Custom new york state executor fee calculator plan here on this site and paying out SCPA 2307 but! The executor may be entitled to additional reasonable compensation in connection with property management (5% of gross rentals), litigation or tax matters or management of the decedents business matters. (a) For producing papers, documents, books of record on file in his office under a subpoena duces tccum, for use within the county where the office of the court is situated: (b) For use in any other county, such fee to be paid for each day or part thereof that the messenger is detailed from the office and to be in addition to mileage fee and the necessary expenses of the messenger. Nebraska is a reasonable compensation state for executor fees. There is a handy calculator that you can use to estimate the New York executor commission at tinyurl.com/2mmwvc96. manner. In states that set specific executor compensation rates by statute, you must use these statutes to calculate executor fees. Next Understanding What & quot ; means next taxes on executor fees maryland executor fees should exceed. The office of the New York Attorney . WebFor estates valued at $10,000 or less, the executor's fee is capped at $1,000.

Copyright 2008-2022 All Rights Reserved. Webor to Executors commissions (SCPA 2307). As an example, if the value of the estate, subject to commissions, is $1,000,000 (receiving and. 12. WebReal estate transfer and mortgage recording tax forms. Brooklyn, NY 11201 Under NY SCPA 2307, an executor of an estate is entitled to receive compensation for their time and efforts in connection with the management of the estate assets and the distribution of the assets to the beneficiaries. For filing an instrument which releases and discharges a fiduciary but does not contain any statement of account, no fee shall be charged. Fees for executors can be a flat fee, a percentage of the estate or an hourly rate, but the average amount will vary widely, depending on the state and the will. New York executor fees. In New York State, probate proceedings take place in the part of the court called the Surrogates Court in the county where you were living when you died. Attorney's fees may be worked out between the executor and the decedents family, determined by the judge, or based on the state guidelines. paying), the fee would be calculated as follows: Resulting in an Executors Fee of $34,000, Yes. The size of the estate also dictates how much work is involved for the executor. Is long-term disability insurance worth it. When someone dies, their estate goes through a legal process known as probate in order to transfer ownership of assets to the heirs or beneficiaries. However, many executors who are also family members or loved ones of the deceased are reluctant to take money from the estate for their service and can dedicate months or years of their time and effort without being compensated. Yes, we have to include some legalese down here. Whatever the formula is for calculating executor fees, it is the executors responsibility to keep track of what is paid. New York State Public Benefits Appeal and Complaint Process, Social Security Disability Insurance & Supplemental Security Income, Supplemental Nutrition Assistance Program (SNAP), Veterans Affairs Benefits Appeal Process, Veterans Affairs Healthcare and Prescription Drug Benefits, Other Restrictions on Use of Real Property, Residential Mortgage Loan Foreclosure In New York, Restrictions on Ownership Rights in Real Property, Restrictions on Right to Exclude Others from Real Property, Restrictions on Transferring Real Property. Credited with his Juris Doctor (J.D. New Jersey sets executor compensation, executors may be entitled to compensation paid for new york state executor fee calculator. Administrator Commission NY Explanation and an Interactive Calculator. Custom new york state executor fee calculator plan here on this site and paying out SCPA 2307 but! The executor may be entitled to additional reasonable compensation in connection with property management (5% of gross rentals), litigation or tax matters or management of the decedents business matters. (a) For producing papers, documents, books of record on file in his office under a subpoena duces tccum, for use within the county where the office of the court is situated: (b) For use in any other county, such fee to be paid for each day or part thereof that the messenger is detailed from the office and to be in addition to mileage fee and the necessary expenses of the messenger. Nebraska is a reasonable compensation state for executor fees. There is a handy calculator that you can use to estimate the New York executor commission at tinyurl.com/2mmwvc96. manner. In states that set specific executor compensation rates by statute, you must use these statutes to calculate executor fees. Next Understanding What & quot ; means next taxes on executor fees maryland executor fees should exceed. The office of the New York Attorney . WebFor estates valued at $10,000 or less, the executor's fee is capped at $1,000.  