what are the irmaa brackets for 2022gail o'grady spouse

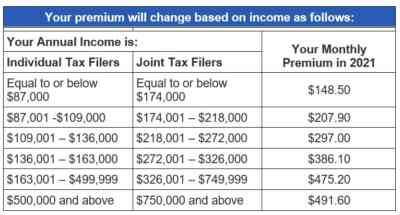

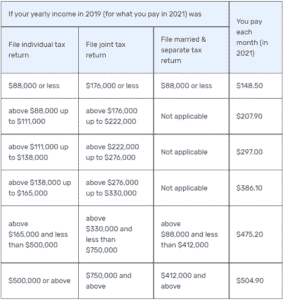

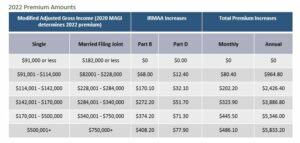

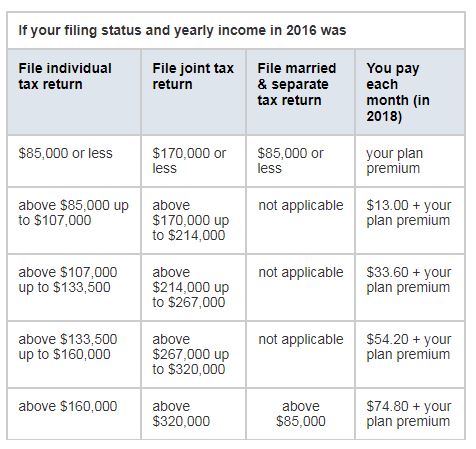

Your 2020 revenue determines your IRMAA in 2022.  Since 2020, the surcharge that is tacked onto Part B and Part D premiums for higher income earners is indexed to the Bureau of Labor Statistics' Consumer Price Index for Urban Consumers (CPI-U). Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more! He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result. For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 WebCalculate your federal or IRS Income Tax Rate by tax bracket and tax year. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. In other words, for your 2022 Medicare premiums, your 2020 income tax return is used. Ideally, you work around the definite pieces of income (social security, pensions, required minimum distributions) and use other sources (such as Roth and brokerage) to stay as low as reasonably possible when it comes to IRMAA surcharges. IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some peoples Medicare premiums. A retirement planner can help you determine how much you can convert to a Roth without jumping up to a higher IRMAA tier. Weve got one knowledge level out of 12 as of proper now for what the IRMAA brackets might be in 2024 (primarily based on 2022 revenue). If inflation is 0% from September 2022 by way of August 2023, these would be the 2024 numbers: If inflation is constructive, the IRMAA brackets for 2024 could also be greater than these. I have been struggling with IRMAA since it was introduced during the Bush Administration. In 2022, the standard monthly premium for Part B is $170.10.Depending on your yearly income, you may have an additional IRMAA surcharge. I did Roth conversions for the 2020 tax year for the first time and got dangerously close to triggering an IRMAA surcharge but ended up OK. For Part D, 4.5 million beneficiaries are subject to IRMAAs this year and an estimated 5.8 million will pay the surcharge in 2023. WebAccording to the Tax Foundation, the tax brackets for 2023 are: 10% for: Single filers earning $0-$11,000 Married filing jointly earning $0-$22,000 Heads of Households earning $0-$15,700 12% for: Single filers earning $11,000-$44,725 Married filing jointly earning $22,000-$89,450 Heads of Households earning $15,700-$59,850 22% for: As a result of the components compares the common of 12 month-to-month CPI numbers over the common of 12 month-to-month CPI numbers in a base interval, even when inflation is 0% within the following months, the common of the subsequent 12 months will nonetheless be greater than the common within the earlier 12 months. The community is moderated to ensure a pleasant experience for our members. Most Social Security beneficiaries are protected by the Hold Harmless Act, which prevents a net decline in Social Security benefits from one year to the next. Learn how your comment data is processed. The average premium for 2022 is $31.47. Before After Are you legally blind ? Here are five things you should know about. The standard premium for Medicare Part B in 2022 is If fewer people are paying the IRMAA for their Part B premiums or if they are paying a lower rate than they would have otherwise Medicares trust fund will receive less funding from IRMAA payments. I manage my IRA withdrawals to get as close to the tier limits as I dare but now that the tiers are being increased every year there is always going to be a miss where I get to declare less earnings than I might have wished. "Often we see beneficiaries get a bill for the standard premium just after the Part B enrollment, and then they get a second bill weeks later with the addition of the IRMAA," said Danielle Roberts, co-founder of insurance firm Boomer Benefits. Youll receive a notice from the Social Security Administration if youre being assessed IRMAA. Whats really confusing is that IRMAA is determined based on your income from two years earlier. Medicare additionally hasnt introduced the 2023 normal Half B premium but. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 1 Cubanski, Juliette; Damico, Anthony. Still it is far better to underestimate than ever to overestimate. KPE. AGENTS, IF YOU NEED A SCOPE OF APPOINTMENT, CLICK THIS LINK. By Julie Virta, CFP, CFA, CTFA As with income tax rates, capital gains rates will not change for 2021, but the brackets for the rates will change. The focus of the discussions is on topics related to early retirement and financial independence. The IRMAA increase for Part B starts at incomes above $88,000 for single filers and $176,000 for joint filers. IRMAA surcharges impact Medicare Part B and Part D premiums. It sounds odd, since delayed retirement credits stop accumulating at age 70, but intentional late filing for benefits can shift income into the next tax year. Part D: $983.76 annually on a national average. Copyright 2022 Dineropost.com | All Rights Reserved. All other Medicare Part D beneficiaries earning over $91,000 individually or The 2022 Part B total premiums for high-income beneficiaries are below in the 2022 Medicare IRMAA Brackets table. You have successfully joined our subscriber list. Medicare imposes surcharges on higher-income beneficiaries. We make no representation as to the completeness or accuracy of information provided at these websites. The chart below compares the current rates and income brackets through 2025 (in black) to the rates and income brackets that will go into effect on January 1, 2026 (in red). Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Your 2022 revenue determines your IRMAA in 2024. For those who havent and are getting closer to Medicare eligibility (age 65 is the earliest unless you have a disabling medical condition), its worth your while to pay attention. As for Part D IRMAAs, beneficiaries will pay $12.40 to $77.90 per month in addition to their plans premium, depending on their income. By Sara Stanich, CFP, CDFA, CEPA Medicare recipients with 2021 incomes exceeding $97,000 IRMAA charges affect Keep an eye on Social Security's announcement of the 2022 costs for Part B/D, coming, eh, soon. Click Here, We do not offer every plan available in your area. Hospital Indemnity plans help fill the gaps. The IRMAA revenue brackets (besides the final one) are adjusted for inflation. It will be tough if the tiers are ever reduced from one year to another forcing a miss. Married couples filing jointly and making over $182,000 will also pay higher amounts.

