plymouth ma property tax ratepiedmontese cattle pros and cons

To compare Plymouth County with property tax rates in other states, see our map of property taxes by state. What is the richest area in Massachusetts? This is a logical area to look carefully for appraisal unevenness and mistakes. Town of Hanson Treasurer and Collector Website

This The taxes owed on a home worth $216,100 at that rate would be $3,926 per year. qtr. Bridgewater Board of Assessors Website

Town of Abington Treasurer and Collector Website

Submit your request in writing to the Assessors Office. Property taxes differ greatly between cities in Worcester County, but on average, the effective tax rate across the county is 1.62%. If so, it is helpful to cite specific examples. Under the state code, reexaminations must be conducted on a regular basis. View Brockton Tax Collector Department home page including documents, forms, staff directory and contact information. The average residential property tax rate for Worcester County is 14.42 County Office is not affiliated with any government agency. The average yearly property tax paid by Plymouth County residents amounts to about 4.3% of their yearly income. Homeowners who believe their home's assessed value is too high can file an abatement application. What is the most important reason for that score?  Web1.700% of Assessed Home Value. Part time Clerk. You can use these numbers as a reliable benchmark for comparing Plymouth County's property taxes with property taxes in other areas. Especially school districts for the most part rely on property taxes. Massachusetts has 14 counties, with median property taxes ranging from a high of $4,356.00 in Middlesex County to a low of $2,386.00 in Berkshire County. View Carver Town Hall finance campaign guide, reports, organization forms, and field reports. Then payments are allocated to these taxing entities according to a preset payment schedule. Marion Assessor's Office Website

A citys property tax rules should comply with Massachusetts constitutional rules and regulations. https://www.town.duxbury.ma.us/assessing-department

The median property tax in Plymouth County, Massachusetts is $3,670 per year for a home worth the median value of $360,700.

Web1.700% of Assessed Home Value. Part time Clerk. You can use these numbers as a reliable benchmark for comparing Plymouth County's property taxes with property taxes in other areas. Especially school districts for the most part rely on property taxes. Massachusetts has 14 counties, with median property taxes ranging from a high of $4,356.00 in Middlesex County to a low of $2,386.00 in Berkshire County. View Carver Town Hall finance campaign guide, reports, organization forms, and field reports. Then payments are allocated to these taxing entities according to a preset payment schedule. Marion Assessor's Office Website

A citys property tax rules should comply with Massachusetts constitutional rules and regulations. https://www.town.duxbury.ma.us/assessing-department

The median property tax in Plymouth County, Massachusetts is $3,670 per year for a home worth the median value of $360,700.  The median home value in Norfolk County is $491,000, over $209,000 more than double the national average. As calculated, a composite tax rate times the market worth total will show the countys total tax burden and include your share. View Kingston Assessing Department home page including tax rates, fees, maps, tax exemption information, forms, applications and contact information. Note: Contacting the Assessors office will aid us in putting your name on as a "care of".Exception: Current recorded subdivision plan. For example, in the city of Plymouth the total rate for 2021 is $16.16 per $1,000 in assessed value. Website Disclaimer Government Websites by CivicPlus , FY2023 Property Tax Classification Hearing, Cemetery & Crematory Office Hours and Information, Permit for Group Visits, Tours and Working in the Cemeteries, Selectmans Cemetery Policy regarding Group Visits, Events & Outside Work, Center for Active Living Monthly Newsletter, (NWS) Weather Forecast Office Boston / Taunton, Water Street Sewer Interceptor Replacement, Harbor Plan - Final Draft / Selectman's Meeting August 22, 2017, Conflict of Interest Law for Municipal Employees, Employee and Retiree Benefits Information, Employment Application for Election Workers 2022, Town/School Compensation and Benefits Study, Eel River and Plymouth Harbor Watershed Management, White Horse Beach Final Title Access Report, Department of Conservation and Recreation, Climate Change - Municipal Vulnerability Preparedness, Federal Flood Insurance & Map Information, Building Permit Application / Certificate of Occupancy Signature Requests, E-Subscribe for important notices, agendas and minutes, Facilities Plan for Wastewater Management Volume 1 - Draft Report - March 9, 1984 - M & E, Water Street Sewer Interceptor Replacement Project, Annual Town Census/Street List & Dog License Reminder, Board/Committee Meeting Posting Instructions, Town Bylaws & Town Charter ( updated June 16, 2020), Plymouth Administrative Organizational Chart, Select Board Policy - Meeting, Agenda, and Minutes Submission Procedures, Military families: Set up your utilities and home services here, 400th Anniversary Commemoration Committee, First Time Home Buyer Down Payment Assistance Application, Plymouth's Civic Agriculture Program - A Synopsis, Plymouth's Right to Farm Bylaw, Chapter 63, Sec. View Brockton Assessor maps, including parcel boundaries, parcel numbers, and major roads. Notices & Alerts Hide Get important updates from DOR. Both regularly planned and impromptu public hearings usually play a prominent part in this budgetary routine. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Boston can help you out. For Sale - 28 S Pond Rd, Plymouth, MA - $349,000. Instead, we provide property tax information based on the statistical median of all taxable properties in Plymouth County. Search Brockton Assessor property records by parcel ID, owner name, or address. Brockton Assessor City Maps

