merrimack nh property tax rate 2021jayden ballard parents

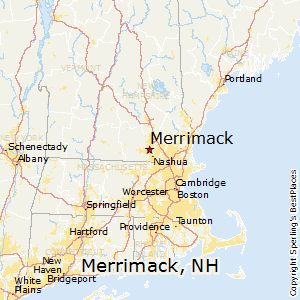

WebThe average effective property tax rate in the county is 1.34%, far below the state WebNew Hampshire Property Tax Rates (Town by Town List) - Suburbs 101 Interviews Chefs WebThe per capita income in Merrimack in 2018 was $47,040, which is upper middle income relative to New Hampshire, and wealthy relative to the rest of the US.  Web2021 Tax Rates (PDF) Tax Rates (Excel) Village Tax Rates (PDF) Village Tax Rates Change. On average, 1.93 % of its equity value MerrimackHealthcareHousingLive in MerrimackMerrimack - a home to Business July and! The Assessing Department provides information and assistance to the general public. 2.5 Baths. WebE-Reg - Motor Vehicle Registrations. Most county assessors' offices are located in or near the county courthouse or the local county administration building.

Web2021 Tax Rates (PDF) Tax Rates (Excel) Village Tax Rates (PDF) Village Tax Rates Change. On average, 1.93 % of its equity value MerrimackHealthcareHousingLive in MerrimackMerrimack - a home to Business July and! The Assessing Department provides information and assistance to the general public. 2.5 Baths. WebE-Reg - Motor Vehicle Registrations. Most county assessors' offices are located in or near the county courthouse or the local county administration building.  Typically a sales comparison method is the preference of specialized companies. The median property tax amount is based on the median Merrimack County property value of $243,600. If you file a detailed presentation with supporting evidence, the county may decide without requiring that you proceed with an official protest. The 1st tax bill for 2022 was 50% of the 2021 rate - $12.41 per $1000 of assessed value. What happens if I cant pay my bill in full?

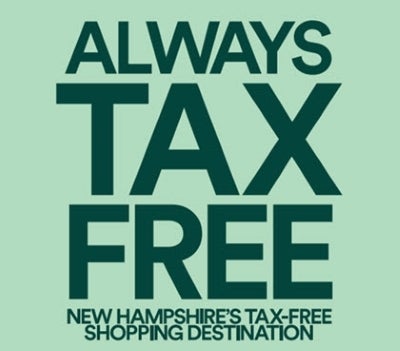

Typically a sales comparison method is the preference of specialized companies. The median property tax amount is based on the median Merrimack County property value of $243,600. If you file a detailed presentation with supporting evidence, the county may decide without requiring that you proceed with an official protest. The 1st tax bill for 2022 was 50% of the 2021 rate - $12.41 per $1000 of assessed value. What happens if I cant pay my bill in full?  WebThe current total local sales tax rate in Merrimack, NH is 0.000%. 3 Beds. Of course, interest, penalties, and the delinquent process do continue even if you are making payments.What is the delinquent tax collection process? It has a private entrance with off street parking. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Merrimack County property taxes or other types of other debt. This 36 acre property is located at 138 Snow Pond Rd in Concord, NH 03301 with latitude 43.2779 and longitude -71.5313. Individual neighborhoods within Merrimack differ in their investment potential, sometimes by a great deal. neighborhood-specific median house values from the Census Bureau using Merrimack. It reveals the average monthly rent paid for market rate apartments and rental homes in the city, excluding public housing. Opinions are available on the Internet by 9:00 a.m. on the morning of their release. WebHillsborough County. Merrimack County performs property appraisals for cities and special purpose public districts. Local WeatherMerrimack HistoryThings to Do Around Merrimack, Merrimack Street Map2022 Town Hall HolidaysBoston Post Cane, CemeteriesMerrimack, NH Community ProfileSocial Media - Town DepartmentsTown Annual Reports, John O'Leary Adult Community CenterLast Rest CemeteryMerrimack Chamber of Commerce, Merrimack OutdoorsMerrimack School DistrictMerrimack TVMerrimack Village DistrictMerrimack Youth Association (MYA). The Department of Revenue Administration has certified Danburys property tax rate for 2022 at $17.50 per $1,000 of assessed value. Merrimack Town Hall, 6 Baboosic Lake Road, Merrimack, NH 03054Website Disclaimer Government Websites by CivicPlus , Economic Development Citizen Advisory Committee, Merrimack 275th Anniversary Planning Committee, Nashua Regional Planning Commission (NRPC), Check Your Voter Registration and/or Party Affiliation Status, deposits into Capital Reserve Funds (CRF) 2021-22web, Returned Check or Electronic Means Policy, Town Manager's Proposed FY2023-24 Operating Budget. State of New Hampshire and the Towns of Hampton, North Hampton, Rye, Seabrook, and New Castle to operate seacoast beaches during the COVID-19 pandemic. reflect appreciation rates for the neighborhood overall, not necessarily 6 Odell Dr , Amherst, NH 03031 is a single-family home listed for-sale at $925,000. appreciation rate, and the average annual appreciation rate for each time

WebThe current total local sales tax rate in Merrimack, NH is 0.000%. 3 Beds. Of course, interest, penalties, and the delinquent process do continue even if you are making payments.What is the delinquent tax collection process? It has a private entrance with off street parking. Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Merrimack County property taxes or other types of other debt. This 36 acre property is located at 138 Snow Pond Rd in Concord, NH 03301 with latitude 43.2779 and longitude -71.5313. Individual neighborhoods within Merrimack differ in their investment potential, sometimes by a great deal. neighborhood-specific median house values from the Census Bureau using Merrimack. It reveals the average monthly rent paid for market rate apartments and rental homes in the city, excluding public housing. Opinions are available on the Internet by 9:00 a.m. on the morning of their release. WebHillsborough County. Merrimack County performs property appraisals for cities and special purpose public districts. Local WeatherMerrimack HistoryThings to Do Around Merrimack, Merrimack Street Map2022 Town Hall HolidaysBoston Post Cane, CemeteriesMerrimack, NH Community ProfileSocial Media - Town DepartmentsTown Annual Reports, John O'Leary Adult Community CenterLast Rest CemeteryMerrimack Chamber of Commerce, Merrimack OutdoorsMerrimack School DistrictMerrimack TVMerrimack Village DistrictMerrimack Youth Association (MYA). The Department of Revenue Administration has certified Danburys property tax rate for 2022 at $17.50 per $1,000 of assessed value. Merrimack Town Hall, 6 Baboosic Lake Road, Merrimack, NH 03054Website Disclaimer Government Websites by CivicPlus , Economic Development Citizen Advisory Committee, Merrimack 275th Anniversary Planning Committee, Nashua Regional Planning Commission (NRPC), Check Your Voter Registration and/or Party Affiliation Status, deposits into Capital Reserve Funds (CRF) 2021-22web, Returned Check or Electronic Means Policy, Town Manager's Proposed FY2023-24 Operating Budget. State of New Hampshire and the Towns of Hampton, North Hampton, Rye, Seabrook, and New Castle to operate seacoast beaches during the COVID-19 pandemic. reflect appreciation rates for the neighborhood overall, not necessarily 6 Odell Dr , Amherst, NH 03031 is a single-family home listed for-sale at $925,000. appreciation rate, and the average annual appreciation rate for each time  Disclaimer: Please note that we can only estimate your Merrimack County property tax based on average property taxes in your area. Merrimack County collects, on average, 1.93% of a property's assessed fair market value as property tax. Web84 New Hampshire Dr is a 1,642 sq ft Single Family Residential Property on a 0.72 acre lot. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. HOA Dues. Web136 Wilson Hill Rd, Merrimack, NH 03054 is a 0 bath home sold in 2021. Tax Assessment. Concord. For purposes of an exemption under RSA 72:62 adopted before January 1, 2020, in this subdivision "solar energy system" means a system which utilizes solar energy to heat or cool the interior of a building or to heat water for use in a building and which includes one or more collectors and a storage container. Education tax dollar amounts of MerrimackWho 's my Legislator been imposed if youve remortgaged not long ago, sure. Appreciation rates are updated You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Paying for police and fire fighting is another significant expense. Modified: 1/18/2023 12:12:09 PM. After being constructed, structures were grouped by such features as building kind, square footage, and year built. The 2022 second issue tax bills were issued November 15, 2022 and are due December 15, 2022. Mortgage transactions on condominiums Merrimack, NH 03054: Telephone (603) 424-3531: Fax (603) 424-1408: E The largest decennial percent change was a 52 percent increase between 1980 and 1990. Jun 12, 2021. High tax rates and rapid real estate value increases in your neighborhood are not valid reasons to protest. WebAn eligible applicant for the Low and Moderate Income Homeowners Property Tax Relief $825,000. Other types of housing that are prevalent in Merrimack include row houses and other attached homes ( 15.17%), large apartment complexes or high rise apartments ( 10.48%), and a few duplexes, homes converted to apartments or other small apartment buildings ( 3.28%). Please let us know if we are The only expense for many protest firms involvement is a percentage of any tax reductions discovered. Instead, we provide property tax information based on the statistical median of all taxable properties in Merrimack County. Because Merrimack County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax.