Since 2020, the surcharge that is tacked onto Part B and Part D premiums for higher income earners is indexed to the Bureau of Labor Statistics' Consumer Price Index for Urban Consumers (CPI-U). Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more! He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result. For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 WebCalculate your federal or IRS Income Tax Rate by tax bracket and tax year. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. In other words, for your 2022 Medicare premiums, your 2020 income tax return is used. Ideally, you work around the definite pieces of income (social security, pensions, required minimum distributions) and use other sources (such as Roth and brokerage) to stay as low as reasonably possible when it comes to IRMAA surcharges. IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some peoples Medicare premiums. A retirement planner can help you determine how much you can convert to a Roth without jumping up to a higher IRMAA tier. Weve got one knowledge level out of 12 as of proper now for what the IRMAA brackets might be in 2024 (primarily based on 2022 revenue). If inflation is 0% from September 2022 by way of August 2023, these would be the 2024 numbers: If inflation is constructive, the IRMAA brackets for 2024 could also be greater than these. I have been struggling with IRMAA since it was introduced during the Bush Administration. In 2022, the standard monthly premium for Part B is $170.10.Depending on your yearly income, you may have an additional IRMAA surcharge. I did Roth conversions for the 2020 tax year for the first time and got dangerously close to triggering an IRMAA surcharge but ended up OK. For Part D, 4.5 million beneficiaries are subject to IRMAAs this year and an estimated 5.8 million will pay the surcharge in 2023. WebAccording to the Tax Foundation, the tax brackets for 2023 are: 10% for: Single filers earning $0-$11,000 Married filing jointly earning $0-$22,000 Heads of Households earning $0-$15,700 12% for: Single filers earning $11,000-$44,725 Married filing jointly earning $22,000-$89,450 Heads of Households earning $15,700-$59,850 22% for: As a result of the components compares the common of 12 month-to-month CPI numbers over the common of 12 month-to-month CPI numbers in a base interval, even when inflation is 0% within the following months, the common of the subsequent 12 months will nonetheless be greater than the common within the earlier 12 months. The community is moderated to ensure a pleasant experience for our members. Most Social Security beneficiaries are protected by the Hold Harmless Act, which prevents a net decline in Social Security benefits from one year to the next. Learn how your comment data is processed. The average premium for 2022 is $31.47. Before After Are you legally blind ? Here are five things you should know about. The standard premium for Medicare Part B in 2022 is If fewer people are paying the IRMAA for their Part B premiums or if they are paying a lower rate than they would have otherwise Medicares trust fund will receive less funding from IRMAA payments. I manage my IRA withdrawals to get as close to the tier limits as I dare but now that the tiers are being increased every year there is always going to be a miss where I get to declare less earnings than I might have wished. "Often we see beneficiaries get a bill for the standard premium just after the Part B enrollment, and then they get a second bill weeks later with the addition of the IRMAA," said Danielle Roberts, co-founder of insurance firm Boomer Benefits. Youll receive a notice from the Social Security Administration if youre being assessed IRMAA. Whats really confusing is that IRMAA is determined based on your income from two years earlier. Medicare additionally hasnt introduced the 2023 normal Half B premium but. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 1 Cubanski, Juliette; Damico, Anthony. Still it is far better to underestimate than ever to overestimate. KPE. AGENTS, IF YOU NEED A SCOPE OF APPOINTMENT, CLICK THIS LINK. By Julie Virta, CFP, CFA, CTFA As with income tax rates, capital gains rates will not change for 2021, but the brackets for the rates will change. The focus of the discussions is on topics related to early retirement and financial independence. The IRMAA increase for Part B starts at incomes above $88,000 for single filers and $176,000 for joint filers. IRMAA surcharges impact Medicare Part B and Part D premiums. It sounds odd, since delayed retirement credits stop accumulating at age 70, but intentional late filing for benefits can shift income into the next tax year. Part D: $983.76 annually on a national average. Copyright 2022 Dineropost.com | All Rights Reserved. All other Medicare Part D beneficiaries earning over $91,000 individually or The 2022 Part B total premiums for high-income beneficiaries are below in the 2022 Medicare IRMAA Brackets table. You have successfully joined our subscriber list. Medicare imposes surcharges on higher-income beneficiaries. We make no representation as to the completeness or accuracy of information provided at these websites. The chart below compares the current rates and income brackets through 2025 (in black) to the rates and income brackets that will go into effect on January 1, 2026 (in red). Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Your 2022 revenue determines your IRMAA in 2024. For those who havent and are getting closer to Medicare eligibility (age 65 is the earliest unless you have a disabling medical condition), its worth your while to pay attention. As for Part D IRMAAs, beneficiaries will pay $12.40 to $77.90 per month in addition to their plans premium, depending on their income. By Sara Stanich, CFP, CDFA, CEPA Medicare recipients with 2021 incomes exceeding $97,000 IRMAA charges affect Keep an eye on Social Security's announcement of the 2022 costs for Part B/D, coming, eh, soon. Click Here, We do not offer every plan available in your area. Hospital Indemnity plans help fill the gaps. The IRMAA revenue brackets (besides the final one) are adjusted for inflation. It will be tough if the tiers are ever reduced from one year to another forcing a miss. Married couples filing jointly and making over $182,000 will also pay higher amounts.  The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. For married couples filing joint tax returns, the surcharges start above $182,000. Learn more about reprints and licensing for this article. Within the grand scheme, when a pair on Medicare has over $194,000 in revenue, theyre already paying a big quantity in taxes. 2022 Medicare IRMAA Brackets: Medicare Part B Income-Related Monthly Adjustment Amounts Since 2007, a beneficiarys Part B monthly premium is based on How to Use MyMedicare.gov to Manage Your Medicare Benefits, Medicare & You 2020 | Your Medicare Handbook, 2023 Medicare Open Enrollment Period Dates | MedicareAdvantage.com, What Do I Do If My Medicare Card Is Lost, Stolen Or Damaged? This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023, according to the latest Medicare trustees report. WebThe additional charge from the IRMAA is added to the insurance companys premium (but generally paid separately). We cannot make a new decision if your income has changed for a reason other than those listed above, such a receiving one-time income from capital gains, the notification letter says.

The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. For married couples filing joint tax returns, the surcharges start above $182,000. Learn more about reprints and licensing for this article. Within the grand scheme, when a pair on Medicare has over $194,000 in revenue, theyre already paying a big quantity in taxes. 2022 Medicare IRMAA Brackets: Medicare Part B Income-Related Monthly Adjustment Amounts Since 2007, a beneficiarys Part B monthly premium is based on How to Use MyMedicare.gov to Manage Your Medicare Benefits, Medicare & You 2020 | Your Medicare Handbook, 2023 Medicare Open Enrollment Period Dates | MedicareAdvantage.com, What Do I Do If My Medicare Card Is Lost, Stolen Or Damaged? This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023, according to the latest Medicare trustees report. WebThe additional charge from the IRMAA is added to the insurance companys premium (but generally paid separately). We cannot make a new decision if your income has changed for a reason other than those listed above, such a receiving one-time income from capital gains, the notification letter says.  YOUR LINK WAS FIRST IN MY SEARCH SO I HOPE YOU CORRECT THESE ERRORS QUICKLY. the 2022 IRMAA thresholds aren't published until Nov/Dec 2021, long after our 2020 MAGI is cast in stone. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com.