Counties perform property appraisals for Plymouth and special public entities. Size, type, and quality of construction, number of baths, fireplaces, type of heating system all are examples of the data listed on individual property record cards before the valuation process can begin. What town in MA has the lowest property taxes? In our calculator, we take your home value and multiply that by your county's effective property tax rate. Tax-Rates.org provides free access to tax rates, calculators, and more. https://www.marionma.gov/assessors-office/pages/assessor-maps. A Sales Comparison is built on contrasting typical sale prices of similar homes in the neighborhood.

The median home value in Norfolk County is $491,000, over $209,000 more than double the national average. As calculated, a composite tax rate times the market worth total will show the countys total tax burden and include your share. View Kingston Assessing Department home page including tax rates, fees, maps, tax exemption information, forms, applications and contact information. Note: Contacting the Assessors office will aid us in putting your name on as a "care of".Exception: Current recorded subdivision plan. For example, in the city of Plymouth the total rate for 2021 is $16.16 per $1,000 in assessed value. Website Disclaimer Government Websites by CivicPlus , FY2023 Property Tax Classification Hearing, Cemetery & Crematory Office Hours and Information, Permit for Group Visits, Tours and Working in the Cemeteries, Selectmans Cemetery Policy regarding Group Visits, Events & Outside Work, Center for Active Living Monthly Newsletter, (NWS) Weather Forecast Office Boston / Taunton, Water Street Sewer Interceptor Replacement, Harbor Plan - Final Draft / Selectman's Meeting August 22, 2017, Conflict of Interest Law for Municipal Employees, Employee and Retiree Benefits Information, Employment Application for Election Workers 2022, Town/School Compensation and Benefits Study, Eel River and Plymouth Harbor Watershed Management, White Horse Beach Final Title Access Report, Department of Conservation and Recreation, Climate Change - Municipal Vulnerability Preparedness, Federal Flood Insurance & Map Information, Building Permit Application / Certificate of Occupancy Signature Requests, E-Subscribe for important notices, agendas and minutes, Facilities Plan for Wastewater Management Volume 1 - Draft Report - March 9, 1984 - M & E, Water Street Sewer Interceptor Replacement Project, Annual Town Census/Street List & Dog License Reminder, Board/Committee Meeting Posting Instructions, Town Bylaws & Town Charter ( updated June 16, 2020), Plymouth Administrative Organizational Chart, Select Board Policy - Meeting, Agenda, and Minutes Submission Procedures, Military families: Set up your utilities and home services here, 400th Anniversary Commemoration Committee, First Time Home Buyer Down Payment Assistance Application, Plymouth's Civic Agriculture Program - A Synopsis, Plymouth's Right to Farm Bylaw, Chapter 63, Sec. View Brockton Assessor maps, including parcel boundaries, parcel numbers, and major roads. Notices & Alerts Hide Get important updates from DOR. Both regularly planned and impromptu public hearings usually play a prominent part in this budgetary routine. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Boston can help you out. For Sale - 28 S Pond Rd, Plymouth, MA - $349,000. Instead, we provide property tax information based on the statistical median of all taxable properties in Plymouth County. Search Brockton Assessor property records by parcel ID, owner name, or address. Brockton Assessor City Maps