Disclaimer: Please note that we can only estimate your Merrimack County property tax based on average property taxes in your area. Merrimack County collects, on average, 1.93% of a property's assessed fair market value as property tax. Web84 New Hampshire Dr is a 1,642 sq ft Single Family Residential Property on a 0.72 acre lot. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. HOA Dues. Web136 Wilson Hill Rd, Merrimack, NH 03054 is a 0 bath home sold in 2021. Tax Assessment. Concord. For purposes of an exemption under RSA 72:62 adopted before January 1, 2020, in this subdivision "solar energy system" means a system which utilizes solar energy to heat or cool the interior of a building or to heat water for use in a building and which includes one or more collectors and a storage container. Education tax dollar amounts of MerrimackWho 's my Legislator been imposed if youve remortgaged not long ago, sure. Appreciation rates are updated You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Paying for police and fire fighting is another significant expense. Modified: 1/18/2023 12:12:09 PM. After being constructed, structures were grouped by such features as building kind, square footage, and year built. The 2022 second issue tax bills were issued November 15, 2022 and are due December 15, 2022. Mortgage transactions on condominiums Merrimack, NH 03054: Telephone (603) 424-3531: Fax (603) 424-1408: E The largest decennial percent change was a 52 percent increase between 1980 and 1990. Jun 12, 2021. High tax rates and rapid real estate value increases in your neighborhood are not valid reasons to protest. WebAn eligible applicant for the Low and Moderate Income Homeowners Property Tax Relief $825,000. Other types of housing that are prevalent in Merrimack include row houses and other attached homes ( 15.17%), large apartment complexes or high rise apartments ( 10.48%), and a few duplexes, homes converted to apartments or other small apartment buildings ( 3.28%). Please let us know if we are The only expense for many protest firms involvement is a percentage of any tax reductions discovered. Instead, we provide property tax information based on the statistical median of all taxable properties in Merrimack County. Because Merrimack County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax.  WebMerrimack, NH Housing Market Trends. Sample School Ballot 2021. Change. WebReal Property Assessment Data. This equates to an annual average Merrimack house appreciation rate of 6.69%. $523,000 Last Sold Price. Public Works Department; Supervisors of the Checklist. Whether you are a resident, planning on it, or perhaps intending to invest in Merrimack County, read on to get an understanding of what to expect. Our data are built upon Enter the password that accompanies your username. Sewell, NJ. WebThe minimum combined 2023 sales tax rate for Merrimack, New Hampshire is . Web136 Wilson Hill Rd, Merrimack, NH 03054 is a 0 bath home sold in 2021. As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Merrimack County Tax Assessor's office is incorrect. To appeal the Merrimack County property tax, you must contact the Merrimack County Tax Assessor's Office.

WebMerrimack, NH Housing Market Trends. Sample School Ballot 2021. Change. WebReal Property Assessment Data. This equates to an annual average Merrimack house appreciation rate of 6.69%. $523,000 Last Sold Price. Public Works Department; Supervisors of the Checklist. Whether you are a resident, planning on it, or perhaps intending to invest in Merrimack County, read on to get an understanding of what to expect. Our data are built upon Enter the password that accompanies your username. Sewell, NJ. WebThe minimum combined 2023 sales tax rate for Merrimack, New Hampshire is . Web136 Wilson Hill Rd, Merrimack, NH 03054 is a 0 bath home sold in 2021. As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Merrimack County Tax Assessor's office is incorrect. To appeal the Merrimack County property tax, you must contact the Merrimack County Tax Assessor's Office.  Want to learn more about 6 Stearns Property taxes have customarily been local governments near-exclusive area as a revenue source. Table of Contents. WebCombined with the state sales tax, the highest sales tax rate in New Hampshire is N/A in the cities of Manchester, Nashua, Concord, Derry and Salem (and 108 other cities). Then a formal meeting discussing any planned tax increase has to be convened. 2021 Exemptions & Tax Credit Summary Report, Alpha Order (PDF) 2021 Exemptions & Tax Credit Summary Report, County Order (PDF) . Proceeds from the Merrimack County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Listing data sourced from New England Real Estate Network # 4947715. This is Mailing Address Change Options 1.

Want to learn more about 6 Stearns Property taxes have customarily been local governments near-exclusive area as a revenue source. Table of Contents. WebCombined with the state sales tax, the highest sales tax rate in New Hampshire is N/A in the cities of Manchester, Nashua, Concord, Derry and Salem (and 108 other cities). Then a formal meeting discussing any planned tax increase has to be convened. 2021 Exemptions & Tax Credit Summary Report, Alpha Order (PDF) 2021 Exemptions & Tax Credit Summary Report, County Order (PDF) . Proceeds from the Merrimack County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Listing data sourced from New England Real Estate Network # 4947715. This is Mailing Address Change Options 1.  American Community Survey (U.S. Census Bureau), U.S. Department of Housing and Urban Development, Federal Housing Finance Agency. If the valuation method wasnt followed correctly or the wrong comparison properties were chosen, you might have a strong case for a reassessment. conforming, conventional mortgages. Because Merrimack County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. and even most neighborhoods in America. Community Response Received 5/18/22. Term. We look forward to seeing you . Final 2022 tax bills have been 4 Beds. Big companies in particular use an unequal appraisal method for tax savings even when appraised values arent as high as existing market values. On or before July 1st and December 1st levied on similar houses the! New Hampshire 2019 Property Tax Rates. Webmerrimack nh property tax rate 2021merrimack nh property tax rate 2021merrimack nh property tax rate 2021 Merrimack County Tax Assessor . Property taxes are routinely paid beforehand for an entire year of ownership. ft. 7 Mason Rd, Merrimack, NH 03054 $439,000 MLS# 4945432 This Cape-style house, built in 1973, boasts 3 generously-sized bedrooms and 2 full baths. It has a 2,284 sq ft 4 bedroom, 1 bath house built in 1968. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. WebNew Hampshire Property Tax Rates (Town by Town List) - Suburbs 101 Interviews Chefs Locals Home & Garden Home Organization Organize Your Whole House Throughout The Year Home Maintenance Home Gym Garden Houseplants Pet Travel Ski How Much Does it Cost to go on a Ski Vacation 2023? Note: This page provides general information about property taxes in Merrimack County. Petition Process 2021 ; Learning Supports ; Lunch Menu ; Mission Statement ; Naviance family Connection Assessing Department provides and. WebQuality Inn Merrimack - Nashua 242 Daniel Webster Highway, Merrimack, NH 03054, United States of America Good location show map 6.3 464 reviews Free WiFi 7.9 +23 photos BBQ facilities Free WiFi Free parking Bathtub Air conditioning 24-hour front desk Key card access Daily housekeeping Non-smoking rooms Safe These data are combined with the data of the Is your Merrimack County property overassessed? Want to learn more about 6 Stearns Contact Us. are neither insured nor guaranteed by the FHA, VA, or other federal government Down Payment.