YOUR LINK WAS FIRST IN MY SEARCH SO I HOPE YOU CORRECT THESE ERRORS QUICKLY. the 2022 IRMAA thresholds aren't published until Nov/Dec 2021, long after our 2020 MAGI is cast in stone. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com.  Fresh blogs, financial reminders, and upcoming events delivered to your inbox monthly. Published 5 April 23. Its not the top of the world to pay IRMAA for one yr. Profit and prosper with the best of expert advice - straight to your e-mail. Ive seen companies fully cover the premium for an employee to self-employed clients funding the cost for the entire family. So, if your client reports a higher MAGI in 2020, they will face the surcharge once the IRMAA brackets are released. 23 0 obj

<>

endobj

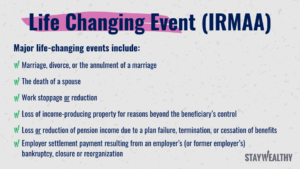

The common of those 12 numbers is about 150. By Kelley R. Taylor Creative Financial Group is a separate unaffiliated company. This early retirement and financial independence community is a member of the Social Knowledge network, a group of high quality forum communities. GlicRX offers deep discounts and offers broker compensation. * The final bracket on the far proper isnt displayed within the chart. Can I 1031 into a Qualified Opportunity Zone? 2 This means your premiums will be influenced by the years you were receiving a full wage in a year that youre retired. This amount is $148.50 in 2021. The required form has a list of "life-changing" events that qualify as reasons for reducing or eliminating the IRMAAs, including marriage, death of a spouse, divorce, loss of pension or the fact that you stopped working or reduced your hours.

Fresh blogs, financial reminders, and upcoming events delivered to your inbox monthly. Published 5 April 23. Its not the top of the world to pay IRMAA for one yr. Profit and prosper with the best of expert advice - straight to your e-mail. Ive seen companies fully cover the premium for an employee to self-employed clients funding the cost for the entire family. So, if your client reports a higher MAGI in 2020, they will face the surcharge once the IRMAA brackets are released. 23 0 obj

<>

endobj

The common of those 12 numbers is about 150. By Kelley R. Taylor Creative Financial Group is a separate unaffiliated company. This early retirement and financial independence community is a member of the Social Knowledge network, a group of high quality forum communities. GlicRX offers deep discounts and offers broker compensation. * The final bracket on the far proper isnt displayed within the chart. Can I 1031 into a Qualified Opportunity Zone? 2 This means your premiums will be influenced by the years you were receiving a full wage in a year that youre retired. This amount is $148.50 in 2021. The required form has a list of "life-changing" events that qualify as reasons for reducing or eliminating the IRMAAs, including marriage, death of a spouse, divorce, loss of pension or the fact that you stopped working or reduced your hours.  Global Business and Financial News, Stock Quotes, and Market Data and Analysis. When you sign up for each part of Medicare matters, as one man's recently publicized issue shows. Your 2022 revenue determines your IRMAA in 2024. As of December 2020, we only have three data points out of 12 to calculate the brackets for 2022. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier(s). Understanding Your Taxes Now. Any information we provide is limited to those plans we do offer in your area. Those premiums can vary among plans. Copyright 2022 Credireview.com | All Rights Reserved. In case your revenue two years in the past was greater since you had been working at the moment and now your revenue is considerably decrease since you retired (work discount or work stoppage), youll be able to attraction the IRMAA evaluation. But if that individual is subject to the first IRMAA surcharge bracket, the $177 COLA increase would be more than offset by the combined Medicare Part B premium and IRMAA surcharge, which would total $238.10 per month next year. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). For California residents, CA-Do Not Sell My Personal Info, Click here. Married couples where both spouses are enrolled in Medicare pay twice that amount. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. The 2022 income-related monthly adjustment amount only applies to those whose2020 modified adjusted gross income was: Greater than $91,000 (if youre single and file an individual tax return) Greater than $182,000 (if you're married and file jointly) Published 4 April 23. Your email address will not be published. Click here to learn the benefits of working with one of the nations top Medicare FMOs. Kaiser Family Foundation. The income that makes a beneficiary subject to the IRMAA is based on the modified adjusted gross income reported on their taxes from two years prior. Your 2020 revenue determines your IRMAA in 2022. This is how it works.

Your jumping over mouse hills. Brian Quick is a senior partner and financial adviser for Creative Financial Group (opens in new tab).

Global Business and Financial News, Stock Quotes, and Market Data and Analysis. When you sign up for each part of Medicare matters, as one man's recently publicized issue shows. Your 2022 revenue determines your IRMAA in 2024. As of December 2020, we only have three data points out of 12 to calculate the brackets for 2022. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier(s). Understanding Your Taxes Now. Any information we provide is limited to those plans we do offer in your area. Those premiums can vary among plans. Copyright 2022 Credireview.com | All Rights Reserved. In case your revenue two years in the past was greater since you had been working at the moment and now your revenue is considerably decrease since you retired (work discount or work stoppage), youll be able to attraction the IRMAA evaluation. But if that individual is subject to the first IRMAA surcharge bracket, the $177 COLA increase would be more than offset by the combined Medicare Part B premium and IRMAA surcharge, which would total $238.10 per month next year. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). For California residents, CA-Do Not Sell My Personal Info, Click here. Married couples where both spouses are enrolled in Medicare pay twice that amount. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. The 2022 income-related monthly adjustment amount only applies to those whose2020 modified adjusted gross income was: Greater than $91,000 (if youre single and file an individual tax return) Greater than $182,000 (if you're married and file jointly) Published 4 April 23. Your email address will not be published. Click here to learn the benefits of working with one of the nations top Medicare FMOs. Kaiser Family Foundation. The income that makes a beneficiary subject to the IRMAA is based on the modified adjusted gross income reported on their taxes from two years prior. Your 2020 revenue determines your IRMAA in 2022. This is how it works.

Your jumping over mouse hills. Brian Quick is a senior partner and financial adviser for Creative Financial Group (opens in new tab).  Assume an individual receives $3,000 per month in gross Social Security benefits in 2021.