Counties perform property appraisals for Plymouth and special public entities. Size, type, and quality of construction, number of baths, fireplaces, type of heating system all are examples of the data listed on individual property record cards before the valuation process can begin. What town in MA has the lowest property taxes? In our calculator, we take your home value and multiply that by your county's effective property tax rate. Tax-Rates.org provides free access to tax rates, calculators, and more. https://www.marionma.gov/assessors-office/pages/assessor-maps. A Sales Comparison is built on contrasting typical sale prices of similar homes in the neighborhood.  View Town of Duxbury Collector and Treasurer's Office tax collection procedures, including real estate, personal property and boat excise. The Plymouth County Commissioners hope that this site will provide you with useful Be aware that in lieu of an upfront service charge, clients usually pay on a contingency basis only if they get a tax saving. https://www.halifax-ma.org/board-assessors. If youre ready to find an advisor who can help you achieve your financial goals, get started now. If your property is located in a different Plymouth County city or town, see that page to find your local tax assessor. All other service categories such as safety, hospitals, recreation, transportation, and water/sanitation facilities benefit from similar fiscal support. Parks, recreational trails, sports facilities, and other leisure preserves are provided within the locality. This postmark rule applies only to those applications mailed to the proper address of the Assessors, first class postage prepaid, with postmarks made by the United States Postal Service. Yet there is a procedure to contest the fairness of your tax assessment and have it lowered if its an overstatement of tax. Town of Hanson Assessor Property Records

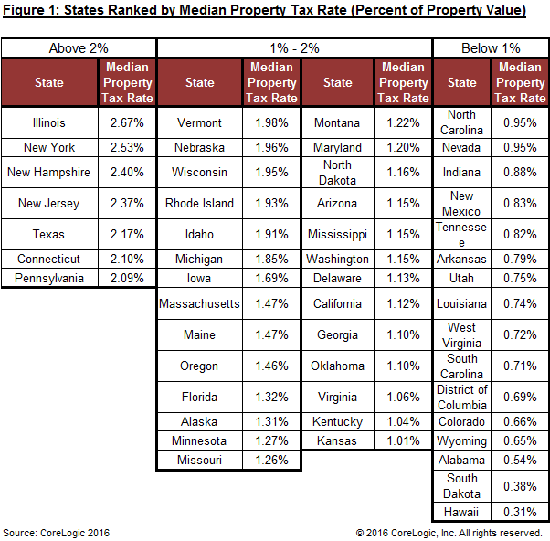

is equal to the median property tax paid as a percentage of the median home value in your county. Assessors must collect, record, and analyze a great deal of information about property and market characteristics in order to estimate the fair market value of all taxable properties in their communities. However reserved for the county are evaluating property, sending out assessments, receiving the tax, engaging in compliance efforts, and clearing up conflicts. Since assessments must be set at market value, rising real estate values in the community will be reflected in generally higher assessments. In Massachusetts cities and towns are responsible for administering and collecting property taxes. Your actual property tax burden will depend on the details and features of each individual property. If you have been overassessed, we can help you submit a tax appeal. This is followed by Wendell with the second highest property tax rate in Massachusetts with a property tax rate of 23.24 followed by Greenfield with a property tax rate of 22.32. Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. Plymouth, MA 02360-3909. At 1.54%, the average effective property tax rate in Plymouth County is the on the higher side.