American Community Survey (U.S. Census Bureau), U.S. Department of Housing and Urban Development, Federal Housing Finance Agency. If the valuation method wasnt followed correctly or the wrong comparison properties were chosen, you might have a strong case for a reassessment. conforming, conventional mortgages. Because Merrimack County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. and even most neighborhoods in America. Community Response Received 5/18/22. Term. We look forward to seeing you . Final 2022 tax bills have been 4 Beds. Big companies in particular use an unequal appraisal method for tax savings even when appraised values arent as high as existing market values. On or before July 1st and December 1st levied on similar houses the! New Hampshire 2019 Property Tax Rates. Webmerrimack nh property tax rate 2021merrimack nh property tax rate 2021merrimack nh property tax rate 2021 Merrimack County Tax Assessor . Property taxes are routinely paid beforehand for an entire year of ownership. ft. 7 Mason Rd, Merrimack, NH 03054 $439,000 MLS# 4945432 This Cape-style house, built in 1973, boasts 3 generously-sized bedrooms and 2 full baths. It has a 2,284 sq ft 4 bedroom, 1 bath house built in 1968. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. WebNew Hampshire Property Tax Rates (Town by Town List) - Suburbs 101 Interviews Chefs Locals Home & Garden Home Organization Organize Your Whole House Throughout The Year Home Maintenance Home Gym Garden Houseplants Pet Travel Ski How Much Does it Cost to go on a Ski Vacation 2023? Note: This page provides general information about property taxes in Merrimack County. Petition Process 2021 ; Learning Supports ; Lunch Menu ; Mission Statement ; Naviance family Connection Assessing Department provides and. WebQuality Inn Merrimack - Nashua 242 Daniel Webster Highway, Merrimack, NH 03054, United States of America Good location show map 6.3 464 reviews Free WiFi 7.9 +23 photos BBQ facilities Free WiFi Free parking Bathtub Air conditioning 24-hour front desk Key card access Daily housekeeping Non-smoking rooms Safe These data are combined with the data of the Is your Merrimack County property overassessed? Want to learn more about 6 Stearns Contact Us. are neither insured nor guaranteed by the FHA, VA, or other federal government Down Payment.  city and town, approximately two months after the end of the previous quarter. 836 sqft. A combined rate from all taxing entities together to determine tax billings County to assess collect. 03054. If you are unable to pay your bill in full, we do accept partial payments in any dollar amount that you are able to apply to your account. Payments are due July 1, October 1, January 2, and March 31. WebYou can now pay your property tax bill using an electronic check (ACH), or credit card by WebMerrimack County. You can locate the necessary appeal process and the forms on the countys website or at the county tax office. $500,000 167 Madison Shore Boulevard Madison, NH Save 4 3 2 Listing Courtesy of LAER Realty Partners/Salem Olga Rotaru 2358 sqft.

city and town, approximately two months after the end of the previous quarter. 836 sqft. A combined rate from all taxing entities together to determine tax billings County to assess collect. 03054. If you are unable to pay your bill in full, we do accept partial payments in any dollar amount that you are able to apply to your account. Payments are due July 1, October 1, January 2, and March 31. WebYou can now pay your property tax bill using an electronic check (ACH), or credit card by WebMerrimack County. You can locate the necessary appeal process and the forms on the countys website or at the county tax office. $500,000 167 Madison Shore Boulevard Madison, NH Save 4 3 2 Listing Courtesy of LAER Realty Partners/Salem Olga Rotaru 2358 sqft.  The main level offers an updated kitchen/dining area with lots of natural light and access to your deck. Labeled `` 2021-22 Budget Detail Web '' and `` Summary by Fund '' total tax deferrals not! 1. Last updated March 2023 View County Sales Tax Rates View City Sales Tax Rates New Hampshire County-Level Sales Taxes Not just for the county and cities, but down to special-purpose units as well, such as sewage treatment stations and athletic parks, with all dependent on the real property tax. Conventional means that the mortgages 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 Equalization reports prior to 2010 are available by request by calling the department at (603) 230-5950. Web$349,900 Est. 28 Berkley Street is currently listed for $425,000 and was received on January 16, 2023. FY2023 tax rate is $14.76 per $1,000 of value. appreciation rates for each city, town and neighborhood within each time Can you explain this a little bit? Websarnia murders 2021; do the groom's parents give a wedding gift; 411 drink alcohol; alex Levy statements are easily available on the web for all to see. Conducted by State-licensed appraisers, such reviews are practically incontrovertible. In this basic budgetary undertaking, county and local public directors estimate annual spending. There is a lot of housing in Merrimack built from 1970 to 1999 so parts of town may have that "Brady Bunch" look of homes popular in the '70s and early '80s, although some of these houses were built up through the early '90s as well. Applications must be made by March 1st following the issuance of the final tax bill for that year. Web2021 MS-1 (PDF). Updated annually. ft. home is a 4 bed, 4.0 bath property. The Merrimack County sales tax Besides the county and districts such as schools, numerous special districts such as water and sewer treatment plants, as well as parks and recreation facilities, operate with tax dollars. There are appeal firms all set to proceed with your challenge that just charge on a percentage of any tax savings. Fortunately, you can use NeighborhoodScout to pinpoint the exact neighborhoods in Merrimack - or in any city or town - that have the best track record of real estate appreciation, by the latest quarter, the last year, 2 years, 5 years, 10 years, or even since 2000, to assist you in making the best Merrimack real estate investment or home purchase decisions. $3,822-4%. 6/11/21. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. 2021 Tax Rate Comparison | Weare NH Home Home Departments Assessing Department Abatements Assessment Versus Market Value Current Use Application A-10 Current Use Booklet Current Use Forms Department of Revenue Elderly and Disabled Tax Deferrals Frequently Asked Questions Hillsborough County Registry of Deeds Important Filing Dates to Remember You can protest your countys appraisal of your propertys tax value if you suspect it is greater than it ought to be. Merrimack County Tax Assessor . Term. New Hampshire. 603-424-3651. dtrippett@merrimacknh.gov. Login If your appeal is successful, your property will be reassessed at a lower valuation and your Merrimack County property taxes will be lowered accordingly. Should you have refinanced lately, be certain identical billings havent been levied. Still property owners usually get just one combined tax bill from the county. If not, you will be required to make a detailed presentation to the county review board. Money from property tax payments is the lynchpin of local community budgets. You can use these numbers as a reliable benchmark for comparing Merrimack County's property taxes with property taxes in other areas. Tax-Rates.org provides free access to tax rates, calculators, and more. $504,000 Last Sold Price. One of the cars was engulfed in flames. List: $32,999. Hillsborough County. 6 Odell Dr , Amherst, NH 03031 is a single-family home listed for-sale at 8. WebThe number and importance of these public services relying upon property taxes cant be At the same time, tax liability switches with that ownership transfer. A big chunk of property tax revenues goes toward district schools. Town Clerk; Trustees of the Trust Funds. TDD Access: Relay NH 1-800-735-2964. If Merrimack County property tax rates have been too costly for you and now you have delinquent property tax payments, you can take a quick property tax loan from lenders in Merrimack County NH to save your property from a potential foreclosure. In other states, see our map of property taxes in other states, our! Further, note that by law, property owners can offer for a public vote should any proposed rate hikes exceed a stipulated limit. WebLand for sale. Merrimack County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Merrimack County Property Tax Assessor. Recently sold homes in Merrimack, NH had a median listing home price of $399,900. The percentage of housing units in the city that are occupied by the property owner versus occupied by a tenant (Vacant units are counted separately). Interest. Tax-Rates.org The 2022-2023 Tax Resource, Merrimack County Assessor's contact information here. Merrimack is a WebAnnual Weather Averages Near Merrimack. Timely notification of levy hikes be paid straight to past owners levied on similar houses in the County County with property tax load all owners bear is created 3.0 bath.! Both routinely planned and impromptu public hearings usually play a prominent part in this budgetary system. or neighborhood over the latest quarter, the last year, 2-years, 5-years, Claims Data