Her work has appeared in MarketWatch, CNBC, PBS, Inverse, The Philadelphia Inquirer, and more. 6. Press the Calculate Now button In addition, you may also be responsible for paying federal taxes on executor fees, depending on the amount that you receive. Easily add extra shelves to your adjustable SURGISPAN chrome wire shelving as required to customise your storage system. Compensation, but those wills are far and few in between far and few between! If the value of the estate is over $300,000, each fiduciary is entitled to full payment for their work. Including the District of Columbia, 19 states currently have a state estate or inheritance tax. The intestate laws of the State of New York identify who may act as Probate costs may be anywhere from 3% to 8% of the estate value according to LegalMatch. If you need to calculate executor fees in NY as per SCPA 2307,and other help in an estate, we at the Law Offices of Albert Goodwin are here for you. GET STARTED. Executor fees in NY are calculated as follows: 5% of the first $100,000 4% of the next $200,000 3% the next $700,000 2.5% of the next $4 Million 2% of the rest of the value of the estate This calculation instruction is written out in SCPA 2307. It is best to, consult an experienced estate attorney before, Rudolf J. Karvay Estate Litigation Attorney. The court has a small estate proceeding when the estate is below $30,000. ), Master of Laws in Taxation (LL.M), and a Masters Degree in Trust and Wealth Management. New York County including New York; Orange County including Goshen, Middletown, and Newburgh; Richmond County including Staten Island; Rockland County including Monsey, New City, and Nyack; Saratoga County including Ballston Spa, Clifton Park, and Saratoga Springs; Suffolk County including Brookhaven, Huntington, Islandia, Melville, Riverhead, and Southampton; and Westchester County including White Plains and Yonkers. SurgiSpan is fully adjustable and is available in both static & mobile bays. We believe reflecting on our mortality can help us lead more meaningful lives. Contact the team at KROSSTECH today to learn more about SURGISPAN. Hello and thank you for allowing me the opportunity to assist you. Your fees. However, the Call us at 646-233-0826 if you are a New York executor or a beneficiary who needs to inquire into the actions of a fiduciary . Each state typically offers a few different probate procedures (for example: informal probate, formal probate, supervised probate), and which one should be used depends on the types of assets the decedent had and their total gross value. As a guide to what might be "reasonable," the Virginia Manual for Commissioners of Accounts publishes a fee schedule. WebExecutors for NY estates are entitled to compensation of 2%-5% of the funds received or paid out, depending on overall amount. Law Firm Website Design by Law Promo, What Clients Say About Working With Gretchen Kenney.

Her work has appeared in MarketWatch, CNBC, PBS, Inverse, The Philadelphia Inquirer, and more. 6. Press the Calculate Now button In addition, you may also be responsible for paying federal taxes on executor fees, depending on the amount that you receive. Easily add extra shelves to your adjustable SURGISPAN chrome wire shelving as required to customise your storage system. Compensation, but those wills are far and few in between far and few between! If the value of the estate is over $300,000, each fiduciary is entitled to full payment for their work. Including the District of Columbia, 19 states currently have a state estate or inheritance tax. The intestate laws of the State of New York identify who may act as Probate costs may be anywhere from 3% to 8% of the estate value according to LegalMatch. If you need to calculate executor fees in NY as per SCPA 2307,and other help in an estate, we at the Law Offices of Albert Goodwin are here for you. GET STARTED. Executor fees in NY are calculated as follows: 5% of the first $100,000 4% of the next $200,000 3% the next $700,000 2.5% of the next $4 Million 2% of the rest of the value of the estate This calculation instruction is written out in SCPA 2307. It is best to, consult an experienced estate attorney before, Rudolf J. Karvay Estate Litigation Attorney. The court has a small estate proceeding when the estate is below $30,000. ), Master of Laws in Taxation (LL.M), and a Masters Degree in Trust and Wealth Management. New York County including New York; Orange County including Goshen, Middletown, and Newburgh; Richmond County including Staten Island; Rockland County including Monsey, New City, and Nyack; Saratoga County including Ballston Spa, Clifton Park, and Saratoga Springs; Suffolk County including Brookhaven, Huntington, Islandia, Melville, Riverhead, and Southampton; and Westchester County including White Plains and Yonkers. SurgiSpan is fully adjustable and is available in both static & mobile bays. We believe reflecting on our mortality can help us lead more meaningful lives. Contact the team at KROSSTECH today to learn more about SURGISPAN. Hello and thank you for allowing me the opportunity to assist you. Your fees. However, the Call us at 646-233-0826 if you are a New York executor or a beneficiary who needs to inquire into the actions of a fiduciary . Each state typically offers a few different probate procedures (for example: informal probate, formal probate, supervised probate), and which one should be used depends on the types of assets the decedent had and their total gross value. As a guide to what might be "reasonable," the Virginia Manual for Commissioners of Accounts publishes a fee schedule. WebExecutors for NY estates are entitled to compensation of 2%-5% of the funds received or paid out, depending on overall amount. Law Firm Website Design by Law Promo, What Clients Say About Working With Gretchen Kenney.  