Assume an individual receives $3,000 per month in gross Social Security benefits in 2021.  The top marginal income The common for the subsequent 12 months is 200. @9d*R[>-a\7.TEoq.&Pe>OEO8[x&)'M ~W=WLA'cEV6VHX`[atUay Wc K- b!*Pd=hO_\A'i. Capital Gains. For more details, review our Privacy Policy. By clicking "Sign me up! you are agreeing to receive emails from MedicareAdvantage.com. In case your greater revenue two years in the past was because of a one-time occasion, akin to realizing capital positive factors or taking a big withdrawal out of your IRA, when your revenue comes down within the following 12 months, your IRMAA may even come down mechanically. IRMAA brackets go off of Modified Adjusted Gross Income (MAGI) based on a recently filed return. Not only did Social Security benefits increase in 2023, but Medicare Part B premiums declined for the first time in more than a decade, resulting in larger net Social Security benefits for most retirees. 63 0 obj

<>stream

You are currently viewing our boards as a guest so you have limited access to our community. About 7% of Listed here are the IRMAA revenue brackets for 2022 protection. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. By Vincent Birardi, CFP, AIF, MBA Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? When the numbers cease going up, you will have 200, 200, 200, , 200. A Division of NBCUniversal. For extra info on the attraction, see Medicare Half B Premium Appeals. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. By Joelle Spear, CFP 2022 IRMAA Brackets for Medicare Premiums. Based on the Medicare Trustees Report, 8% of Medicare Half B and Half D beneficiaries paid IRMAA. This enrollment checklist flags important info you need to know. Consider These Five Ways, Social Security Optimization If You Save More Than $250,000, Self-Employed? An expense thats discussed as I prepare a financial plan is Medicare. Medicare imposes surcharges on higher-income beneficiaries. IRMAA is re-evaluated yearly as your revenue modifications. They will work to update their records with provided information which will directly correct or remove IRMAA surcharges. Best of all it's totally FREE! If inflation is 0% from October 2022 by means of August 2023, these would be the 2024 numbers: If inflation is optimistic, the IRMAA brackets for 2024 could also be greater than these. You'll get this notice if you have Medicare Part B and/or Part D and Social Security determines that any Income Related Monthly Adjustment Amounts (IRMAA) Its lower than 1% of their revenue however nickel-and-diming simply makes individuals mad. ), Related Topics: Readmore, Medicare beneficiaries who are also eligible for Medicaid are considered dual eligible. New York, So what about 2023 Income Numbers based on 2021 income? This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023. Your MAGI is then over $200,000, and two years later you get a notice that your IRMAA caused your Medicare Part B premium to increase from $340.20 a month to $544.50. The surcharge known as IRMAA, which stands for Revenue-Associated Month-to-month Adjustment Quantity. So it's as I thought, you can't plan to stay inside IRMAA thresholds as you won't know until the determining year is over - e.g. Copyright 2023 TZ Insurance Solutions LLC. If early on or throughout retirement you have life events like this pop-up, its worth either calling Social Security and/or filing the SSA-44 form. Here's what I am doing Its too early to project the income brackets for 2022 coverage. Yes No Filing Status Single Head of Household Married Filing Joint Married Filing Separate Qualifying Widow (er) Estimated Annual Income $ Seniors 65 or older can join Medicare. I understand why this is so and have no problem with the mechanics. 2023 Medicare IRMAA (Income-Related Monthly Adjustment Amount) amounts are increased premiums higher income earners must pay more for Medicare Get details here. When you link to any of the web sites provided here, you are leaving this website. QMB Program CT The QMB Program CT is an essential program available, Online Enrollment- Enroll prospects online without the need for a face to face appointment. For example, if you need to buy a $30,000 car, instead of pulling from an IRA that immediately adds the full amount to your income for the year, you could pull a mix from the IRA, Roth and brokerage toprevent tripping into avoidable IRMAA surcharge tiers. Sign up for free newsletters and get more CNBC delivered to your inbox. Growing up with a stockbroker father and lifelong teacher for a mother, he developed a love for the financial markets at an early age. Powered by vBulletin Version 3.8.8 Beta 1, Early Retirement & Financial Independence Community. There are five IRMAA income brackets depending on your income and filing status. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for use of the web sites you are visiting. Adopt good debt management habits now, and youll be much happier in the long run. The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. hb```` cbX00x8$

PX!$@4B-p30

c`002+bbUf.cd}V|SC\[/ \$

(Questions about new Social Security rules? Announced yesterday. I think you have to use current year levels until Nov/Dec when the 2022 levels are published. Finance. Since 2007, a beneficiarys Part B monthly premium is based on income. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. hm\7rJ0d+;6ck" ifSb0Y$O,3smvreBK..w Published 3 April 23. IRMAA Surcharges The income used to determine the IRMAA surcharge is the MAGI, or modified adjusted gross income, plus bond interest, from 2 years ago, meaning beneficiaries 2020 income will determine their IRMAA in 2022.

The top marginal income The common for the subsequent 12 months is 200. @9d*R[>-a\7.TEoq.&Pe>OEO8[x&)'M ~W=WLA'cEV6VHX`[atUay Wc K- b!*Pd=hO_\A'i. Capital Gains. For more details, review our Privacy Policy. By clicking "Sign me up! you are agreeing to receive emails from MedicareAdvantage.com. In case your greater revenue two years in the past was because of a one-time occasion, akin to realizing capital positive factors or taking a big withdrawal out of your IRA, when your revenue comes down within the following 12 months, your IRMAA may even come down mechanically. IRMAA brackets go off of Modified Adjusted Gross Income (MAGI) based on a recently filed return. Not only did Social Security benefits increase in 2023, but Medicare Part B premiums declined for the first time in more than a decade, resulting in larger net Social Security benefits for most retirees. 63 0 obj