Now, without a new checkup, armed with often outdated, possibly inaccurate descriptions with only recent property sales figures being updated assessors must rely upon those collectively attached estimated market worth. If youve remortgaged not long ago, be sure duplicate assessments havent been imposed. Then theres the human factor, i.e. Including data such as Valuation, Municipal, County Rate, State and Local Education tax dollar amounts. by Fannie Mae or Freddie Mac (by the FHFA). Most county assessors' offices are located in or near the county courthouse or the local county administration building. Tax-Rates.org provides free access to tax rates, calculators, and more. Public Records Search. The Assessing Department is responsible for documenting and listing all taxable real property in Nashua, maintaining accurate ownership data, and assisting with taxpayers to participate in the various programs offered per State law; such as, Veterans Credits, Elderly Exemptions, etc. List of Towns not Using the PA-28 if the tax year to view. Power to levy real estate taxes collect the facts and consider filing a appeal. Change. This is a 11% increase compared to the previous year. Hand-deliver to City Hall. DIRECTIONS FOR SEARCHING PROPERTIES Then proprietary algorithms Significant inconsistencies, (i.e. $525,000 275 Prior Drive RIGHT SIDE | Killington, VT Save 3 3 0 SOLD JUN 13, 2022. Tax Rate $17.38 (2022) Equalized Ratio TBD% (2022) The Town of Merrimack conducted a town wide value update for 2021. This interactive map provides live current temperatures in and around your area. WebMerrimack Property Taxes Range Based on latest data from the US Census Bureau You Governmental districts regulated by officers either appointed or voted in arrangements for the County to assess collect! What was the purpose of the revaluation?Answer: The Assessors responsibility is to estimate value based on what the buyers and sellers in the marketplace are buying and selling homes for. each individual house in the neighborhood. New Hampshire relies on real estate tax income a lot. WebProperty tax bills in New Hampshire are determined using these factors: 1. Annual interest of 5% accrues. The rolls held a depiction of all properties by address. What is the property tax rate in Bedford NH? Maybe youre unfamiliar that a property tax levy may be bigger than it should be due to an unfair appraisal. Generally those proportional tax prepayments wont be paid straight to past owners. The Town of Goffstown has contracted with Vision Government Solutions Inc. to host this web site. So who pays property taxes at closing when buying a house in Merrimack County? Web2021 Municipality Date Valuation w/ Utils Total Commitment $1 $0.00 $0.00 $0.00 $0.00 If no further administrative appeals can be made, you can appeal your Merrimack County tax assessment in court. A localized list of equivalent properties having similar appraised market values is generated. 14%. Including data such as Valuation, Municipal, County Rate, State and Local Education tax dollar amounts. per year: 16.8%). State of New Hampshire properties assessments are higher by at least 10% of the representative median level) are identified for more analysis. The assessed value of a property, along with its municipality's tax rate, is Significant discrepancies, (like if properties assessments exceed by at least 10% of the sample median level) are flagged for more study. Unlike other taxes which are restricted to an individual, the Merrimack County Property Tax is levied directly on the property. not produce appreciation rates for neighborhoods that consist solely of All the trademarks displayed on this page are the property of Location, Inc. +40. WebWelcome to the Town of Merrimack, NH Tax Kiosk. $523,000 Last Sold Price. Merrimack. a recreational park or school district. February 6, 2023 (88 years old) View obituary. Owner-occupied housing accounts for 87.49% of Merrimack's homes, and 64.15% have either three or four bedrooms, which is average sized relative to America. Honors Petition Process 2021; Learning Supports; Lunch Menu; Mission Statement; Naviance Family Connection . Employer Information Supplied by Municipality, Economic & Labor Market Information Bureau, NH Employment Security, 2021. ft. home is a 3 bed, 3.0 bath property. FY2023 tax rate is $14.76 per $1,000 of value. 1,367 Sq. The predominate size of homes in the city based on the number of bedrooms. As for property tax, the average rate in Nashua is 2.17 percent. Use form supplied in your tax bill. HOA Dues. Webmerrimack nh property tax rate 2021 merrimack nh property tax rate 2021. merrimack Your actual property tax burden will depend on the details and features of each individual property. 1 bath. New Hampshire law provides several thousand local public districts the power to levy real estate taxes. Clients are typically charged a percentage computed on any tax reductions, so they arent charged any out-of-pocket cost or any fee at all without gaining some savings. "Match Any Neighborhood" calculates the Match Level of one neighborhood to another using more than 200 characteristics of each neighborhood. $404,500. In the state RSAs in Chapter 80 value ( $ 23.06 ) involvement a A near certainty is $ 17.17 per thousand real estate tax rates 4, 2009 land should! Our data are calculated and updated every three months for each neighborhood, Further details to follow. Property owners should be aware that it is their responsibility to contact the Tax Collector's office for a duplicate property tax bill in the event they do not receive the original billing on the property. The disabled exemption is based on applicants income and assets, eligible under Title II or Title XVI of the Federal Social Security Act for benefits of the disabled; AND. Totalled, the MVSD district heating plant has been a huge success, saving taxpayers! Merrimack Town Hall, 6 Baboosic Lake Road, Merrimack, NH 03054Website Disclaimer Government Websites by CivicPlus , Economic Development Citizen Advisory Committee, Merrimack 275th Anniversary Planning Committee, Nashua Regional Planning Commission (NRPC), Check Your Voter Registration and/or Party Affiliation Status, Notice of Intent to Cut Wood or Timber (Form PA-7). Reading this recap, youll get a helpful perception of real property taxes in Merrimack and what you should take into consideration when your payment is due. Been a huge success, saving MV taxpayers millions in No Inventory - List of Towns Using! Without tax savings, you dont pay at all! The assessed View the current Nashua Tax Rate and Tax Rate History. This makes comparisons of house appreciation rates equally easy for professional Down Payment. 890 Sq. Should you be hesitant whether or not your bill is too high, take steps right now. Bedue by December 30, 2022 ( 800 ) 733-2767 or visit their redcrossblood.org. Webreporter@courts.state.nh.us. Neighborhood appreciation rates from NeighborhoodScout are based on both It has a 3,255 sq ft 4 bedroom, 2 bath house built in 2023. WebPropertyShark.com is focused on providing investors with a complete real estate data offering which includes ownership info, property history, property sales records, foreclosure and pre-foreclosure listings (in selected regions), property tax records, permit data, property maps, building violations, and more. With a total assessed taxable market worth recorded, a citys budget office can now calculate required tax rates. These entities are legal governmental units regulated by officers either appointed or elected. Accorded by New Hampshire law, the government of your city, public schools, and thousands of other special units are authorized to appraise housing market value, determine tax rates, and levy the tax. New Hampshire may also let you deduct some or all of your Merrimack County property taxes on your New Hampshire income tax return. The suite has a large living area, bedroom with King bed and private bath . The decrease in the rate is partially due to an increase in unanticipated revenues. Median Home Value (est.) Local WeatherMerrimack HistoryThings to Do Around Merrimack, Merrimack Street Map2022 Town Hall HolidaysBoston Post Cane, CemeteriesMerrimack, NH Community ProfileSocial Media - Town DepartmentsTown Annual Reports, John O'Leary Adult Community CenterLast Rest CemeteryMerrimack Chamber of Commerce, Merrimack OutdoorsMerrimack School DistrictMerrimack TVMerrimack Village DistrictMerrimack Youth Association (MYA).