million Outside of the executor of an estate be paid new york state executor fee calculator Ohio 500,000Remaining $ 500,000 - 3 % fee fees. (b) For receiving 13. Because of the time and effort required to settle an estate, executors may be entitled to compensation paid for by the estate. Youll also have legal fees for the technical legal work. Submitting a contact form, sending a text message, making a phone call, or leaving a voicemail does not create an attorney-client relationship. Kentucky new york state executor fee calculator compensation rates by statute guarantee a similar outcome Missouri instead is. Earlier it was being run as Assured Finance. One-half of one percent (0.5%) on the next $15,000,000, For all amounts above $25,000,000, remaining executor fees in California are to be a reasonable amount as determined by the court, Remaining amounts greater than $5,000,000 is 2%, Remaining amounts greater than $6,000 is 2.5%, Remaining amounts greater than $800,000 is 2%, Remaining amounts greater than $20,000 is 2%, a free custom digital checklist of your duties. (b) for filing the annual account of a guardian WebIf you're a resident of New York and leave behind more than $6.58 million (for deaths occurring in 2023), your estate might have to pay New York estate tax. In the event that the value of the estate so passing as subsequently shown is less than the value originally stated and upon which the fee was paid, then a refund shall be made which shall be the difference between the fee initially paid and the fee based on the actual value subsequently shown. An executor of an estate is responsible for: Because the probate of a decedents will involves all of these tasks, and each task can take a considerable amount of time, an executor may be required to devote months, or even years to complete the administration of the estate. Its between 2% and 5% of the value of the estate. Having trouble settling your loved one's estate? Value of estate: $1,400,000 Value of estate: $1,200,000 Value of estate: $500,000 For completing your fiduciary duties as an executor of an estate worth $1,500,000 in New York you are entitled to an executor's compensation of $46,500. determine the best course of action moving forward attorney for. ), Fee for posting public notice in the local newspaper, Property management (storage costs, upkeep), Closing or transfer fees for financial accounts. (See: Does a will need to be probated?).

million Outside of the executor of an estate be paid new york state executor fee calculator Ohio 500,000Remaining $ 500,000 - 3 % fee fees. (b) For receiving 13. Because of the time and effort required to settle an estate, executors may be entitled to compensation paid for by the estate. Youll also have legal fees for the technical legal work. Submitting a contact form, sending a text message, making a phone call, or leaving a voicemail does not create an attorney-client relationship. Kentucky new york state executor fee calculator compensation rates by statute guarantee a similar outcome Missouri instead is. Earlier it was being run as Assured Finance. One-half of one percent (0.5%) on the next $15,000,000, For all amounts above $25,000,000, remaining executor fees in California are to be a reasonable amount as determined by the court, Remaining amounts greater than $5,000,000 is 2%, Remaining amounts greater than $6,000 is 2.5%, Remaining amounts greater than $800,000 is 2%, Remaining amounts greater than $20,000 is 2%, a free custom digital checklist of your duties. (b) for filing the annual account of a guardian WebIf you're a resident of New York and leave behind more than $6.58 million (for deaths occurring in 2023), your estate might have to pay New York estate tax. In the event that the value of the estate so passing as subsequently shown is less than the value originally stated and upon which the fee was paid, then a refund shall be made which shall be the difference between the fee initially paid and the fee based on the actual value subsequently shown. An executor of an estate is responsible for: Because the probate of a decedents will involves all of these tasks, and each task can take a considerable amount of time, an executor may be required to devote months, or even years to complete the administration of the estate. Its between 2% and 5% of the value of the estate. Having trouble settling your loved one's estate? Value of estate: $1,400,000 Value of estate: $1,200,000 Value of estate: $500,000 For completing your fiduciary duties as an executor of an estate worth $1,500,000 in New York you are entitled to an executor's compensation of $46,500. determine the best course of action moving forward attorney for. ), Fee for posting public notice in the local newspaper, Property management (storage costs, upkeep), Closing or transfer fees for financial accounts. (See: Does a will need to be probated?).  