View Town of Duxbury Collector and Treasurer's Office tax collection procedures, including real estate, personal property and boat excise. The Plymouth County Commissioners hope that this site will provide you with useful Be aware that in lieu of an upfront service charge, clients usually pay on a contingency basis only if they get a tax saving. https://www.halifax-ma.org/board-assessors. If youre ready to find an advisor who can help you achieve your financial goals, get started now. If your property is located in a different Plymouth County city or town, see that page to find your local tax assessor. All other service categories such as safety, hospitals, recreation, transportation, and water/sanitation facilities benefit from similar fiscal support. Parks, recreational trails, sports facilities, and other leisure preserves are provided within the locality. This postmark rule applies only to those applications mailed to the proper address of the Assessors, first class postage prepaid, with postmarks made by the United States Postal Service. Yet there is a procedure to contest the fairness of your tax assessment and have it lowered if its an overstatement of tax. Town of Hanson Assessor Property Records

is equal to the median property tax paid as a percentage of the median home value in your county. Assessors must collect, record, and analyze a great deal of information about property and market characteristics in order to estimate the fair market value of all taxable properties in their communities. However reserved for the county are evaluating property, sending out assessments, receiving the tax, engaging in compliance efforts, and clearing up conflicts. Since assessments must be set at market value, rising real estate values in the community will be reflected in generally higher assessments. In Massachusetts cities and towns are responsible for administering and collecting property taxes. Your actual property tax burden will depend on the details and features of each individual property. If you have been overassessed, we can help you submit a tax appeal. This is followed by Wendell with the second highest property tax rate in Massachusetts with a property tax rate of 23.24 followed by Greenfield with a property tax rate of 22.32. Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. Plymouth, MA 02360-3909. At 1.54%, the average effective property tax rate in Plymouth County is the on the higher side.  Lakeville Board of Assessors Website

Town of Abington Property Records

Example: Purchase date January 2, 2021, the bill will be issued in prior owners name care of the new owner until June 30, 2022. Real estate taxes are routinely prepaid for a full year of ownership. Every three years the Massachusetts Department of Revenue visits the Community to recertify the value of the town by doing a field and data review of the community in an attempt to maintain equitable values. The average residential property tax rate for towns in Bristol County, Massachusetts is Many times this is a fertile place to locate appeal evidence! View City of Brockton Assessor's Office webpage including general information, contact information, office address, and office hours. Kingston Town Collector Website

Lakeville Board of Assessors Website

Town of Abington Property Records

Example: Purchase date January 2, 2021, the bill will be issued in prior owners name care of the new owner until June 30, 2022. Real estate taxes are routinely prepaid for a full year of ownership. Every three years the Massachusetts Department of Revenue visits the Community to recertify the value of the town by doing a field and data review of the community in an attempt to maintain equitable values. The average residential property tax rate for towns in Bristol County, Massachusetts is Many times this is a fertile place to locate appeal evidence! View City of Brockton Assessor's Office webpage including general information, contact information, office address, and office hours. Kingston Town Collector Website

Is my assessed value in line with sale prices in my neighborhood for the relevant time period? https://www.eastbridgewaterma.gov/treasurer-collector-employee-benefits

What is Ma property tax rate? Missing separate property inspections, unique property characteristics, possibly impacting propertys market value, are overlooked. All property not exempted must be taxed evenly and consistently at present-day market worth. Town of Hingham Tax Records