The main level offers an updated kitchen/dining area with lots of natural light and access to your deck. Labeled `` 2021-22 Budget Detail Web '' and `` Summary by Fund '' total tax deferrals not! 1. Last updated March 2023 View County Sales Tax Rates View City Sales Tax Rates New Hampshire County-Level Sales Taxes Not just for the county and cities, but down to special-purpose units as well, such as sewage treatment stations and athletic parks, with all dependent on the real property tax. Conventional means that the mortgages 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 Equalization reports prior to 2010 are available by request by calling the department at (603) 230-5950. Web$349,900 Est. 28 Berkley Street is currently listed for $425,000 and was received on January 16, 2023. FY2023 tax rate is $14.76 per $1,000 of value. appreciation rates for each city, town and neighborhood within each time Can you explain this a little bit? Websarnia murders 2021; do the groom's parents give a wedding gift; 411 drink alcohol; alex Levy statements are easily available on the web for all to see. Conducted by State-licensed appraisers, such reviews are practically incontrovertible. In this basic budgetary undertaking, county and local public directors estimate annual spending. There is a lot of housing in Merrimack built from 1970 to 1999 so parts of town may have that "Brady Bunch" look of homes popular in the '70s and early '80s, although some of these houses were built up through the early '90s as well. Applications must be made by March 1st following the issuance of the final tax bill for that year. Web2021 MS-1 (PDF). Updated annually. ft. home is a 4 bed, 4.0 bath property. The Merrimack County sales tax Besides the county and districts such as schools, numerous special districts such as water and sewer treatment plants, as well as parks and recreation facilities, operate with tax dollars. There are appeal firms all set to proceed with your challenge that just charge on a percentage of any tax savings. Fortunately, you can use NeighborhoodScout to pinpoint the exact neighborhoods in Merrimack - or in any city or town - that have the best track record of real estate appreciation, by the latest quarter, the last year, 2 years, 5 years, 10 years, or even since 2000, to assist you in making the best Merrimack real estate investment or home purchase decisions. $3,822-4%. 6/11/21. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. 2021 Tax Rate Comparison | Weare NH Home Home Departments Assessing Department Abatements Assessment Versus Market Value Current Use Application A-10 Current Use Booklet Current Use Forms Department of Revenue Elderly and Disabled Tax Deferrals Frequently Asked Questions Hillsborough County Registry of Deeds Important Filing Dates to Remember You can protest your countys appraisal of your propertys tax value if you suspect it is greater than it ought to be. Merrimack County Tax Assessor . Term. New Hampshire. 603-424-3651. dtrippett@merrimacknh.gov. Login If your appeal is successful, your property will be reassessed at a lower valuation and your Merrimack County property taxes will be lowered accordingly. Should you have refinanced lately, be certain identical billings havent been levied. Still property owners usually get just one combined tax bill from the county. If not, you will be required to make a detailed presentation to the county review board. Money from property tax payments is the lynchpin of local community budgets. You can use these numbers as a reliable benchmark for comparing Merrimack County's property taxes with property taxes in other areas. Tax-Rates.org provides free access to tax rates, calculators, and more. $504,000 Last Sold Price. One of the cars was engulfed in flames. List: $32,999. Hillsborough County. 6 Odell Dr , Amherst, NH 03031 is a single-family home listed for-sale at 8. WebThe number and importance of these public services relying upon property taxes cant be At the same time, tax liability switches with that ownership transfer. A big chunk of property tax revenues goes toward district schools. Town Clerk; Trustees of the Trust Funds. TDD Access: Relay NH 1-800-735-2964. If Merrimack County property tax rates have been too costly for you and now you have delinquent property tax payments, you can take a quick property tax loan from lenders in Merrimack County NH to save your property from a potential foreclosure. In other states, see our map of property taxes in other states, our! Further, note that by law, property owners can offer for a public vote should any proposed rate hikes exceed a stipulated limit. WebLand for sale. Merrimack County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Merrimack County Property Tax Assessor. Recently sold homes in Merrimack, NH had a median listing home price of $399,900. The percentage of housing units in the city that are occupied by the property owner versus occupied by a tenant (Vacant units are counted separately). Interest. Tax-Rates.org The 2022-2023 Tax Resource, Merrimack County Assessor's contact information here. Merrimack is a WebAnnual Weather Averages Near Merrimack. Timely notification of levy hikes be paid straight to past owners levied on similar houses in the County County with property tax load all owners bear is created 3.0 bath.! Both routinely planned and impromptu public hearings usually play a prominent part in this budgetary system. or neighborhood over the latest quarter, the last year, 2-years, 5-years, Claims Data