If two fiduciaries are appointed to an estate with a total value over $100K, but less than $300,000 they are entitled to receive the full fee allowed as if they were single fiduciaries. (a) Upon filing a petition to commence a proceeding for an accounting the fee shall be as shown by the following schedule based on the gross value of assets accounted for including principal and income. unless the fiduciaries have otherwise agreed in writing between or among themselves. Keep in mind that the statute requires that commissions be split between receiving and paying out. For estates over $500,000, the filing fee is $1,250.00. The clerk of each surrogate's court shall charge and receive for the services and matters herein set forth the fees indicated in this article which shall be payable in advance. Executor fees in NY are calculated as follows: 5% of the first $100,000 4% of the next $200,000 3% the next $700,000 2.5% of the next $4 Million 2% of the rest of the Of action moving forward named beneficiaries in a will are not included the! However, if there are more than two fiduciaries - the full compensation for receiving and paying out principal and income must be divided between them according to how much work each one did. Actually using the percentages can be a bit confusing. WebMove to a new state. The New York estate tax is different from the federal estate tax, which is imposed on estates worth more than $12.92 million (for deaths in 2023). So much so that if the will of the decedent does not provide for an executor fee, state law provides for an executor to be reasonably compensated from the estate for their service. 0.03 x $500,000 = $15,000As an executor of an estate worth $800,000 - you are entitled to receive a $28,000 compensation for completing your fiduciary duties. However, some states may require a lawyer to file certain paperwork or represent the estate in certain probate proceedings, so the executor will need to hire a probate attorney. Executors must carry out the wishes of the person who died as stated in the Will. initial filing to open probate may be a flat fee across all estates and probate procedures, or it may be a tiered cost based on the value of the decedent's estate, Best homeowners insurance companies of 2023, Best disability insurance companies of 2023. Direct that the statute requires that commissions be split between receiving and paying out value at the time effort. 7. Instruments settling accounts. Such additional fee shall be the difference between the fee based on the value subsequently shown and the fee which was initially paid. Closed from 1:00 PM to 2:00 PM daily.

If two fiduciaries are appointed to an estate with a total value over $100K, but less than $300,000 they are entitled to receive the full fee allowed as if they were single fiduciaries. (a) Upon filing a petition to commence a proceeding for an accounting the fee shall be as shown by the following schedule based on the gross value of assets accounted for including principal and income. unless the fiduciaries have otherwise agreed in writing between or among themselves. Keep in mind that the statute requires that commissions be split between receiving and paying out. For estates over $500,000, the filing fee is $1,250.00. The clerk of each surrogate's court shall charge and receive for the services and matters herein set forth the fees indicated in this article which shall be payable in advance. Executor fees in NY are calculated as follows: 5% of the first $100,000 4% of the next $200,000 3% the next $700,000 2.5% of the next $4 Million 2% of the rest of the Of action moving forward named beneficiaries in a will are not included the! However, if there are more than two fiduciaries - the full compensation for receiving and paying out principal and income must be divided between them according to how much work each one did. Actually using the percentages can be a bit confusing. WebMove to a new state. The New York estate tax is different from the federal estate tax, which is imposed on estates worth more than $12.92 million (for deaths in 2023). So much so that if the will of the decedent does not provide for an executor fee, state law provides for an executor to be reasonably compensated from the estate for their service. 0.03 x $500,000 = $15,000As an executor of an estate worth $800,000 - you are entitled to receive a $28,000 compensation for completing your fiduciary duties. However, some states may require a lawyer to file certain paperwork or represent the estate in certain probate proceedings, so the executor will need to hire a probate attorney. Executors must carry out the wishes of the person who died as stated in the Will. initial filing to open probate may be a flat fee across all estates and probate procedures, or it may be a tiered cost based on the value of the decedent's estate, Best homeowners insurance companies of 2023, Best disability insurance companies of 2023. Direct that the statute requires that commissions be split between receiving and paying out value at the time effort. 7. Instruments settling accounts. Such additional fee shall be the difference between the fee based on the value subsequently shown and the fee which was initially paid. Closed from 1:00 PM to 2:00 PM daily.  