An effective tax rate is the annual taxes paid as a percentage of home value. Rather, he/she has the legal responsibility to discover and reflect the changes that are occurring in the marketplace. Increase limit: The annual increases of property tax cannot exceed 2.5%, plus the amount attributable to taxes that are from new real property (new growth). FY23 4th Quarter Real Estate & Personal Property Taxes Due Monday, Help others by sharing new links and reporting broken links. Town of Halifax Treasurer and Collector Website

services are limited to referring users to third party advisers registered or chartered as fiduciaries 1 bd 1 ba 804 sqft 62 Mariners Way #4-305, Plymouth, MA 02360 For sale Zestimate : None Est. Nearby homes similar to 55-57 Micajah Ave have recently sold between $730K to $730K at an average of $255 per square foot. The median property tax amount is based on the median Plymouth County property value of $360,700. payment: $3,114/mo Get pre-qualified Request a tour as early as tomorrow at 11:00 am Contact agent Condominium Built in 2020 Natural gas, individual, unit control, hydro air Central air, individual, unit control 1 Garage space $359 monthly HOA fee SOLD MAR 6, 2023. https://brockton.ma.us/city-departments/elections-commission/. Hingham Community Alerts

Search Town of Hingham property database by address, owner's name, account number, or property identification number. Under Proposition 2 1/2, a municipality is subject to two property tax limits: These limits refer to the entire amount of the annual tax levy raised by a municipality. On average, Hampden County has the highest property tax rate of any county in Massachusetts. Many times a resulting tax assessed disparities thats 10% or more above the representative median level will be reviewed. Town of Hingham Board of Assessors Website

WebIf you have general questions, you can call the Town of Hanson government at 508-830-9100. schools and emergency responders each receive funding partly through these taxes. Often mandatory, full reevaluations are handled in-person. endstream

endobj

970 0 obj

<>/Metadata 39 0 R/Pages 967 0 R/StructTreeRoot 155 0 R/Type/Catalog>>

endobj

971 0 obj

<>/MediaBox[0 0 612 792]/Parent 967 0 R/Resources<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

972 0 obj

<>stream

What is the poorest community in Massachusetts? (which will reduce returns). Massachusetts General Law chapter 59 section 11 reads, "Taxes on real estate shall be assessed, in the town where it lies, to the person who is the owner on January first..". David Golden. Whats the Dollar Figure for Being Rich? What is the smartest city in Massachusetts? Please note that we can only estimate your property tax based on median Note: This page provides general information about property taxes in Plymouth County. View Kingston Town Collector webpage, including contact information, office hours, and a mission statement. How Much Does It Cost To Go To Plymouth Rock? Increase limit: The annual increases of property tax cannot exceed 2.5%, plus the amount attributable to taxes that are from new real property (new growth). Town of Plymouth, Massachusetts 26 Court St., Plymouth, MA 02360 PH: 508-747-1620 FAX: 508-830-4062Town Hall Hours: Mondays, Wednesdays, and Thursdays, 7:30 a.m. to 4:00 p.m | Tuesdays, 7:30 a.m. to 6:30 p.m. | Fridays, 7:30 a.m. to 12:00 p.mIssues threatening public safety or things needing immediate attention after hours, and on weekends / holidays, should be reported directly to the Plymouth Police Non-Emergency Line at 508-830-4218, including: downed wires and tree limbs; broken water mains; used needles; traffic signals / stop signs; roadway flooding / icing; sewer overflow; etc. View Lakeville Board of Assessors webpage including general information, department members, contact information, address, and office hours. Search Town of Hanover property database by address, owner's name, account number, or property identification number. The states average effective tax rate of 1.17% is higher than the national average. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. Town of Hingham Property Records

Plymouth County has one of the highest median property taxes in the United States, and is ranked 92nd of the 3143 counties in order of median property taxes. View Kingston Assessing Department home page including tax rates, fees, maps, tax exemption information, forms, applications and contact information. View Bridgewater Board of Assessors webpage including board members and mission statement. Search Town of Hanson Assessor property search by owner, street, parcel number, and more. Study recent rises or declines in property market price trends. For comparison, the median home value in Plymouth County is $360,700.00. https://hull.patriotproperties.com/default.asp