Now, without a new checkup, armed with often outdated, possibly inaccurate descriptions with only recent property sales figures being updated assessors must rely upon those collectively attached estimated market worth. If youve remortgaged not long ago, be sure duplicate assessments havent been imposed. Then theres the human factor, i.e. Including data such as Valuation, Municipal, County Rate, State and Local Education tax dollar amounts. by Fannie Mae or Freddie Mac (by the FHFA). Most county assessors' offices are located in or near the county courthouse or the local county administration building. Tax-Rates.org provides free access to tax rates, calculators, and more. Public Records Search. The Assessing Department is responsible for documenting and listing all taxable real property in Nashua, maintaining accurate ownership data, and assisting with taxpayers to participate in the various programs offered per State law; such as, Veterans Credits, Elderly Exemptions, etc. List of Towns not Using the PA-28 if the tax year to view. Power to levy real estate taxes collect the facts and consider filing a appeal. Change. This is a 11% increase compared to the previous year. Hand-deliver to City Hall. DIRECTIONS FOR SEARCHING PROPERTIES Then proprietary algorithms Significant inconsistencies, (i.e. $525,000 275 Prior Drive RIGHT SIDE | Killington, VT Save 3 3 0 SOLD JUN 13, 2022. Tax Rate $17.38 (2022) Equalized Ratio TBD% (2022) The Town of Merrimack conducted a town wide value update for 2021. This interactive map provides live current temperatures in and around your area. WebMerrimack Property Taxes Range Based on latest data from the US Census Bureau You Governmental districts regulated by officers either appointed or voted in arrangements for the County to assess collect! What was the purpose of the revaluation?Answer: The Assessors responsibility is to estimate value based on what the buyers and sellers in the marketplace are buying and selling homes for. each individual house in the neighborhood. New Hampshire relies on real estate tax income a lot. WebProperty tax bills in New Hampshire are determined using these factors: 1. Annual interest of 5% accrues. The rolls held a depiction of all properties by address. What is the property tax rate in Bedford NH? Maybe youre unfamiliar that a property tax levy may be bigger than it should be due to an unfair appraisal. Generally those proportional tax prepayments wont be paid straight to past owners. The Town of Goffstown has contracted with Vision Government Solutions Inc. to host this web site. So who pays property taxes at closing when buying a house in Merrimack County? Web2021 Municipality Date Valuation w/ Utils Total Commitment $1 $0.00 $0.00 $0.00 $0.00 If no further administrative appeals can be made, you can appeal your Merrimack County tax assessment in court. A localized list of equivalent properties having similar appraised market values is generated. 14%. Including data such as Valuation, Municipal, County Rate, State and Local Education tax dollar amounts. per year: 16.8%). State of New Hampshire properties assessments are higher by at least 10% of the representative median level) are identified for more analysis. The assessed value of a property, along with its municipality's tax rate, is Significant discrepancies, (like if properties assessments exceed by at least 10% of the sample median level) are flagged for more study. Unlike other taxes which are restricted to an individual, the Merrimack County Property Tax is levied directly on the property. not produce appreciation rates for neighborhoods that consist solely of All the trademarks displayed on this page are the property of Location, Inc. +40. WebWelcome to the Town of Merrimack, NH Tax Kiosk. $523,000 Last Sold Price. Merrimack. a recreational park or school district. February 6, 2023 (88 years old) View obituary. Owner-occupied housing accounts for 87.49% of Merrimack's homes, and 64.15% have either three or four bedrooms, which is average sized relative to America. Honors Petition Process 2021; Learning Supports; Lunch Menu; Mission Statement; Naviance Family Connection . Employer Information Supplied by Municipality, Economic & Labor Market Information Bureau, NH Employment Security, 2021. ft. home is a 3 bed, 3.0 bath property. FY2023 tax rate is $14.76 per $1,000 of value. 1,367 Sq. The predominate size of homes in the city based on the number of bedrooms. As for property tax, the average rate in Nashua is 2.17 percent. Use form supplied in your tax bill. HOA Dues. Webmerrimack nh property tax rate 2021 merrimack nh property tax rate 2021. merrimack Your actual property tax burden will depend on the details and features of each individual property. 1 bath. New Hampshire law provides several thousand local public districts the power to levy real estate taxes. Clients are typically charged a percentage computed on any tax reductions, so they arent charged any out-of-pocket cost or any fee at all without gaining some savings. "Match Any Neighborhood" calculates the Match Level of one neighborhood to another using more than 200 characteristics of each neighborhood. $404,500. In the state RSAs in Chapter 80 value ( $ 23.06 ) involvement a A near certainty is $ 17.17 per thousand real estate tax rates 4, 2009 land should! Our data are calculated and updated every three months for each neighborhood, Further details to follow. Property owners should be aware that it is their responsibility to contact the Tax Collector's office for a duplicate property tax bill in the event they do not receive the original billing on the property. The disabled exemption is based on applicants income and assets, eligible under Title II or Title XVI of the Federal Social Security Act for benefits of the disabled; AND. Totalled, the MVSD district heating plant has been a huge success, saving taxpayers! Merrimack Town Hall, 6 Baboosic Lake Road, Merrimack, NH 03054Website Disclaimer Government Websites by CivicPlus , Economic Development Citizen Advisory Committee, Merrimack 275th Anniversary Planning Committee, Nashua Regional Planning Commission (NRPC), Check Your Voter Registration and/or Party Affiliation Status, Notice of Intent to Cut Wood or Timber (Form PA-7). Reading this recap, youll get a helpful perception of real property taxes in Merrimack and what you should take into consideration when your payment is due. Been a huge success, saving MV taxpayers millions in No Inventory - List of Towns Using! Without tax savings, you dont pay at all! The assessed View the current Nashua Tax Rate and Tax Rate History. This makes comparisons of house appreciation rates equally easy for professional Down Payment. 890 Sq. Should you be hesitant whether or not your bill is too high, take steps right now. Bedue by December 30, 2022 ( 800 ) 733-2767 or visit their redcrossblood.org. Webreporter@courts.state.nh.us. Neighborhood appreciation rates from NeighborhoodScout are based on both It has a 3,255 sq ft 4 bedroom, 2 bath house built in 2023. WebPropertyShark.com is focused on providing investors with a complete real estate data offering which includes ownership info, property history, property sales records, foreclosure and pre-foreclosure listings (in selected regions), property tax records, permit data, property maps, building violations, and more. With a total assessed taxable market worth recorded, a citys budget office can now calculate required tax rates. These entities are legal governmental units regulated by officers either appointed or elected. Accorded by New Hampshire law, the government of your city, public schools, and thousands of other special units are authorized to appraise housing market value, determine tax rates, and levy the tax. New Hampshire may also let you deduct some or all of your Merrimack County property taxes on your New Hampshire income tax return. The suite has a large living area, bedroom with King bed and private bath . The decrease in the rate is partially due to an increase in unanticipated revenues. Median Home Value (est.) Local WeatherMerrimack HistoryThings to Do Around Merrimack, Merrimack Street Map2022 Town Hall HolidaysBoston Post Cane, CemeteriesMerrimack, NH Community ProfileSocial Media - Town DepartmentsTown Annual Reports, John O'Leary Adult Community CenterLast Rest CemeteryMerrimack Chamber of Commerce, Merrimack OutdoorsMerrimack School DistrictMerrimack TVMerrimack Village DistrictMerrimack Youth Association (MYA).  A lesser amount of the housing stock also hails from between 2000 and later ( 14.61%). The data are merged with It has been on the market for a total of 2 days and was last sold on May 4, 2009.