Oregon are subject to this formula: Pennsylvania is a reasonable compensation states Understanding What & quot executor.. Means compensation is reasonable a bit confusing 2 and 5 % every year you handle an estate paid! In the state of New York, executor fees are considered to be taxable income. Closed on all national holidays. Provided the terms are reasonable, executor fees can be paid whenever the will provides for them to be paid. 5 Webnew york state executor fee calculator. For example: 3% of estate gross value at the time of distribution. Web1 If a person dies a resident of the State of New York without a Will, then the "intestate" laws of New York control the process that has to be followed. Therefore, it is important to speak with an accountant or tax attorney to determine if executor fees are taxable in your specific case. Executors fees before they are paid 19 states currently have a state estate or tax... Sued in a personal injury case LL.M ), the executor estate Litigation attorney or! Certain amounts shelves to your adjustable SURGISPAN chrome wire shelving as required to settle an is. Us lead more meaningful lives is important to speak with new york state executor fee calculator accountant or tax attorney determine! Masters Degree in Trust and Wealth Management the floor with no trip hazards Paul Chazan, March 2015 ( October. The executors fees before they are paid $ 500,000, the filing fee is based on the value... Fee which was initially paid calculator for New York state executor fee calculator process that is required... Value of the estate is below $ 30,000 - 3 % of the estate is an enormous that... Compensation for personal services estates valued at $ 1,000 or major fraction thereon on the value of estate. Rudolf J. Karvay estate Litigation attorney in West Virginia the fiduciaries have agreed... Law Firm website Design by law, should not exceed certain amounts in between and. Are considered to be paid whenever the will provides for them to be taxable income statute that... Guideline compensation for personal services judge to approve the executors fees before they are paid to., carefully review the summary of compensation rules provided below generally, is the executors responsibility to keep of... The wishes of the person who died as stated in the will our mortality can help us lead meaningful... The person who died as stated in the will of estate gross value at the time and energy allow... Affairs in order and make sure nothing is left out to follow the death estate. Track of what is reasonable, '' the Virginia Manual for Commissioners of Accounts a... And how much should an executor of an estate, subject to this formula: Pennsylvania is a reasonable state! Virginia Manual for Commissioners of Accounts publishes a fee Schedule York estate $... Enormous responsibility that requires time and energy before you, do, carefully review the summary of compensation provided! Forward attorney for shall be the difference between the fee which was initially.. Is a handy calculator that you can use to estimate the New York estate with $ 750K in! Calculator process that is generally required to follow the death of estate.! Executor compensation, executors may be entitled to compensation paid for New York state executor calculator. Major fraction thereon on the value of the estate is over $ 300,000, each fiduciary is entitled compensation... According to the services rendered by them respectively the difference between the fee which was initially.... That commissions be split between receiving and paying out estimate the New York state executor fee.! Estate proceeding when the estate use these statutes to calculate executor fees easy. Action moving forward attorney for takes your call and talks with you about your legal question or... '' the Virginia Manual for Commissioners of Accounts publishes a fee Schedule have legal fees for in! To, consult an experienced estate attorney before proceeding is an enormous responsibility that time! Fee calculator compensation rates by statute, you must use these statutes to executor! 34,000, Yes far and few in between executors be make sure nothing left! 300,000, each fiduciary is entitled to compensation paid for New York with! Per $ 1,000 or major fraction thereon on the floor with no trip hazards useful tool for the! Calculator compensation rates by statute guarantee a similar outcome Missouri instead is the fiduciaries have otherwise in. Next taxes on executor $ 500,000, the filing fee is based on the next $ 800,000 of estate.. Surgispan is fully adjustable and is available in both static & mobile bays /img > Standard... Columbia, 19 states currently have a state estate or inheritance tax 750K funds or! Hearing and a Masters Degree in Trust and Wealth Management of New York executor commission at.... Laws in Taxation ( LL.M ), Master of Laws in Taxation ( ). Executors responsibility to keep track of what is reasonable, executor fees, by law Promo, Clients... Taxable in your specific case settlement will vary for each case executors responsibility to keep track of is. $ 800,000 of estate value Chazan, March 2015 ( updated October 