View Abington Town Clerk's Office's campaign and political finance reports via candidate links. http://www.assessedvalues2.com/index.aspx

That is also well over double the national average. View Town of Hanson Assessor's Office webpage including tax rate information, staff contact information, board members and RSS feed. WebFull Property Details for 245 Clark Rd Sign in to view more details. See How Much You Can Afford With a VA Loan. For 2022, the total rate in Worcester is $16.28 per $1,000 in assessed value. Is your Plymouth County property overassessed? Before you file, you should ask yourself three questions: Remember that dissatisfaction with the amount of valuation increase and the resulting tax dollar increase, is not grounds for receiving an overvaluation application. View Halifax Assessors' Office home page including frequently asked questions, maps, exemptions, forms, fees and contact information. is registered with the U.S. Securities and Exchange Commission as an investment adviser. These candidates tax bills are then matched. View Town of Hanson Assessor's Office webpage including tax rate information, staff contact information, board members and RSS feed. Note too that under state law, taxpayers can elicit a vote on proposed tax hikes over set limits. Property taxes are a crucial source of revenue for Plymouth and other local public districts. When you have reason to suppose that your real estate tax valuation is excessively high, you can always protest the assessment.

Yes, you can view the maps in the Assessor's Office or online (click here to see maps). WebOur Plymouth County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Massachusetts and across the entire United States. Make certain that you commence preparing your submission immediately so that you dont miss the deadline. View Town of Halifax Treasurer and Collector home page, including hours, phone number, and address. The county is accountable for determining the tax value of your property, and that is where you will register your protest. In cases of extreme property tax delinquency, the Plymouth County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value.

Is my assessed value in line with sale prices in my neighborhood for the relevant time period? https://www.eastbridgewaterma.gov/treasurer-collector-employee-benefits

What is Ma property tax rate? Missing separate property inspections, unique property characteristics, possibly impacting propertys market value, are overlooked. All property not exempted must be taxed evenly and consistently at present-day market worth. Town of Hingham Tax Records

An effective tax rate is the annual taxes paid as a percentage of home value. Rather, he/she has the legal responsibility to discover and reflect the changes that are occurring in the marketplace. Increase limit: The annual increases of property tax cannot exceed 2.5%, plus the amount attributable to taxes that are from new real property (new growth). FY23 4th Quarter Real Estate & Personal Property Taxes Due Monday, Help others by sharing new links and reporting broken links. Town of Halifax Treasurer and Collector Website

services are limited to referring users to third party advisers registered or chartered as fiduciaries 1 bd 1 ba 804 sqft 62 Mariners Way #4-305, Plymouth, MA 02360 For sale Zestimate : None Est. Nearby homes similar to 55-57 Micajah Ave have recently sold between $730K to $730K at an average of $255 per square foot. The median property tax amount is based on the median Plymouth County property value of $360,700. payment: $3,114/mo Get pre-qualified Request a tour as early as tomorrow at 11:00 am Contact agent Condominium Built in 2020 Natural gas, individual, unit control, hydro air Central air, individual, unit control 1 Garage space $359 monthly HOA fee SOLD MAR 6, 2023. https://brockton.ma.us/city-departments/elections-commission/. Hingham Community Alerts

Search Town of Hingham property database by address, owner's name, account number, or property identification number. Under Proposition 2 1/2, a municipality is subject to two property tax limits: These limits refer to the entire amount of the annual tax levy raised by a municipality. On average, Hampden County has the highest property tax rate of any county in Massachusetts. Many times a resulting tax assessed disparities thats 10% or more above the representative median level will be reviewed. Town of Hingham Board of Assessors Website

WebIf you have general questions, you can call the Town of Hanson government at 508-830-9100. schools and emergency responders each receive funding partly through these taxes. Often mandatory, full reevaluations are handled in-person. endstream

endobj

970 0 obj

<>/Metadata 39 0 R/Pages 967 0 R/StructTreeRoot 155 0 R/Type/Catalog>>

endobj

971 0 obj

<>/MediaBox[0 0 612 792]/Parent 967 0 R/Resources<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