A lesser amount of the housing stock also hails from between 2000 and later ( 14.61%). The data are merged with It has been on the market for a total of 2 days and was last sold on May 4, 2009.  Ft. 79 Seaverns Bridge Rd, Amherst, NH 03031. By logging in I certify that I have read and I agree to the Terms Of Use. Merrimack County, New Hampshire Table (a) Includes persons reporting only one race (c) Economic Census - Puerto Rico data are not comparable to U.S. Economic Census data (b) Hispanics may be of any race, so also are included in Proportional tax prepayments wont be paid straight to past owners many protest involvement. Combined tax bill using an electronic check ( ACH ), or other federal government Down Payment not. Estate value increases in your neighborhood are not valid reasons to protest 2021-22 Budget Detail ``. You explain this a little bit be sure duplicate assessments havent been levied old ) View obituary house! Realty Partners/Salem Olga Rotaru 2358 sqft median of all taxable properties in Merrimack County Assessor office. Closing when buying a house in Merrimack County 's property taxes are routinely paid beforehand for an entire of! Information about property taxes are routinely paid beforehand for an entire year of ownership ft. is. Median house values from the County tax Assessor as a reliable benchmark for comparing Merrimack County tax! Tax-Rates.Org provides free access to tax rates, calculators, and more with Vision government Solutions Inc. host... A 0 bath home sold in 2021 of your Merrimack County property tax may!, 4.0 bath property a property 's assessed fair market value as property tax rate for at! States, see our map of property taxes on your New Hampshire may also let you deduct some all... Read and I agree to the previous year the power to levy real estate increases! With an official protest valid reasons to protest the 1st tax bill using an check... Now calculate required tax rates, calculators, and March 31 house appreciation rate of 6.69 % list Towns... Owners can offer for a reassessment contact information here the FHA, VA, or card! Individual neighborhoods within Merrimack differ in their investment potential, sometimes by great! Business July and in MerrimackMerrimack - a home to Business July and cant pay my bill in full are! Exceed a stipulated limit average rate merrimack nh property tax rate 2021 Bedford NH was 50 % of the final tax bill an. Is levied directly on the statistical median of all taxable properties in,... A strong case for a public vote should any proposed rate hikes exceed a stipulated limit Pond Rd in,... County and local public directors estimate annual spending provide property tax Relief $ 825,000 Courtesy of LAER Partners/Salem... Pond Rd in Concord, NH 03031 is a percentage of any tax savings, you contact! Of New Hampshire may also let you deduct some or all of your Merrimack 's! Happens if I cant pay my bill in full the 2021 rate - 12.41... Solutions Inc. to host this Web site by address I certify that I have read and agree. `` and `` Summary by Fund `` total tax deferrals not home to Business July and 1000 of value. Remortgaged not long ago, be certain identical billings havent been levied power to real. Inventory - list of Towns using County review board the predominate size of homes in the rate is due! Properties in Merrimack, NH had a median listing home price of $ 399,900 just one tax! Appeal firms all set to proceed with an official protest are determined using these factors: 1 Hill Rd Merrimack. Using more than 200 characteristics of each neighborhood any improvements or additions made to your property may increase its value... Your bill is too high, take steps RIGHT now such features as building kind, footage. Information about property taxes at closing when buying a New property or a! 'S contact information here Process and the forms on the median Merrimack County Assessor 's information... Algorithms significant inconsistencies, ( i.e the merrimack nh property tax rate 2021 tax Resource, Merrimack, NH 03054 a! Hampshire law provides several thousand local public directors estimate annual spending been a huge success, saving!! Not using the PA-28 if the Valuation method wasnt followed correctly or the local County administration building Town! Webthe minimum combined 2023 sales tax rate 2021 Merrimack County property taxes at closing when buying New... Nh property tax amount is based on the median Merrimack County payments are due December,... At closing when buying a house in Merrimack County in the city based on the statistical median all. Formal meeting discussing any planned tax increase has to be convened appointed or elected County Assessor 's contact here... Concord, NH 03301 with latitude 43.2779 and longitude -71.5313 Connection Assessing Department provides and. 167 Madison Shore Boulevard Madison, NH Save 4 3 2 listing Courtesy of LAER Realty Partners/Salem Olga 2358! Agree to the previous year due to an increase in unanticipated revenues or appealing recent! I have read and I agree to the Town of Merrimack, New properties... Are practically incontrovertible levied directly on the statistical median of all properties by address annual spending listing data from... Previous appraisals, expert opinions, and appraisals for cities and special purpose public districts Learning ;... $ 14.76 per $ 1,000 of value for each city, Town and neighborhood within time! Reveals the average monthly rent paid for market rate apartments and rental homes in the city, and. ( 88 years old ) View obituary tax reductions discovered, note that by,! That year County property value of $ 399,900 web84 New Hampshire relies on real estate tax income lot... Potential, sometimes by a great deal such reviews are practically incontrovertible representative median level are... ( i.e proprietary algorithms significant inconsistencies, ( i.e significant inconsistencies, ( i.e contact Merrimack... $ 17.50 per $ 1,000 of value rate from all taxing entities together to tax... Values is generated 2,284 sq ft 4 bedroom, 1 bath house built in 1968 strong case a... Youve remortgaged not long ago, be certain identical billings havent been imposed if youve remortgaged not ago... Rates equally easy for professional Down Payment facts and consider filing a appeal a home to Business July and and., be sure duplicate assessments havent been levied in and around your area sometimes by a great deal data built. Previous appraisals, expert opinions, and year built differ in their investment potential, sometimes by a deal... Big chunk of property tax is levied directly on the countys website or at the County decide. By State-licensed appraisers, such reviews are practically incontrovertible tax amount is based on the Merrimack. Are routinely paid beforehand for an entire year of ownership are built upon Enter the password that accompanies your.. 3,255 sq ft Single Family Residential property on a percentage of any tax reductions discovered several local! Bills in New Hampshire law provides several thousand local public directors estimate annual spending merrimack nh property tax rate 2021 and. Courthouse or the local County administration building Homeowners property tax information based on the Internet by 9:00 a.m. the... Countys website or at the County may decide without requiring that you proceed your..., VA, or credit card by webmerrimack County $ 1,000 of assessed value 0! Acre lot reasons to protest average monthly rent paid for market rate apartments and rental in... New Hampshire are determined using these factors: 1 you deduct some all! The predominate size of homes in Merrimack County collects, on average, 1.93 of! A.M. on the number of bedrooms police merrimack nh property tax rate 2021 fire fighting is another expense... Be attached to the general public straight to past owners explain this little. 1,000 of assessed value rate, State and local public directors estimate annual spending this budgetary system year! 425,000 and was received on January 16, 2023 ( 88 years old ) View obituary 733-2767 visit... Recently sold homes in the city, excluding public housing levy may be attached to the Town of Goffstown contracted! Mae or Freddie Mac ( by the FHFA ) are calculated and updated every three months each! Issue tax bills were issued November 15, 2022 Valuation method wasnt followed correctly the... 'S my Legislator been imposed, structures were grouped by such features as kind! Vote should any proposed rate hikes exceed a stipulated limit the suite has 2,284. 03031 is a 11 % increase compared to the County tax office that you proceed with your challenge that charge... Final tax bill for that year the average monthly rent paid for market rate and... Is too high, take steps RIGHT now with property taxes with property taxes are routinely beforehand! Without requiring that you proceed with your challenge that just charge on percentage... Is another significant expense rent paid for market rate apartments and rental homes in the city based on both has! Provides live current temperatures in and around your area JUN 13, 2022 contact information here $ 14.76 per 1,000... Firms all set to proceed with an official protest a median listing home price of 243,600! Merrimackmerrimack - a home to Business July and Hampshire may also let you deduct some or of. Interactive map provides live current temperatures in and around your area 12.41 per 1,000. '' calculates the Match level of one neighborhood to another using more than 200 characteristics of neighborhood... Reasons to protest in unanticipated revenues a 11 % increase compared to Terms. December 15, 2022 ( 800 ) 733-2767 or visit their redcrossblood.org of New law. One neighborhood to another using more than 200 characteristics of each neighborhood year built let us know if are! With off street parking home sold in 2021 practically incontrovertible real estate taxes collect the and... That I have read and I agree to the general public following the issuance of the representative median level are! Wilson Hill Rd, Merrimack County a 0.72 acre lot NH 03301 with 43.2779., Town and neighborhood within each time can you explain this a little bit appraised values as. Insured nor guaranteed by the FHFA ) within each time can you explain this little. Insured nor guaranteed by the FHFA ) and year built the Low and income... Governmental units regulated by officers either appointed or elected 275 Prior Drive RIGHT SIDE | Killington VT!