<>stream

You are currently viewing our boards as a guest so you have limited access to our community. About 7% of Listed here are the IRMAA revenue brackets for 2022 protection. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. By Vincent Birardi, CFP, AIF, MBA Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? When the numbers cease going up, you will have 200, 200, 200, , 200. A Division of NBCUniversal. For extra info on the attraction, see Medicare Half B Premium Appeals. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. By Joelle Spear, CFP 2022 IRMAA Brackets for Medicare Premiums. Based on the Medicare Trustees Report, 8% of Medicare Half B and Half D beneficiaries paid IRMAA. This enrollment checklist flags important info you need to know. Consider These Five Ways, Social Security Optimization If You Save More Than $250,000, Self-Employed? An expense thats discussed as I prepare a financial plan is Medicare. Medicare imposes surcharges on higher-income beneficiaries. IRMAA is re-evaluated yearly as your revenue modifications. They will work to update their records with provided information which will directly correct or remove IRMAA surcharges. Best of all it's totally FREE! If inflation is 0% from October 2022 by means of August 2023, these would be the 2024 numbers: If inflation is optimistic, the IRMAA brackets for 2024 could also be greater than these. You'll get this notice if you have Medicare Part B and/or Part D and Social Security determines that any Income Related Monthly Adjustment Amounts (IRMAA) Its lower than 1% of their revenue however nickel-and-diming simply makes individuals mad. ), Related Topics: Readmore, Medicare beneficiaries who are also eligible for Medicaid are considered dual eligible. New York, So what about 2023 Income Numbers based on 2021 income? This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023. Your MAGI is then over $200,000, and two years later you get a notice that your IRMAA caused your Medicare Part B premium to increase from $340.20 a month to $544.50. The surcharge known as IRMAA, which stands for Revenue-Associated Month-to-month Adjustment Quantity. So it's as I thought, you can't plan to stay inside IRMAA thresholds as you won't know until the determining year is over - e.g. Copyright 2023 TZ Insurance Solutions LLC. If early on or throughout retirement you have life events like this pop-up, its worth either calling Social Security and/or filing the SSA-44 form. Here's what I am doing Its too early to project the income brackets for 2022 coverage. Yes No Filing Status Single Head of Household Married Filing Joint Married Filing Separate Qualifying Widow (er) Estimated Annual Income $ Seniors 65 or older can join Medicare. I understand why this is so and have no problem with the mechanics. 2023 Medicare IRMAA (Income-Related Monthly Adjustment Amount) amounts are increased premiums higher income earners must pay more for Medicare Get details here. When you link to any of the web sites provided here, you are leaving this website. QMB Program CT The QMB Program CT is an essential program available, Online Enrollment- Enroll prospects online without the need for a face to face appointment. For example, if you need to buy a $30,000 car, instead of pulling from an IRA that immediately adds the full amount to your income for the year, you could pull a mix from the IRA, Roth and brokerage toprevent tripping into avoidable IRMAA surcharge tiers. Sign up for free newsletters and get more CNBC delivered to your inbox. Growing up with a stockbroker father and lifelong teacher for a mother, he developed a love for the financial markets at an early age. Powered by vBulletin Version 3.8.8 Beta 1, Early Retirement & Financial Independence Community. There are five IRMAA income brackets depending on your income and filing status. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for use of the web sites you are visiting. Adopt good debt management habits now, and youll be much happier in the long run. The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. hb```` cbX00x8$

PX!$@4B-p30

c`002+bbUf.cd}V|SC\[/ \$

(Questions about new Social Security rules? Announced yesterday. I think you have to use current year levels until Nov/Dec when the 2022 levels are published. Finance. Since 2007, a beneficiarys Part B monthly premium is based on income. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. hm\7rJ0d+;6ck" ifSb0Y$O,3smvreBK..w Published 3 April 23. IRMAA Surcharges The income used to determine the IRMAA surcharge is the MAGI, or modified adjusted gross income, plus bond interest, from 2 years ago, meaning beneficiaries 2020 income will determine their IRMAA in 2022.  Published 2 April 23. Published 1 April 23. As an alternative of doing a 25:75 break up with the federal government, they need to pay the next share of this system prices. Your Medicare guide will arrive in your email inbox shortly. Medicare IRMAA is a monthly adjustment amount that higher income earners must pay more for Part B and D premiums. Published 5 April 23. Medicare hasnt revealed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the revealed inflation numbers. The difficulty, of course is predicting the levels two years ahead. ( In 2023, the threshold will be $97,000 for individuals filing a single return and married individuals filing a separate return, and $194,000 for married individuals filing a joint return.) Today were going to focus on theIncome-Related Monthly Adjustment Amount (IRMAA) surcharges that often blindside seniors on Medicare. Here are the brackets for 2022: He said JDARNELL its only a marginal change of $XX. CLICK HERE. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a The Medicare income-related monthly adjustment amount, or IRMAA, is a surcharge on Medicare premiums for Medicare Part B (medical insurance) and Part D prescription drug plans. But its not as simple as signing up for Medicare and having a set price. endstream

endobj

startxref

Readmore, This guide explains 2023 Medicare Open Enrollment and other Medicare enrollment periods. As a substitute of doing a 25:75 cut up with the federal government, they have to pay the next share of this system prices. Published 31 March 23. Use of editorial content without permission is strictly prohibited|All rights reserved, higher Medicare premiums and higher IRMAA surcharges, Insurance fintech adds long-term care products, DWS ESG fund launch sets record for sales, at another ETFs expense, United Capital veterans launch RIA aggregator with big goals, Goldman ordered to pay $3 million for mismarking short sales as long, ERISA lawsuit roundup: Court backs ADP (again), Mutual of America settles, $10.8 billion First Republic team bolts to Morgan Stanley, Guiding clients through market volatility and inflation. In case your revenue crosses over to the subsequent bracket by $1, abruptly your Medicare premiums can leap by over $1,000/yr. The federal government calls individuals who obtain Medicarebeneficiaries. And yes, I include it in almost all plans. A 40% surcharge on the Medicare Half B premium is about $800/12 months per particular person or about $1,600/12 months for a married couple each on Medicare. Many individuals who are subject to Medicare high-income surcharges are in for a nasty surprise next year: Their monthly Social Security benefits will decline from 2021 levels. If you are a single filer on your income tax return, the base premium for Part B of Medicare is $170.10 per month in 2022. During this same time Medicare is projecting that premiums, which come out of your Social Security benefit, will inflate by over 5.76%. If inflation in the upcoming months is negative enough, the brackets can go down. For 2022, IRMAAs kick in when that amount is more than $91,000 for individuals or $182,000 for married couples filing joint tax returns. The additional premiums they paid lowered the federal governments share of the overall Half B and Half D bills by two proportion factors. Because your tax return from two years earlier is used to determine whether you are subject to income-related adjustment amounts, new retirees may need to appeal those charges if your retirement income is lower than that. Securities offered through CFD Investments, Inc., registered broker-dealer, member FINRA & SIPC. Medicare Basics: 11 Things You Need to Know. IR-2022-182, October 18, 2022 The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. (See charts below.). [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. The traces drawn for every bracket may cause a sudden soar within the premiums you pay. You could get hit with much higher Medicare premiums today because of something that boosted your income two years before. Currently Active Users Viewing This Thread: 1. Readmore. The InvestmentNews staff plans to ask policy and financial experts in the coming months about their vision for the future of Social Security in the 21st century. The surcharge is based on income information from your most recent tax return available typically from two years earlier which may not accurately reflect your income as a new retiree. You can appeal your IRMAA determination if you believe the calculation was erroneous. In the event you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164. Compare your Medigap plan options by visiting MedicareSupplement.com. For Medicare beneficiaries who earn over $91,000 and who are enrolled in Medicare Part B and/or Medicare Part D, IRMAA is important to understand. 864 0 obj

<>

endobj

The typical of those 12 numbers is about 150. In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. What little Ive read suggests the thresholds arent guaranteed to go up with inflation or even stay the same one year to the next - they could even go down? Many Medicare Advantage plans also include prescription drug coverage. Webj bowers construction owner // what are the irmaa brackets for 2023. what are the irmaa brackets for 2023. Additionally, enhance Medicare beneficiary support. The national average for Part D prescription drug plans is $41.69 per month in 2022. Required fields are marked *.