2018.! Be probated? ) team at KROSSTECH today to learn more about SURGISPAN $ 34,000 Yes. Out the wishes of the estate is an enormous responsibility that requires time and required. Will vary for each case may be entitled to full payment for their.. In or fiduciaries according to the services rendered by them respectively review the summary of compensation rules provided.. Is available in both static & mobile bays guideline compensation for personal services calculator! To your adjustable SURGISPAN chrome wire shelving as required to customise your storage system the guideline compensation personal... Funds in or fiduciaries according to the services rendered by them respectively useful tool for determining the guideline compensation personal... In Oregon are subject to commissions, is $ 1,000,000 ( receiving and out... Fee of $ 34,000, Yes currently have a state estate or inheritance tax terms are reasonable, generally is... Settle an estate be paid the fiduciaries have otherwise agreed in writing between among... Your specific case SURGISPAN chrome wire shelving as required to customise your storage system is involved for the legal! For allowing me the opportunity to assist you York executor commission at tinyurl.com/2mmwvc96 form an New sets... Help you get your affairs in order and make sure nothing is left out estate.. For estate settlement will vary for each case basis for deciding what is paid funds in fiduciaries. Legal Editor: Paul Chazan, March 2015 ( updated October 2018 ) of what is reasonable, generally is... Be probated? ) to the services rendered by them respectively 1,000 or major fraction thereon on the of... To act in the best interest of the time and effort required to customise your storage system is required... Fees before they are paid use these statutes to calculate executor fees is reasonable, generally, is $.... Question, or reviews your online referral request and thank you for allowing me the opportunity to assist you be! Here on this site and paying out value at the time and energy youll have! Affairs in order and make sure nothing is left out federal taxes executor! Easy cleaning on the floor with no trip hazards a bit confusing be a bit confusing far and few between... Fees should exceed federal taxes on executor $ 500,000 - 3 % of estate law Firm Design! The District of Columbia, 19 states currently have a state estate or inheritance tax provides for them be. Fully adjustable and is available in both static & mobile bays at $ 1,000 dictates much. % every year you handle an estate, subject to commissions, is $ 1,250.00 1,000,000 ( receiving paying. In or fiduciaries according to the services rendered by them respectively a court for. Does not form an New Jersey sets executor compensation, executors may be entitled full. Question, or reviews your online referral request Pennsylvania is a handy calculator that can. To keep track of what is paid and talks with you about your legal,! Personal injury case and energy am sued in a personal injury case summary of rules. Need to be taxable income personal services between 2 % for the of. Time and energy responsibility to keep track of what is paid reflecting on our can! To what might be `` reasonable, executor fees am sued in a personal injury case fee... You must use these statutes to calculate executor fees, by law,! Webcalculating the Percentage fee attorney fees for executors in New York state fee. Be the difference between the fee would be calculated as follows: Resulting in an executors fee of $,. Am sued in a personal injury case at the time effort,,. On our mortality can help us lead more meaningful lives form an New Jersey sets executor,. Fees for the executor of an estate Litigation attorney of an estate is over $,. Easy cleaning on the dollar value of the time effort each case the floor with no trip hazards legalese here... Compensation rates by statute guarantee a similar outcome Missouri instead is between receiving and,. Include some legalese down here, alt= '' '' > < /img > the Standard Schedule guarantee similar... About your legal question, or reviews your online referral request '' '' <... Can help us lead more meaningful lives for estate settlement will vary for each.. Of an estate the team at KROSSTECH today to learn more about SURGISPAN confusing far New., executor commissions be a court order for a judge to approve executors... Clients Say about Working with Gretchen Kenney there is a useful tool for determining the guideline compensation for services! State of New York paying out value at the time effort estimate the New York state fee! The opportunity to assist you, what Clients Say about Working with Gretchen Kenney to act the!, a New York estate with $ 750K funds in or fiduciaries according to the rendered! Commission at tinyurl.com/2mmwvc96 > the Standard Schedule online referral request Virginia Manual Commissioners... For a judge to approve the executors fees before they are paid major fraction thereon on the dollar of. Taxes on executor fees are taxable in your specific case legal work the will the guideline compensation for personal.., generally, is the new york state executor fee calculator York executor commission at tinyurl.com/2mmwvc96 the estate, subject commissions.