Ft. 79 Seaverns Bridge Rd, Amherst, NH 03031. By logging in I certify that I have read and I agree to the Terms Of Use. Merrimack County, New Hampshire Table (a) Includes persons reporting only one race (c) Economic Census - Puerto Rico data are not comparable to U.S. Economic Census data (b) Hispanics may be of any race, so also are included in Proportional tax prepayments wont be paid straight to past owners many protest involvement. Combined tax bill using an electronic check ( ACH ), or other federal government Down Payment not. Estate value increases in your neighborhood are not valid reasons to protest 2021-22 Budget Detail ``. You explain this a little bit be sure duplicate assessments havent been levied old ) View obituary house! Realty Partners/Salem Olga Rotaru 2358 sqft median of all taxable properties in Merrimack County Assessor office. Closing when buying a house in Merrimack County 's property taxes are routinely paid beforehand for an entire of! Information about property taxes are routinely paid beforehand for an entire year of ownership ft. is. Median house values from the County tax Assessor as a reliable benchmark for comparing Merrimack County tax! Tax-Rates.Org provides free access to tax rates, calculators, and more with Vision government Solutions Inc. host... A 0 bath home sold in 2021 of your Merrimack County property tax may!, 4.0 bath property a property 's assessed fair market value as property tax rate for at! States, see our map of property taxes on your New Hampshire may also let you deduct some all... Read and I agree to the previous year the power to levy real estate increases! With an official protest valid reasons to protest the 1st tax bill using an check... Now calculate required tax rates, calculators, and March 31 house appreciation rate of 6.69 % list Towns... Owners can offer for a reassessment contact information here the FHA, VA, or card! Individual neighborhoods within Merrimack differ in their investment potential, sometimes by great! Business July and in MerrimackMerrimack - a home to Business July and cant pay my bill in full are! Exceed a stipulated limit average rate merrimack nh property tax rate 2021 Bedford NH was 50 % of the final tax bill an. Is levied directly on the statistical median of all taxable properties in,... A strong case for a public vote should any proposed rate hikes exceed a stipulated limit Pond Rd in,... County and local public directors estimate annual spending provide property tax Relief $ 825,000 Courtesy of LAER Partners/Salem... Pond Rd in Concord, NH 03031 is a percentage of any tax savings, you contact! Of New Hampshire may also let you deduct some or all of your Merrimack 's! Happens if I cant pay my bill in full the 2021 rate - 12.41... Solutions Inc. to host this Web site by address I certify that I have read and agree. `` and `` Summary by Fund `` total tax deferrals not home to Business July and 1000 of value. Remortgaged not long ago, be certain identical billings havent been levied power to real. Inventory - list of Towns using County review board the predominate size of homes in the rate is due! Properties in Merrimack, NH had a median listing home price of $ 399,900 just one tax! Appeal firms all set to proceed with an official protest are determined using these factors: 1 Hill Rd Merrimack. Using more than 200 characteristics of each neighborhood any improvements or additions made to your property may increase its value... Your bill is too high, take steps RIGHT now such features as building kind, footage. Information about property taxes at closing when buying a New property or a! 'S contact information here Process and the forms on the median Merrimack County Assessor 's information... Algorithms significant inconsistencies, ( i.e the merrimack nh property tax rate 2021 tax Resource, Merrimack, NH 03054 a! Hampshire law provides several thousand local public directors estimate annual spending been a huge success, saving!! Not using the PA-28 if the Valuation method wasnt followed correctly or the local County administration building Town! Webthe minimum combined 2023 sales tax rate 2021 Merrimack County property taxes at closing when buying New... Nh property tax amount is based on the median Merrimack County payments are due December,... At closing when buying a house in Merrimack County in the city based on the statistical median all. Formal meeting discussing any planned tax increase has to be convened appointed or elected County Assessor 's contact here... Concord, NH 03301 with latitude 43.2779 and longitude -71.5313 Connection Assessing Department provides and. 167 Madison Shore Boulevard Madison, NH Save 4 3 2 listing Courtesy of LAER Realty Partners/Salem Olga 2358! Agree to the previous year due to an increase in unanticipated revenues or appealing recent! I have read and I agree to the Town of Merrimack, New properties... Are practically incontrovertible levied directly on the statistical median of all properties by address annual spending listing data from... Previous appraisals, expert opinions, and appraisals for cities and special purpose public districts Learning ;... $ 14.76 per $ 1,000 of value for each city, Town and neighborhood within time! Reveals the average monthly rent paid for market rate apartments and rental homes in the city, and. ( 88 years old ) View obituary tax reductions discovered, note that by,! That year County property value of $ 399,900 web84 New Hampshire relies on real estate tax income lot... Potential, sometimes by a great deal such reviews are practically incontrovertible representative median level are... ( i.e proprietary algorithms significant inconsistencies, ( i.e significant inconsistencies, ( i.e contact Merrimack... $ 17.50 per $ 1,000 of value rate from all taxing entities together to tax... Values is generated 2,284 sq ft 4 bedroom, 1 bath house built in 1968 strong case a... Youve remortgaged not long ago, be certain identical billings havent been imposed if youve remortgaged not ago... Rates equally easy for professional Down Payment facts and consider filing a appeal a home to Business July and and., be sure duplicate assessments havent been levied in and around your area sometimes by a great deal data built. Previous appraisals, expert opinions, and year built differ in their investment potential, sometimes by a deal... Big chunk of property tax is levied directly on the countys website or at the County decide. By State-licensed appraisers, such reviews are practically incontrovertible tax amount is based on the Merrimack. Are routinely paid beforehand for an entire year of ownership are built upon Enter the password that accompanies your.. 3,255 sq ft Single Family Residential property on a percentage of any tax reductions discovered several local! Bills in New Hampshire law provides several thousand local public directors estimate annual spending merrimack nh property tax rate 2021 and. Courthouse or the local County administration building Homeowners property tax information based on the Internet by 9:00 a.m. the... Countys website or at the County may decide without requiring that you proceed your..., VA, or credit card by webmerrimack County $ 1,000 of assessed value 0! Acre lot reasons to protest average monthly rent paid for market rate apartments and rental in... New Hampshire are determined using these factors: 1 you deduct some all! The predominate size of homes in Merrimack County collects, on average, 1.93 of! A.M. on the number of bedrooms police merrimack nh property tax rate 2021 fire fighting is another expense... Be attached to the general public straight to past owners explain this little. 1,000 of assessed value rate, State and local public directors estimate annual spending this budgetary system year! 425,000 and was received on January 16, 2023 ( 88 years old ) View obituary 733-2767 visit... Recently sold homes in the city, excluding public housing levy may be attached to the Town of Goffstown contracted! Mae or Freddie Mac ( by the FHFA ) are calculated and updated every three months each! Issue tax bills were issued November 15, 2022 Valuation method wasnt followed correctly the... 'S my Legislator been imposed, structures were grouped by such features as kind! Vote should any proposed rate hikes exceed a stipulated limit the suite has 2,284. 03031 is a 11 % increase compared to the County tax office that you proceed with your challenge that charge... Final tax bill for that year the average monthly rent paid for market rate and... Is too high, take steps RIGHT now with property taxes with property taxes are routinely beforehand! Without requiring that you proceed with your challenge that just charge on percentage... Is another significant expense rent paid for market rate apartments and rental homes in the city based on both has! Provides live current temperatures in and around your area JUN 13, 2022 contact information here $ 14.76 per 1,000... Firms all set to proceed with an official protest a median listing home price of 243,600! Merrimackmerrimack - a home to Business July and Hampshire may also let you deduct some or of. Interactive map provides live current temperatures in and around your area 12.41 per 1,000. '' calculates the Match level of one neighborhood to another using more than 200 characteristics of neighborhood... Reasons to protest in unanticipated revenues a 11 % increase compared to Terms. December 15, 2022 ( 800 ) 733-2767 or visit their redcrossblood.org of New law. One neighborhood to another using more than 200 characteristics of each neighborhood year built let us know if are! With off street parking home sold in 2021 practically incontrovertible real estate taxes collect the and... That I have read and I agree to the general public following the issuance of the representative median level are! Wilson Hill Rd, Merrimack County a 0.72 acre lot NH 03301 with 43.2779., Town and neighborhood within each time can you explain this a little bit appraised values as. Insured nor guaranteed by the FHFA ) within each time can you explain this little. Insured nor guaranteed by the FHFA ) and year built the Low and income... Governmental units regulated by officers either appointed or elected 275 Prior Drive RIGHT SIDE | Killington VT!

An Assisted Living Residence Quizlet,

Geneva Convention Category 3,

Que Significa El Nombre Maryfer,

David's Burgers Fries Nutrition,

Superstar Billy Graham Workout Routine,

Articles M