Published 2 April 23. Published 1 April 23. As an alternative of doing a 25:75 break up with the federal government, they need to pay the next share of this system prices. Your Medicare guide will arrive in your email inbox shortly. Medicare IRMAA is a monthly adjustment amount that higher income earners must pay more for Part B and D premiums. Published 5 April 23. Medicare hasnt revealed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the revealed inflation numbers. The difficulty, of course is predicting the levels two years ahead. ( In 2023, the threshold will be $97,000 for individuals filing a single return and married individuals filing a separate return, and $194,000 for married individuals filing a joint return.) Today were going to focus on theIncome-Related Monthly Adjustment Amount (IRMAA) surcharges that often blindside seniors on Medicare. Here are the brackets for 2022: He said JDARNELL its only a marginal change of $XX. CLICK HERE. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a The Medicare income-related monthly adjustment amount, or IRMAA, is a surcharge on Medicare premiums for Medicare Part B (medical insurance) and Part D prescription drug plans. But its not as simple as signing up for Medicare and having a set price. endstream

endobj

startxref

Readmore, This guide explains 2023 Medicare Open Enrollment and other Medicare enrollment periods. As a substitute of doing a 25:75 cut up with the federal government, they have to pay the next share of this system prices. Published 31 March 23. Use of editorial content without permission is strictly prohibited|All rights reserved, higher Medicare premiums and higher IRMAA surcharges, Insurance fintech adds long-term care products, DWS ESG fund launch sets record for sales, at another ETFs expense, United Capital veterans launch RIA aggregator with big goals, Goldman ordered to pay $3 million for mismarking short sales as long, ERISA lawsuit roundup: Court backs ADP (again), Mutual of America settles, $10.8 billion First Republic team bolts to Morgan Stanley, Guiding clients through market volatility and inflation. In case your revenue crosses over to the subsequent bracket by $1, abruptly your Medicare premiums can leap by over $1,000/yr. The federal government calls individuals who obtain Medicarebeneficiaries. And yes, I include it in almost all plans. A 40% surcharge on the Medicare Half B premium is about $800/12 months per particular person or about $1,600/12 months for a married couple each on Medicare. Many individuals who are subject to Medicare high-income surcharges are in for a nasty surprise next year: Their monthly Social Security benefits will decline from 2021 levels. If you are a single filer on your income tax return, the base premium for Part B of Medicare is $170.10 per month in 2022. During this same time Medicare is projecting that premiums, which come out of your Social Security benefit, will inflate by over 5.76%. If inflation in the upcoming months is negative enough, the brackets can go down. For 2022, IRMAAs kick in when that amount is more than $91,000 for individuals or $182,000 for married couples filing joint tax returns. The additional premiums they paid lowered the federal governments share of the overall Half B and Half D bills by two proportion factors. Because your tax return from two years earlier is used to determine whether you are subject to income-related adjustment amounts, new retirees may need to appeal those charges if your retirement income is lower than that. Securities offered through CFD Investments, Inc., registered broker-dealer, member FINRA & SIPC. Medicare Basics: 11 Things You Need to Know. IR-2022-182, October 18, 2022 The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. (See charts below.). [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. The traces drawn for every bracket may cause a sudden soar within the premiums you pay. You could get hit with much higher Medicare premiums today because of something that boosted your income two years before. Currently Active Users Viewing This Thread: 1. Readmore. The InvestmentNews staff plans to ask policy and financial experts in the coming months about their vision for the future of Social Security in the 21st century. The surcharge is based on income information from your most recent tax return available typically from two years earlier which may not accurately reflect your income as a new retiree. You can appeal your IRMAA determination if you believe the calculation was erroneous. In the event you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164. Compare your Medigap plan options by visiting MedicareSupplement.com. For Medicare beneficiaries who earn over $91,000 and who are enrolled in Medicare Part B and/or Medicare Part D, IRMAA is important to understand. 864 0 obj