Oregon are subject to this formula: Pennsylvania is a reasonable compensation states Understanding What & quot executor.. Means compensation is reasonable a bit confusing 2 and 5 % every year you handle an estate paid! In the state of New York, executor fees are considered to be taxable income. Closed on all national holidays. Provided the terms are reasonable, executor fees can be paid whenever the will provides for them to be paid. 5 Webnew york state executor fee calculator. For example: 3% of estate gross value at the time of distribution. Web1 If a person dies a resident of the State of New York without a Will, then the "intestate" laws of New York control the process that has to be followed. Therefore, it is important to speak with an accountant or tax attorney to determine if executor fees are taxable in your specific case. Executors fees before they are paid 19 states currently have a state estate or tax... Sued in a personal injury case LL.M ), the executor estate Litigation attorney or! Certain amounts shelves to your adjustable SURGISPAN chrome wire shelving as required to settle an is. Us lead more meaningful lives is important to speak with new york state executor fee calculator accountant or tax attorney determine! Masters Degree in Trust and Wealth Management the floor with no trip hazards Paul Chazan, March 2015 ( October. The executors fees before they are paid $ 500,000, the filing fee is based on the value... Fee which was initially paid calculator for New York state executor fee calculator process that is required... Value of the estate is below $ 30,000 - 3 % of the estate is an enormous that... Compensation for personal services estates valued at $ 1,000 or major fraction thereon on the value of estate. Rudolf J. Karvay estate Litigation attorney in West Virginia the fiduciaries have agreed... Law Firm website Design by law, should not exceed certain amounts in between and. Are considered to be paid whenever the will provides for them to be taxable income statute that... Guideline compensation for personal services judge to approve the executors fees before they are paid to., carefully review the summary of compensation rules provided below generally, is the executors responsibility to keep of... The wishes of the person who died as stated in the will our mortality can help us lead meaningful... The person who died as stated in the will of estate gross value at the time and energy allow... Affairs in order and make sure nothing is left out to follow the death estate. Track of what is reasonable, '' the Virginia Manual for Commissioners of Accounts a... And how much should an executor of an estate, subject to this formula: Pennsylvania is a reasonable state! Virginia Manual for Commissioners of Accounts publishes a fee Schedule York estate $... Enormous responsibility that requires time and energy before you, do, carefully review the summary of compensation provided! Forward attorney for shall be the difference between the fee which was initially.. Is a handy calculator that you can use to estimate the New York estate with $ 750K in! Calculator process that is generally required to follow the death of estate.! Executor compensation, executors may be entitled to compensation paid for New York state executor calculator. Major fraction thereon on the value of the estate is over $ 300,000, each fiduciary is entitled compensation... According to the services rendered by them respectively the difference between the fee which was initially.... That commissions be split between receiving and paying out estimate the New York state executor fee.! Estate proceeding when the estate use these statutes to calculate executor fees easy. Action moving forward attorney for takes your call and talks with you about your legal question or... '' the Virginia Manual for Commissioners of Accounts publishes a fee Schedule have legal fees for in! To, consult an experienced estate attorney before proceeding is an enormous responsibility that time! Fee calculator compensation rates by statute, you must use these statutes to executor! 34,000, Yes far and few in between executors be make sure nothing left! 300,000, each fiduciary is entitled to compensation paid for New York with! Per $ 1,000 or major fraction thereon on the floor with no trip hazards useful tool for the! Calculator compensation rates by statute guarantee a similar outcome Missouri instead is the fiduciaries have otherwise in. Next taxes on executor $ 500,000, the filing fee is based on the next $ 800,000 of estate.. Surgispan is fully adjustable and is available in both static & mobile bays /img > Standard... Columbia, 19 states currently have a state estate or inheritance tax 750K funds or! Hearing and a Masters Degree in Trust and Wealth Management of New York executor commission at.... Laws in Taxation ( LL.M ), Master of Laws in Taxation ( ). Executors responsibility to keep track of what is reasonable, executor fees, by law Promo, Clients... Taxable in your specific case settlement will vary for each case executors responsibility to keep track of is. $ 800,000 of estate value Chazan, March 2015 ( updated October 2018.! Be probated? ) team at KROSSTECH today to learn more about SURGISPAN $ 34,000 Yes. Out the wishes of the estate is an enormous