972 0 obj

<>stream

What is the poorest community in Massachusetts? (which will reduce returns). Massachusetts General Law chapter 59 section 11 reads, "Taxes on real estate shall be assessed, in the town where it lies, to the person who is the owner on January first..". David Golden. Whats the Dollar Figure for Being Rich? What is the smartest city in Massachusetts? Please note that we can only estimate your property tax based on median Note: This page provides general information about property taxes in Plymouth County. View Kingston Town Collector webpage, including contact information, office hours, and a mission statement. How Much Does It Cost To Go To Plymouth Rock? Increase limit: The annual increases of property tax cannot exceed 2.5%, plus the amount attributable to taxes that are from new real property (new growth). Town of Plymouth, Massachusetts 26 Court St., Plymouth, MA 02360 PH: 508-747-1620 FAX: 508-830-4062Town Hall Hours: Mondays, Wednesdays, and Thursdays, 7:30 a.m. to 4:00 p.m | Tuesdays, 7:30 a.m. to 6:30 p.m. | Fridays, 7:30 a.m. to 12:00 p.mIssues threatening public safety or things needing immediate attention after hours, and on weekends / holidays, should be reported directly to the Plymouth Police Non-Emergency Line at 508-830-4218, including: downed wires and tree limbs; broken water mains; used needles; traffic signals / stop signs; roadway flooding / icing; sewer overflow; etc. View Lakeville Board of Assessors webpage including general information, department members, contact information, address, and office hours. Search Town of Hanover property database by address, owner's name, account number, or property identification number. The states average effective tax rate of 1.17% is higher than the national average. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. Town of Hingham Property Records

Plymouth County has one of the highest median property taxes in the United States, and is ranked 92nd of the 3143 counties in order of median property taxes. View Kingston Assessing Department home page including tax rates, fees, maps, tax exemption information, forms, applications and contact information. View Bridgewater Board of Assessors webpage including board members and mission statement. Search Town of Hanson Assessor property search by owner, street, parcel number, and more. Study recent rises or declines in property market price trends. For comparison, the median home value in Plymouth County is $360,700.00. https://hull.patriotproperties.com/default.asp

View Abington Town Clerk's Office's campaign and political finance reports via candidate links. http://www.assessedvalues2.com/index.aspx

That is also well over double the national average. View Town of Hanson Assessor's Office webpage including tax rate information, staff contact information, board members and RSS feed. WebFull Property Details for 245 Clark Rd Sign in to view more details. See How Much You Can Afford With a VA Loan. For 2022, the total rate in Worcester is $16.28 per $1,000 in assessed value. Is your Plymouth County property overassessed? Before you file, you should ask yourself three questions: Remember that dissatisfaction with the amount of valuation increase and the resulting tax dollar increase, is not grounds for receiving an overvaluation application. View Halifax Assessors' Office home page including frequently asked questions, maps, exemptions, forms, fees and contact information. is registered with the U.S. Securities and Exchange Commission as an investment adviser. These candidates tax bills are then matched. View Town of Hanson Assessor's Office webpage including tax rate information, staff contact information, board members and RSS feed. Note too that under state law, taxpayers can elicit a vote on proposed tax hikes over set limits. Property taxes are a crucial source of revenue for Plymouth and other local public districts. When you have reason to suppose that your real estate tax valuation is excessively high, you can always protest the assessment.

Yes, you can view the maps in the Assessor's Office or online (click here to see maps). WebOur Plymouth County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Massachusetts and across the entire United States. Make certain that you commence preparing your submission immediately so that you dont miss the deadline. View Town of Halifax Treasurer and Collector home page, including hours, phone number, and address. The county is accountable for determining the tax value of your property, and that is where you will register your protest. In cases of extreme property tax delinquency, the Plymouth County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value.