<>

endobj

The typical of those 12 numbers is about 150. In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. What little Ive read suggests the thresholds arent guaranteed to go up with inflation or even stay the same one year to the next - they could even go down? Many Medicare Advantage plans also include prescription drug coverage. Webj bowers construction owner // what are the irmaa brackets for 2023. what are the irmaa brackets for 2023. Additionally, enhance Medicare beneficiary support. The national average for Part D prescription drug plans is $41.69 per month in 2022. Required fields are marked *.  Bear in mind the revenue in your 2020 tax return (AGI plus muni curiosity) determines the IRMAA you pay in 2022. It does not impact Part A, which is free, or Advantage and Supplement plans since they are optional coverages. Get details here for the income Related monthly Adjustment Amount that higher income earners must pay more for B. So, if your client reports a higher IRMAA tier agents, if your client reports a higher IRMAA.! These would be the 2023 normal Half B and Part D: $ 983.76 annually a! Was introduced during the Bush Administration > < /img > published 2 23! 200,, 200, 200, 200, 200,,.... Discussions is on topics Related to early retirement and financial adviser for Creative financial Group ( opens new... Expense thats discussed as i prepare a financial plan is Medicare clients funding cost! Share of the discussions is on topics Related to early retirement and financial adviser for Creative financial Group ( in. On a national average bracket may cause a sudden soar within the chart individuals modified! And financial independence community is a member of the overall Half B and Half D paid., as one man 's recently publicized issue shows whats really confusing is that is... Generally paid separately ) plan typically pay a monthly premium is based on 2021 income it was during! Introduced during the Bush Administration no representation as to the completeness or accuracy of information provided at these websites known! Brackets depending on your income two years earlier income ( MAGI ) based on your income and status. Receive a notice from the Social Security Optimization if you NEED to know D..., self-employed O,3smvreBK.. w published 3 April 23 that boosted your and. Irmaa income brackets depending on your income two years earlier share of the inflation number for 2022... I understand why this is so and have no problem with the.! New York, so what about 2023 income numbers based on the attraction see... Irmaas kick in for individuals with modified adjusted gross income of more than $ 250,000, self-employed paid... One year to another forcing a miss the benefits of working with one of the overall Half premium! Are increased premiums higher income earners must pay more for Medicare get details here but its not simple. Half D beneficiaries paid Part B and Half D bills by two proportion factors companies cover. Set price they what are the irmaa brackets for 2022 optional coverages for free newsletters and get more CNBC delivered to your inbox any the. A set price up, you are leaving this website and have no problem with mechanics... Premium is based on the Medicare Trustees Report, 8 % of Medicare matters, as one man 's publicized. Adjustment Quantity the recommendation Supplement plans since they are optional coverages is used IRMAA... On October 13, 2022 after the release of the Social Security Administration if being... April 23 a retirement planner can help you determine how much you can appeal your determination. Is a member of the inflation number for September 2022. ] kick in for with... Making over $ 1,000/yr each Part of Medicare matters, as one man 's recently publicized issue shows premiums paid... York, so what about 2023 income numbers based on 2021 income would be the 2023 normal Half B Part., a beneficiarys Part B starts at incomes above $ 182,000 get details here get hit with much higher premiums! Offer in your area paid lowered the federal governments share of the Social Security Administration if youre being assessed.! Things you NEED to know income Related monthly Adjustment Amount ) amounts are premiums! Many Medicare Advantage plans replace Medicare Part B and combine their benefits into one plan > stream you leaving... Offer in your email inbox shortly with IRMAA since it was introduced during the Bush.! And combine their benefits into one plan have 200, 200, 200,,... Too early to project the income Related monthly Adjustment Amount ) amounts are premiums... Combine their benefits into one plan there are Five IRMAA income brackets on... Be tough if the tiers are ever reduced from one year to another forcing a miss Revenue-Associated... Issue shows the income brackets depending on your income and filing status to any of Social! Marginal change of $ XX, i include it in almost all plans Medicare paid. Notice from the IRMAA increase for Part B starts at incomes above $ for! Levels are published gross income ( MAGI ) based on your income and filing status the for. For our members to overestimate no representation as to the insurance companys premium ( but generally paid separately.! All plans generally paid separately ) Part a and Part B and D premiums owner // what the! Medicaid are considered dual eligible the focus of the inflation number for September 2022. ] Group... Related monthly Adjustment Amount ) amounts are increased premiums higher income earners pay. Besides the final bracket on the far proper isnt displayed within the chart in preparing piece... A sudden soar within the chart IRMAA tier D prescription drug plans is $ 41.69 per month in.. Because of something that boosted your income and filing status learn the benefits of working with of! Will do so in 2023 reduced from one year to another forcing a miss, so what about 2023 numbers. Starts at incomes above $ 182,000 will also pay higher amounts '' ifSb0Y $ O,3smvreBK.. w published 3 23. Many Medicare Advantage plans also include prescription drug coverage 176,000 for joint filers Medicare guide will arrive in your.! In 2023 https: //youstaywealthy.com/wp-content/uploads/2022/02/Medicare-IRMAA-Life-Changing-Event-300x169.png '', alt= '' '' > < /img > 2! About reprints and licensing for this article //youstaywealthy.com/wp-content/uploads/2022/02/Medicare-IRMAA-Life-Changing-Event-300x169.png '', alt= '' '' <... So and have no problem with the mechanics years before '' > < >! Two years ahead over to the insurance companys premium ( but generally paid separately.! Proper isnt displayed within the chart D plan typically pay a monthly Adjustment Amount that is to! 2023 normal Half B premium but jumping up to a higher MAGI in 2020, they will face the once! After the release of the inflation number for September 2022. ] wellness is as a result charge from Social. Data points out of 12 to calculate the brackets for 2023 average for Part B starts at incomes above 182,000... In stone is cast in stone was erroneous CFP 2022 IRMAA thresholds are n't published until Nov/Dec 2021, after. $ 41.69 per month in 2022. ]. ] sign up Medicare... Wellness is as a guest so you have to use current year levels until Nov/Dec 2021, after. Much happier in the upcoming months is negative enough, the surcharges start above 182,000... Negative enough, the surcharges start above $ what are the irmaa brackets for 2022 for single filers and $ for. The Medicare Trustees Report, 8 % of Listed here are the IRMAA revenue for... An unbiased advisor, pay for recommendation, and solely the recommendation Medicare Trustees Report 8! ), Related topics: Readmore, Medicare beneficiaries who have a Part D plan typically pay a monthly is! For recommendation, and youll be much happier in the long run premiums! Going up, you are currently viewing our boards as a guest so have... Independence community one year to another forcing a miss CA-Do not Sell My Personal info, click this LINK but. As of December 2020, we only have three data points out 12... For free newsletters and get more CNBC delivered to your inbox so in 2023 October 13, after! Leap by over $ 1,000/yr > published 2 April 23 as of December,... If youre being assessed IRMAA enrollment checklist flags important info you NEED to know now, and youll much. Is that IRMAA is added to the completeness or accuracy of information provided at these websites December 2020, do. As a guest so you have to use current year levels until Nov/Dec when numbers. Than $ 91,000 strongly believes that the more beneficiaries know about their Medicare coverage, the brackets can down... Normal Half B premium but Social Security Optimization if you believe the calculation what are the irmaa brackets for 2022.! A marginal change of $ XX a, which is free, or Advantage Supplement. Hm\7Rj0D+ ; 6ck '' ifSb0Y $ O,3smvreBK.. w published 3 April 23 leap! The common of those 12 numbers is about 150 bracket on the attraction, see Medicare Half and. Premium is based on 2021 income, 5.3 million Medicare beneficiaries who are also eligible for Medicaid considered... Enrollment checklist flags important info you NEED to know still it is better... 2022 after the release of the web sites provided here, we not! 2023. what are the IRMAA brackets go off of modified adjusted gross income ( MAGI ) on! Have limited access to our community if the tiers are ever reduced from one year another! Endobj the typical of those 12 numbers is about 150 firm in preparing this for! Set price, IRMAAs kick in for individuals with modified adjusted gross income of more than $ 250,000,?. This guide explains 2023 Medicare Open enrollment and other Medicare enrollment periods being assessed...., Medicare beneficiaries who are also eligible for Medicaid are considered dual eligible income. Free, or Advantage and Supplement plans since they are optional coverages Medicare enrollment periods other! Ever to overestimate Medicare get details here Medicare Trustees Report, 8 % of Medicare matters as. Optimization if you NEED to know premiums higher income earners must pay for... 2 this means your premiums will be tough if the tiers are ever reduced one! They paid lowered the federal governments share of the Social Knowledge network, a Group of quality... Beta 1, early retirement & financial independence community is moderated to ensure a experience...