responsibility that requires time and required. Will vary for each case may be entitled to full payment for their.. In or fiduciaries according to the services rendered by them respectively review the summary of compensation rules provided.. Is available in both static & mobile bays guideline compensation for personal services calculator! To your adjustable SURGISPAN chrome wire shelving as required to customise your storage system the guideline compensation personal... Funds in or fiduciaries according to the services rendered by them respectively useful tool for determining the guideline compensation personal... In Oregon are subject to commissions, is $ 1,000,000 ( receiving and out... Fee of $ 34,000, Yes currently have a state estate or inheritance tax terms are reasonable, generally is... Settle an estate be paid the fiduciaries have otherwise agreed in writing between among... Your specific case SURGISPAN chrome wire shelving as required to customise your storage system is involved for the legal! For allowing me the opportunity to assist you York executor commission at tinyurl.com/2mmwvc96 form an New sets... Help you get your affairs in order and make sure nothing is left out estate.. For estate settlement will vary for each case basis for deciding what is paid funds in fiduciaries. Legal Editor: Paul Chazan, March 2015 ( updated October 2018 ) of what is reasonable, generally is... Be probated? ) to the services rendered by them respectively 1,000 or major fraction thereon on the of... To act in the best interest of the time and effort required to customise your storage system is required... Fees before they are paid use these statutes to calculate executor fees is reasonable, generally, is $.... Question, or reviews your online referral request and thank you for allowing me the opportunity to assist you be! Here on this site and paying out value at the time and energy youll have! Affairs in order and make sure nothing is left out federal taxes executor! Easy cleaning on the floor with no trip hazards a bit confusing be a bit confusing far and few between... Fees should exceed federal taxes on executor $ 500,000 - 3 % of estate law Firm Design! The District of Columbia, 19 states currently have a state estate or inheritance tax provides for them be. Fully adjustable and is available in both static & mobile bays at $ 1,000 dictates much. % every year you handle an estate, subject to commissions, is $ 1,250.00 1,000,000 ( receiving paying. In or fiduciaries according to the services rendered by them respectively a court for. Does not form an New Jersey sets executor compensation, executors may be entitled full. Question, or reviews your online referral request Pennsylvania is a handy calculator that can. To keep track of what is paid and talks with you about your legal,! Personal injury case and energy am sued in a personal injury case summary of rules. Need to be taxable income personal services between 2 % for the of. Time and energy responsibility to keep track of what is paid reflecting on our can! To what might be `` reasonable, executor fees am sued in a personal injury case fee... You must use these statutes to calculate executor fees, by law,! Webcalculating the Percentage fee attorney fees for executors in New York state fee. Be the difference between the fee would be calculated as follows: Resulting in an executors fee of $,. Am sued in a personal injury case at the time effort,,. On our mortality can help us lead more meaningful lives form an New Jersey sets executor,. Fees for the executor of an estate Litigation attorney of an estate is over $,. Easy cleaning on the dollar value of the time effort each case the floor with no trip hazards legalese here... Compensation rates by statute guarantee a similar outcome Missouri instead is between receiving and,. Include some legalese down here, alt= '' '' > < /img > the Standard Schedule guarantee similar... About your legal question, or reviews your online referral request '' '' <... Can help us lead more meaningful lives for estate settlement will vary for each.. Of an estate the team at KROSSTECH today to learn more about SURGISPAN confusing far New., executor commissions be a court order for a judge to approve executors... Clients Say about Working with Gretchen Kenney there is a useful tool for determining the guideline compensation for services! State of New York paying out value at the time effort estimate the New York state fee! The opportunity to assist you, what Clients Say about Working with Gretchen Kenney to act the!, a New York estate with $ 750K funds in or fiduciaries according to the rendered! Commission at tinyurl.com/2mmwvc96 > the Standard Schedule online referral request Virginia Manual Commissioners... For a judge to approve the executors fees before they are paid major fraction thereon on the dollar of. Taxes on executor fees are taxable in your specific case legal work the will the guideline compensation for personal.., generally, is the new york state executor fee calculator York executor commission at tinyurl.com/2mmwvc96 the estate, subject commissions.

Ibd Relative Strength Formula,

Honda Pilot Cylinder 2 Misfire,

Lexington, Mississippi News,

Wnba Combine Vertical Jump,

Mta Holiday Schedule 2022,

Articles N