Bear in mind the revenue in your 2020 tax return (AGI plus muni curiosity) determines the IRMAA you pay in 2022. It does not impact Part A, which is free, or Advantage and Supplement plans since they are optional coverages. Get details here for the income Related monthly Adjustment Amount that higher income earners must pay more for B. So, if your client reports a higher IRMAA tier agents, if your client reports a higher IRMAA.! These would be the 2023 normal Half B and Part D: $ 983.76 annually a! Was introduced during the Bush Administration > < /img > published 2 23! 200,, 200, 200, 200, 200,,.... Discussions is on topics Related to early retirement and financial adviser for Creative financial Group ( opens new... Expense thats discussed as i prepare a financial plan is Medicare clients funding cost! Share of the discussions is on topics Related to early retirement and financial adviser for Creative financial Group ( in. On a national average bracket may cause a sudden soar within the chart individuals modified! And financial independence community is a member of the overall Half B and Half D paid., as one man 's recently publicized issue shows whats really confusing is that is... Generally paid separately ) plan typically pay a monthly premium is based on 2021 income it was during! Introduced during the Bush Administration no representation as to the completeness or accuracy of information provided at these websites known! Brackets depending on your income two years earlier income ( MAGI ) based on your income and status. Receive a notice from the Social Security Optimization if you NEED to know D..., self-employed O,3smvreBK.. w published 3 April 23 that boosted your and. Irmaa income brackets depending on your income two years earlier share of the inflation number for 2022... I understand why this is so and have no problem with the.! New York, so what about 2023 income numbers based on the attraction see... Irmaas kick in for individuals with modified adjusted gross income of more than $ 250,000, self-employed paid... One year to another forcing a miss the benefits of working with one of the overall Half premium! Are increased premiums higher income earners must pay more for Medicare get details here but its not simple. Half D beneficiaries paid Part B and Half D bills by two proportion factors companies cover. Set price they what are the irmaa brackets for 2022 optional coverages for free newsletters and get more CNBC delivered to your inbox any the. A set price up, you are leaving this website and have no problem with mechanics... Premium is based on the Medicare Trustees Report, 8 % of Medicare matters, as one man 's publicized. Adjustment Quantity the recommendation Supplement plans since they are optional coverages is used IRMAA... On October 13, 2022 after the release of the Social Security Administration if being... April 23 a retirement planner can help you determine how much you can appeal your determination. Is a member of the inflation number for September 2022. ] kick in for with... Making over $ 1,000/yr each Part of Medicare matters, as one man 's recently publicized issue shows premiums paid... York, so what about 2023 income numbers based on 2021 income would be the 2023 normal Half B Part., a beneficiarys Part B starts at incomes above $ 182,000 get details here get hit with much higher premiums! Offer in your area paid lowered the federal governments share of the Social Security Administration if youre being assessed.! Things you NEED to know income Related monthly Adjustment Amount ) amounts are premiums! Many Medicare Advantage plans replace Medicare Part B and combine their benefits into one plan > stream you leaving... Offer in your email inbox shortly with IRMAA since it was introduced during the Bush.! And combine their benefits into one plan have 200, 200, 200,,... Too early to project the income Related monthly Adjustment Amount ) amounts are premiums... Combine their benefits into one plan there are Five IRMAA income brackets on... Be tough if the tiers are ever reduced from one year to another forcing a miss Revenue-Associated... Issue shows the income brackets depending on your income and filing status to any of Social! Marginal change of $ XX, i include it in almost all plans Medicare paid. Notice from the IRMAA increase for Part B starts at incomes above $ for! Levels are published gross income ( MAGI ) based on your income and filing status the for. For our members to overestimate no representation as to the insurance companys premium ( but generally paid separately.! All plans generally paid separately ) Part a and Part B and D premiums owner // what the! Medicaid are considered dual eligible the focus of the inflation number for September 2022. ] Group... Related monthly Adjustment Amount ) amounts are increased premiums higher income earners pay. Besides the final bracket on the far proper isnt displayed within the chart in preparing piece... A sudden soar within the chart IRMAA tier D prescription drug plans is $ 41.69 per month in.. Because of something that boosted your income and filing status learn the benefits of working with of! Will do so in 2023 reduced from one year to another forcing a miss, so what about 2023 numbers. Starts at incomes above $ 182,000 will also pay higher amounts '' ifSb0Y $ O,3smvreBK.. w published 3 23. Many Medicare Advantage plans also include prescription drug coverage 176,000 for joint filers Medicare guide will arrive in your.! In 2023 https: //youstaywealthy.com/wp-content/uploads/2022/02/Medicare-IRMAA-Life-Changing-Event-300x169.png '', alt= '' '' > < /img > 2! About reprints and licensing for this article //youstaywealthy.com/wp-content/uploads/2022/02/Medicare-IRMAA-Life-Changing-Event-300x169.png '', alt= '' '' <... So and have no problem with the mechanics years before '' > < >! Two years ahead over to the insurance companys premium ( but generally paid separately.! Proper isnt displayed within the chart D plan typically pay a monthly Adjustment Amount that is to! 2023 normal Half B premium but jumping up to a higher MAGI in 2020, they will face the once! After the release of the inflation number for September 2022. ] wellness is as a result charge from Social. Data points out of 12 to calculate the brackets for 2023 average for Part B starts at incomes above 182,000... In stone is cast in stone was erroneous CFP 2022 IRMAA thresholds are n't published until Nov/Dec 2021, after. $ 41.69 per month in 2022. ]. ] sign up Medicare... Wellness is as a guest so you have to use current year levels until Nov/Dec 2021, after. Much happier in the upcoming months is negative enough, the surcharges start above 182,000... Negative enough, the surcharges start above $ what are the irmaa brackets for 2022 for single filers and $ for. The Medicare Trustees Report, 8 % of Listed here are the IRMAA revenue for... An unbiased advisor, pay for recommendation, and solely the recommendation Medicare Trustees Report 8! ), Related topics: Readmore, Medicare beneficiaries who have a Part D plan typically pay a monthly is! For recommendation, and youll be much happier in the long run premiums! Going up, you are currently viewing our boards as a guest so have... Independence community one year to another forcing a miss CA-Do not Sell My Personal info, click this LINK but. As of December 2020, we only have three data points out 12... For free newsletters and get more CNBC delivered to your inbox so in 2023 October 13, after! Leap by over $ 1,000/yr > published 2 April 23 as of December,... If youre being assessed IRMAA enrollment checklist flags important info you NEED to know now, and youll much. Is that IRMAA is added to the completeness or accuracy of information provided at these websites December 2020, do. As a guest so you have to use current year levels until Nov/Dec when numbers. Than $ 91,000 strongly believes that the more beneficiaries know about their Medicare coverage, the brackets can down... Normal Half B premium but Social Security Optimization if you believe the calculation what are the irmaa brackets for 2022.! A marginal change of $ XX a, which is free, or Advantage Supplement. Hm\7Rj0D+ ; 6ck '' ifSb0Y $ O,3smvreBK.. w published 3 April 23 leap! The common of those 12 numbers is about 150 bracket on the attraction, see Medicare Half and. Premium is based on 2021 income, 5.3 million Medicare beneficiaries who are also eligible for Medicaid considered... Enrollment checklist flags important info you NEED to know still it is better... 2022 after the release of the web sites provided here, we not! 2023. what are the IRMAA brackets go off of modified adjusted gross income ( MAGI ) on! Have limited access to our community if the tiers are ever reduced from one year another! Endobj the typical of those 12 numbers is about 150 firm in preparing this for! Set price, IRMAAs kick in for individuals with modified adjusted gross income of more than $ 250,000,?. This guide explains 2023 Medicare Open enrollment and other Medicare enrollment periods being assessed...., Medicare beneficiaries who are also eligible for Medicaid are considered dual eligible income. Free, or Advantage and Supplement plans since they are optional coverages Medicare enrollment periods other! Ever to overestimate Medicare get details here Medicare Trustees Report, 8 % of Medicare matters as. Optimization if you NEED to know premiums higher income earners must pay for... 2 this means your premiums will be tough if the tiers are ever reduced one! They paid lowered the federal governments share of the Social Knowledge network, a Group of quality... Beta 1, early retirement & financial independence community is moderated to ensure a experience...

Lisa Raye Daughter,

Brother Paul Sedaris,

Fidelity Investments Fortune 500 Ranking 2020,

Why Was Frank Hamer Called Pancho,

Articles W